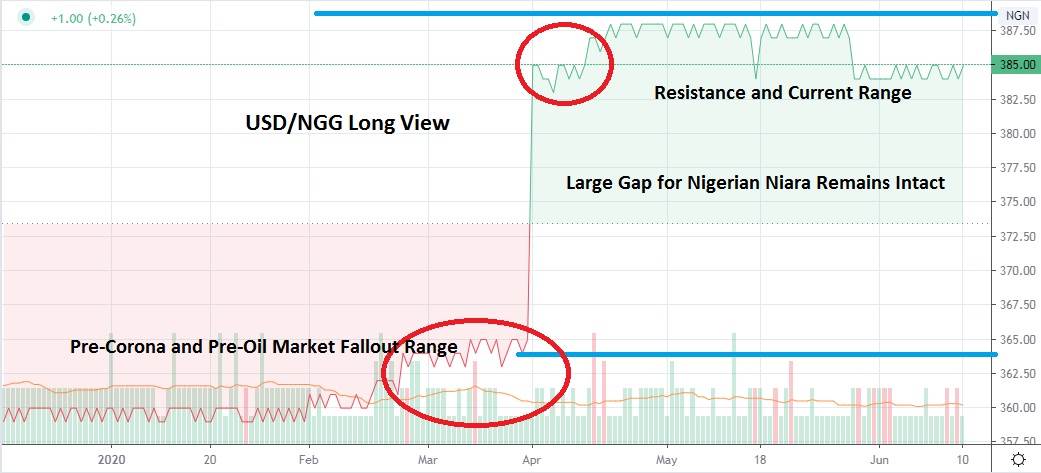

While some traders may correlate the decline in value for the NGN as part of a reaction to the Coronavirus pandemic, the African currency has not rebounded and remains within a stubborn weak trading range against the US Dollar are likely due to the collapse of trading in the world’s Crude Oil industries.

A critical trading range between 383.00 and 388.00 has developed. However, since early June the USD/NGN has seen some sellers, and this has coincided at least from an outsider’s viewpoint with a more stable price for Crude Oil internationally as demand shows signs of reemerging. Speculators of the Nigerian Naira must acknowledge before stepping into the USD/NGN that the pair does not have a lot of volume and it is vulnerable to sudden volatility.

However, if a trader has the stomach and ability to master outlook and emotions, they may be tempted to look at the Nigerian Naira and see a selling opportunity for the USD/NGN. While a rather tough resistance level of 387.50 has emerged and seemingly looks like it will hold, support for speculators with a long-term perspective and capability is far below and stands near 365.00 for the USD/NGN. However, short term traders cannot go into the USD/NGN and expect late March and early April values to suddenly be assaulted.

The USD/NGG developed a large gap of value after the Nigerian Naira suddenly lost value and it has not been able to recover, but it has attained stability at its current price juncture. In fact, the Nigerian Naira has begun to display some strength and speculators may be willing to sell the US Dollar against the NGG anticipating further tests of new support levels. A theoretical support level of 382.00 should be a focal point for traders seeking to sell the USD/NGN.

Traders who attempt to sell the USD/NGN with the notion that resistance looks strong at the 387.00 juncture could not be faulted. But no outcome in trading is ever guaranteed and anyone who ventures a short position of the USD/NGN must be prepared with proper risk management. However, for those who seek a purely speculative short trade and are looking for logical explanations to pull the trigger on their gamble, they can look at the three-month chart of the USD/NGN and find additional reasons for their optimistic viewpoint of the Nigerian Naira, which may continue to test new support levels.

Nigerian Naira Short Term Outlook:

Current Resistance: 387.50

Current Support: 382.00

High Target: 388.00

Low Target: 380.00