The Malaysian Ringgit has provided traders with a solid test of their emotional fortitude the past few sessions as forex markets display signs of volatility. The range of the USD/MYR is still safely within known boundaries and its range is certainly not going to erupt into an unmanageable environment. The Malaysian Ringgit provides speculators with a taste for the exotic and a rather stable atmosphere for emerging forex currency pairs.

However, the week has started off with major questions starting to arise globally again. Concerns about new outbreaks of Coronavirus, the economic health of worldwide economies and issues regarding the relationship of the US and China may factor mightily in the coming days. So why should that matter to traders of the USD/MYR? The Malaysian Ringgit offers a solid amount of transparency from its government and central bank, but because it is an emerging market currency the USD/MYR pair is not immune to volatile behavior which suddenly bursts forth in forex markets as investors position themselves based on their appetite for risk.

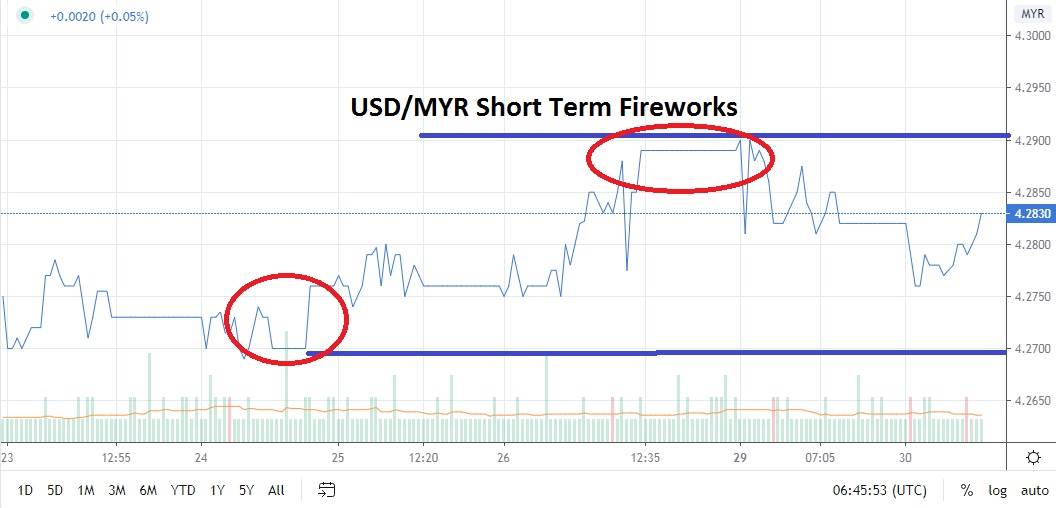

The Malaysian Ringgit has tested resistance the past few trading sessions and while it has shown an ability to reverse downward it is still within the part of its weaker short term range against the US Dollar. Recent consolidation of the USD/MYR should be taken into consideration as its support levels advance higher technically. The global markets appear to be waiting for their next big push and choosing which direction to place a position should be done carefully. After touching higher resistance yesterday, a target if you are a buyer of the USD/MYR should be the 1.2900 juncture if you are entering the forex pair at its current values between 4.2800 and 4.2830.

If you believe the global markets are going to turn positive globally and risk appetite will prove strong, now may be an opportunity to sell the USD/MYR within its current values too. However, because the Malaysian Ringgit has shown weakness the past few days it might prove better to practice patience and see if the USD/MYR tests resistance a bit more and then position for a reversal with a selling position using selected entry points.

Being prudent can cost traders money if they do not enter the market when opportunities lurk, but they can also safeguard against unnecessary risks. Like a good poker player sometimes you have to fold a hand which you believe you can win in order to make yourself stronger for future positions to be speculated. Today and tomorrow are likely to be very good trading days for speculators who are fast and know how to use risk management.

Malaysian Ringgit Short Term Outlook:

Current Resistance: 4.2900

Current Support: 4.2770

High Target: 4.2950

Low Target: 4.2690