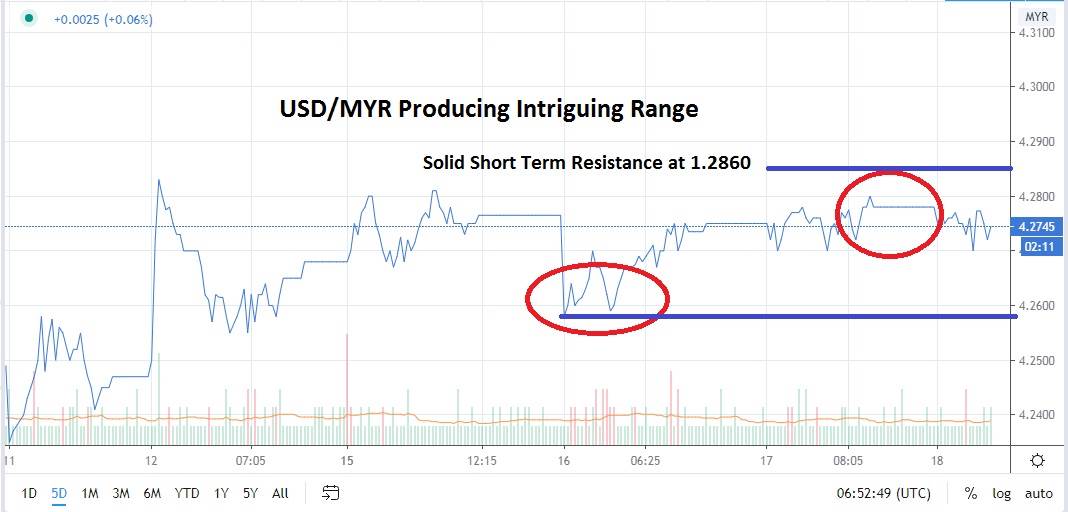

The month of June has seen the USD/MYR trade within a solid range between 1.2500 and 1.2800 and this consolidated value is an attractive trading opportunity for those who can manage their risk properly. A resistance level of 4.2800 has produced plenty of reversals for the Malaysian Ringgit and produced adequate selling of the USD/MYR currency pair.

The Malaysian government is not known as a friend to speculators of the Ringgit. Malaysia’s Bank Negara is a proactive central bank with a solid reputation for oversight. The Malaysian government has also produced stimulus plans in order to try and keep its national economic health well maintained.

The resistance level of 4.2800 appears to remain an important juncture for traders in the short term. The most recent weakest value the Malaysian Ringgit has experienced was near the 4.2900 mark and this occurred in early June. The Malaysian Ringgit has produced a solid range the past week and traders who practice a good use of leverage regarding the size of their speculative positions may have an opportunity to pursue short selling of the USD/MYR.

A near term support level for the USD/MYR of 4.2640 looks attractive. Traders who are willing to sell the USD/MYR between the 4.2740 to 4.2760 junctures will likely have the opinion that the Malaysian Ringgit has less potential to lose a large amount of value compared to its ability to strengthen. Recent trading within the forex pair has consistently tested a support value of 4.2690 the past day.

Global sentiment in the equity markets today appears mixed and this could be the proverbial fly in the ointment for the Malaysian Ringgit and its value. However, even if equity markets remain under short term pressure today and tomorrow, the USD/MYR forex pair has displayed a solid range that has maintained the value of the Malaysian Ringgit and makes it a desirable speculative selling opportunity. With a stiff resistance juncture of 4.2800 up above the current price value of the USD/MYR the pair seems ready to test its waters.

Malaysian Ringgit Short Term Outlook:

Current Resistance: 4.2800

Current Support: 4.2640

High Target: 4.2860

Low Target: 4.2500