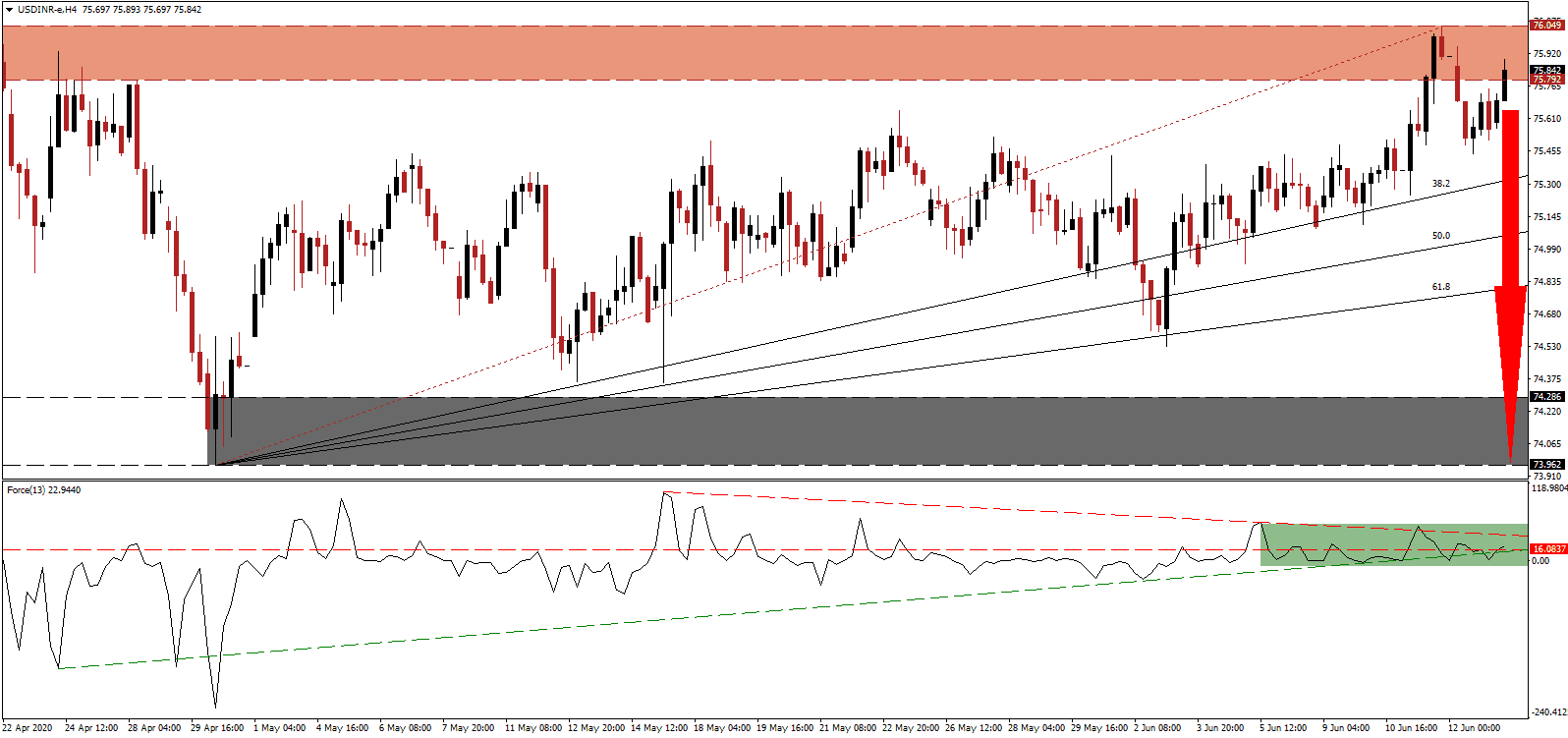

India implemented the most extensive nationwide lockdown in the world but surged to the number four spot in global Covid-19 infection. It only trails the US, Brazil, and Russia. With the South Asian Monsoon season starting this month, experts are divided over its impact on the spread of the virus. It is vital to the economy of India and is informally referred to as the real finance minister of India. A 10% increase in rainfall over the long-term average usually results in massive floods, while a 10% decrease in significant droughts. The USD/INR pushed into its resistance zone, followed by a quick breakdown, and second advance. More downside is favored amid the lack of bullish momentum.

The Force Index, a next-generation technical indicator, failed to eclipse its descending resistance level despite the advance in price action. A negative divergence formed, pointing towards a resumption of the dominant downtrend. The Force Index converted its horizontal support level into resistance following a breakdown, as marked by the green rectangle. It is now on the verge of correcting below its ascending support level and into negative territory. It confirms that bears are in complete control of the USD/INR.

Providing a significant bullish catalyst to the Indian economy and the Rupee is the country’s record FX reserves. They surged past $500 billion ten days ago, and the growth accelerated after the nationwide lockdown was implemented. The massive build-up offers Prime Minister Modi financial flexibility. India had just $5.8 billion in reserves in 1991 when it was forced to pledge its gold reserves to avoid a financial crisis. It adds to breakdown pressures in the USD/INR, expected to face rejection by its resistance zone located between 75.792 and 76.049, as identified by the red rectangle.

A reversal in this currency pair into its ascending 38.2 Fibonacci Retracement Fan Support Level is anticipated. With India’s Forex reserves set to expand further, initiated after the finance ministry announced sweeping corporate tax cuts, which spiked reserves by $73 billion in nine months, an acceleration in the sell-off is likely. Ongoing unrest, riots, and demonstrations in the US, together with a surge in new infections, magnifies the bearish trend. The USD/INR is well-positioned to challenge its support zone located between 73.962 and 74.286, as marked by the grey rectangle, from where more downside is probable.

USD/INR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 75.850

Take Profit @ 73.950

Stop Loss @ 76.300

Downside Potential: 19,000 pips

Upside Risk: 4,500 pips

Risk/Reward Ratio: 4.22

In the event the Force Index pushes above its descending resistance level, the USD/INR may follow suit. US economic conditions are rapidly worsening, plagued by structural issues the government refuses to address. While India is cutting corporate tax rates and increasing reserves and revenues, the US is loading up on debt, and debating tax increases. Any breakout will offer Forex traders a secondary short selling opportunity. Price action will face its next resistance zone between 76.433 and 76.769.

USD/INR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 76.450

Take Profit @ 76.750

Stop Loss @ 76.300

Upside Potential: 3,000 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 2.00