India’s Chief Economic Adviser Krishnamurthy Subramanian continues to believe the economy is on track for a V-shaped recovery, irrelevant of what developments take place. The sole differentiation he outlined is that a vaccine for the Covid-19 virus will enable an economic recovery in the second half of this year, the absence of one will delay it into 2021. His outlook is modeled after the Spanish Flu of 1918, and he supports GDP recovery between 7% to 8% due to steps the government implemented. The USD/INR embarked on a corrective phase following the breakdown below its resistance zone, but it was due to US commentary rather than Subramanian’s misplaced optimism.

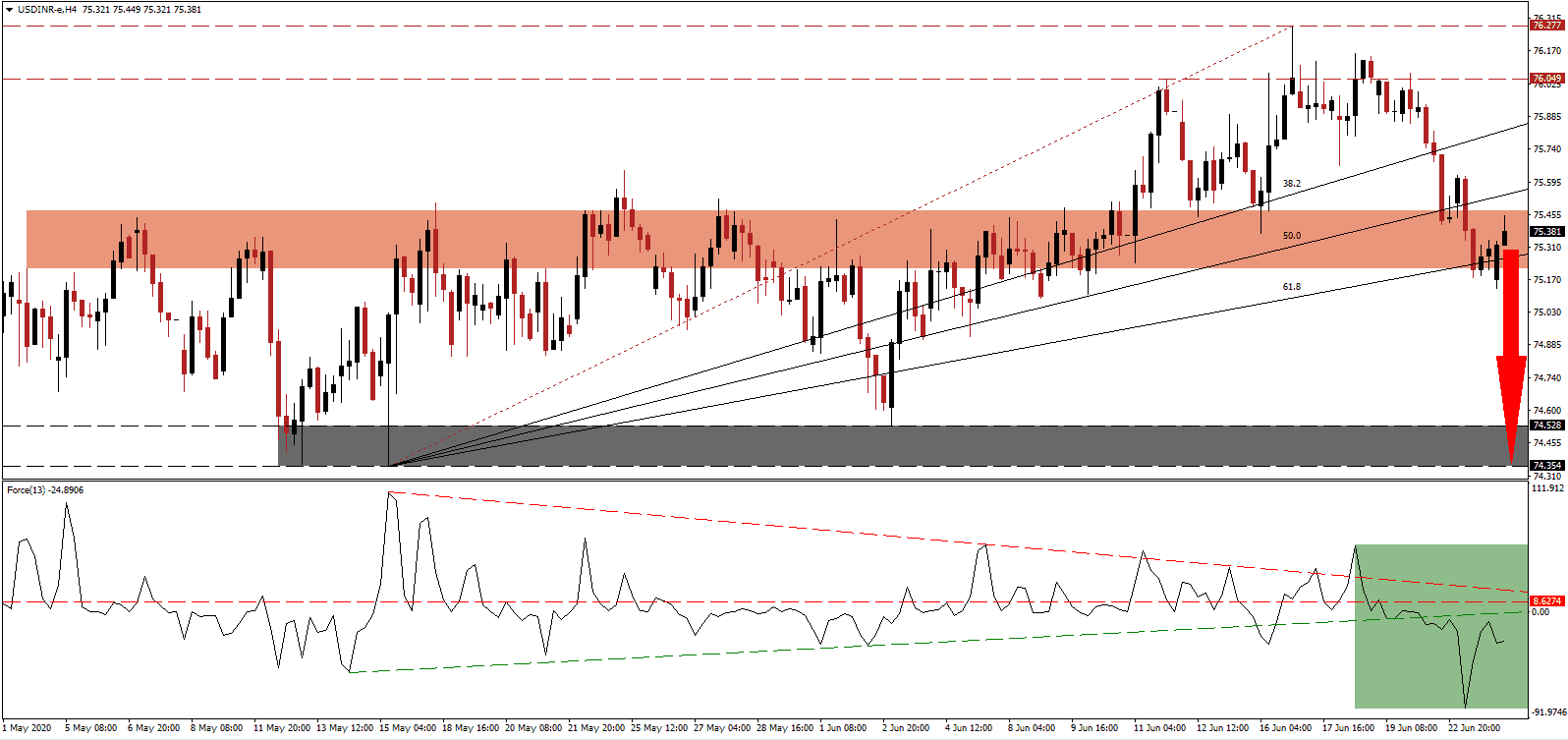

The Force Index, a next-generation technical indicator, points towards the massive rise in bearish momentum, as evident in the new multi-week low. After a brief spike above its descending resistance level, a collapse below its horizontal support level converted it into resistance, as marked by the green rectangle. The breakdown below its ascending support level added to downside pressure in this currency pair. Bears regained complete control of the USD/INR once this technical indicator crossed below the 0 center-line.

Asia’s third-largest economy, and the world’s number five, is likely to face its first annualized GDP contraction this year, the first one in over four decades. It confirms the massive negative impact the Covid-19 pandemic implemented. While government officials remain upbeat, a growing number of private-sector economists suggest it may take India over ten years to achieve 8% GDP growth. The USD/INR paused its sell-off after challenging its ascending 61.8 Fibonacci Retracement Fan Support Level. It is now testing its short-term resistance zone located between 75.218 and 75.469, as marked by the red rectangle.

With new infections continuing to expand globally, India is the fourth most infected country, likely to exceed 500,000 cases this week. The recession is expected to be more challenging than economies are prepared for, leading to more debt-funded assistance programs are debated, which will add to long-term structural issues. Many US households are on the brink of financial collapse, with the $600 subsidy for the unemployed set to expire next month. The USD/INR is well-positioned to accelerate into its support zone located between 74.354 and 74.528, as identified by the grey rectangle. More downside is probably to follow.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 75.380

Take Profit @ 74.350

Stop Loss @ 75.680

Downside Potential: 10,300 pips

Upside Risk: 3,000 pips

Risk/Reward Ratio: 3.43

A breakout in the Force Index above its descending resistance level is likely to result in a breakout attempt in the USD/INR. Forex traders are recommended to consider any price spike from current levels as an excellent short-selling opportunity. While Indian government advisors remain overly optimistic, it is trumped by US counterparts, resulting in ongoing policy missteps. The upside potential is restricted to its resistance zone located between 76.049 and 76.277.

USD/INR Technical Trading Set-Up - Restricted Breakout Scenario

Long Entry @ 75.880

Take Profit @ 76.080

Stop Loss @ 75.780

Upside Potential: 2,000 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 2.00