India announced an extension of the nationwide lockdown until July, as new Covid-19 infections are spiking. Asia’s third-largest economy is on track to overtake the UK’s fifth spot for total confirmed cases. Prime Minister Modi’s government started to ease restrictions in some parts of the country but maintains them in areas contributing approximately 60% of GDP output. The situation is merely trumped by the US, where cases are on the rise, exceeding two million over the weekend. It is reflected in the resilience of the USD/INR, unlikely to sustain a breakout attempt above its short-term resistance zone.

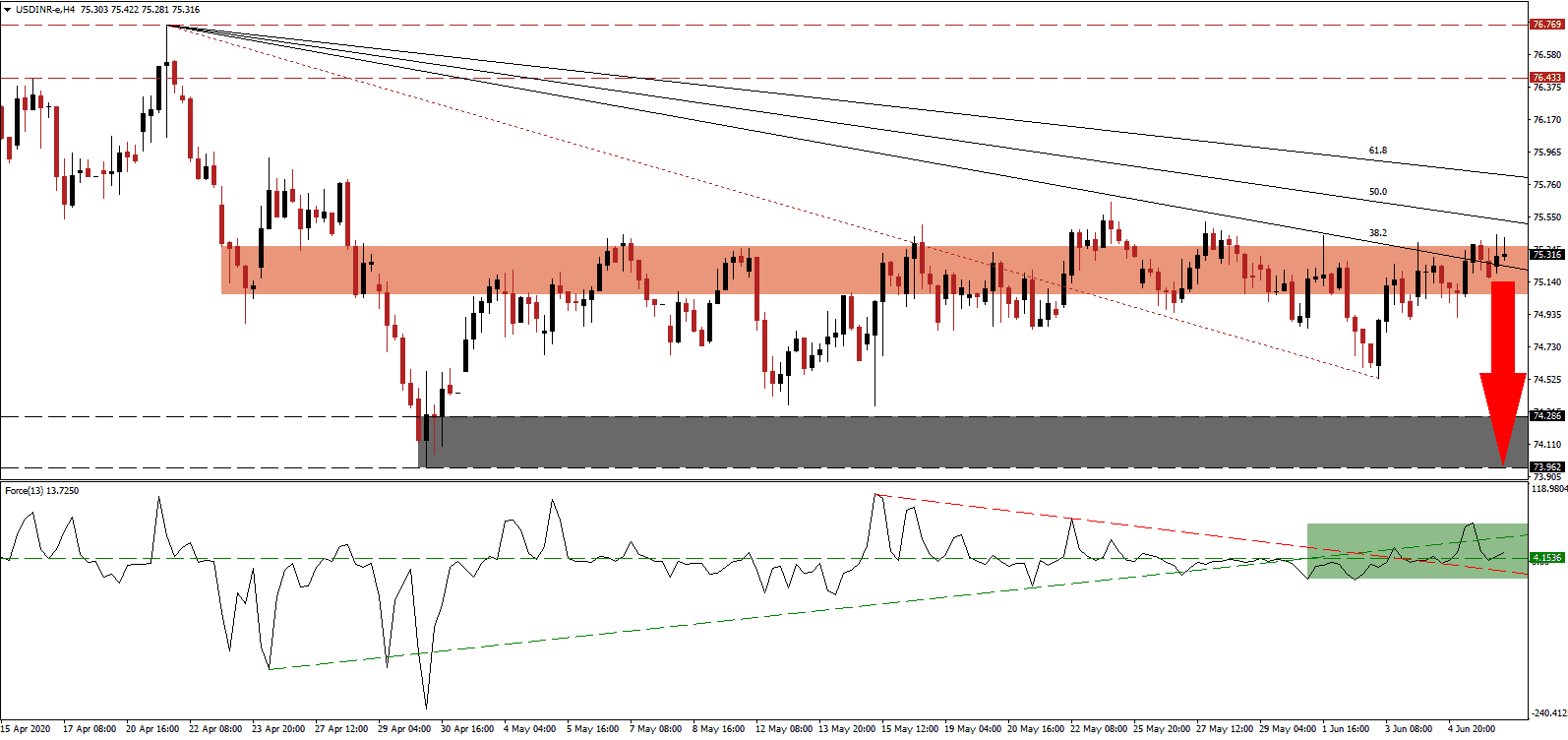

The Force Index, a next-generation technical indicator, highlights the role reversal of the ascending support level and the descending resistance level, as marked by the green rectangle. Bullish momentum started to accumulate, resulting in the conversion of the horizontal resistance level into support, but a brief breakout was swiftly reversed after resulting in a lower high. This technical indicator is anticipated to collapse below the 0 center-line, ceding control of the USD/INR to bears.

With GDP contraction forecasts as high as 5.0% for the fiscal year 2021, and the ₹20 trillion spending package under scrutiny due to the lack of significant capital injections, India’s economy is faced with more short-term shocks. An early locust outbreak is adding to concern, in the sole sector offering hope. Despite ongoing disruptions, US developments are adding more dominant pressures on price action. The USD/INR is favored to face rejection by its short-term resistance zone located between 75.059 and 75.363, as marked by the red rectangle, while the descending 50.0 Fibonacci Retracement Fan Resistance Level is maintaining the established long-term bearish trend.

Optimism over the US NFP report from last Friday could be short-lived. The retail and hospitality sector added temporary staff to check customers' temperature, disinfect goods and surfaces, and for crowd control. Initial jobless claims increased last month, and are likely to remain elevated. Ongoing riots and demonstrations, together with the disregard of advice by health officials, increase the risk of a spike in Covid-19 cases. It adds to breakdown pressures in the USD/INR, expected to accelerate into its support zone located between 73.962 and 74.286, as identified by the grey rectangle.

USD/INR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 75.320

Take Profit @ 73.970

Stop Loss @ 75.770

Downside Potential: 13,500 pips

Upside Risk: 4,500 pips

Risk/Reward Ratio: 3.00

In the event the Force Index moves above its ascending support level, serving as resistance, the USD/INR may follow with a breakout. India attempts to maintain fiscal responsibility, adding a long-term bullish catalyst to this currency pair, magnified by the US thirst to explode its debt to the upside. Annualized interest payments exceed $1 trillion, poised to increase further. Forex traders are advised to consider any price spike as a selling opportunity. The next resistance zone is located between 76.433 and 76.769.

USD/INR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 75.970

Take Profit @ 76.420

Stop Loss @ 75.770

Upside Potential: 4,500 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 2.25