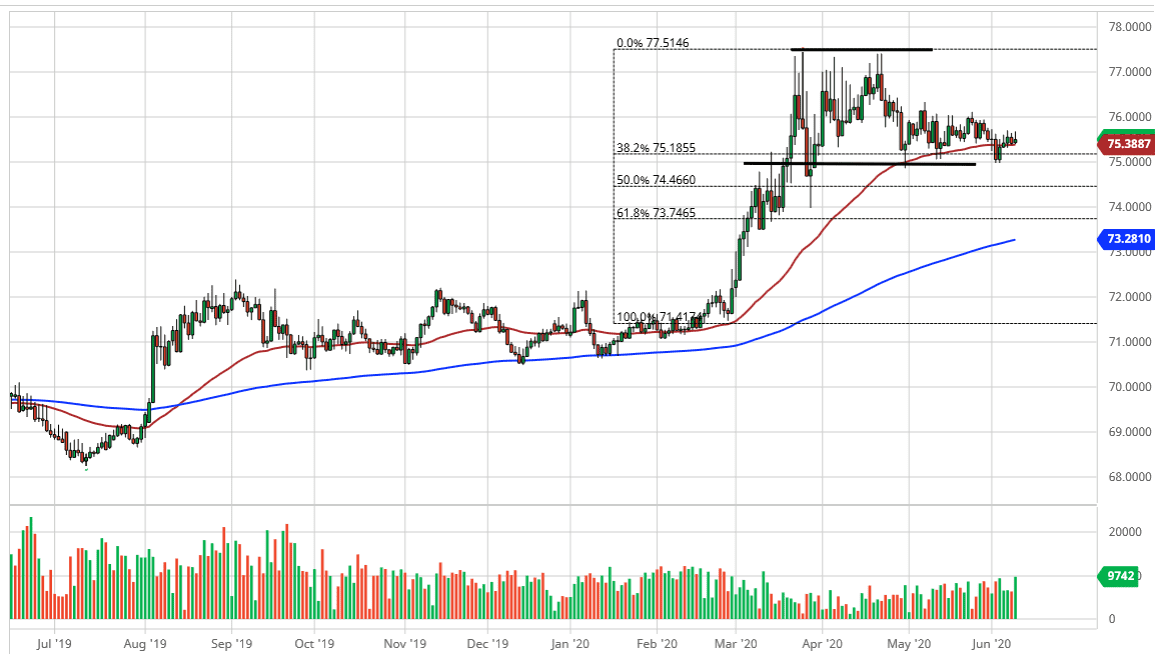

The US dollar initially tried to rally against the Indian rupee during the trading session on Tuesday but has given back a bit of the gains. This is a market that seems to be sitting right around the 50 day EMA, looking for a signal as to which direction we are going. Underneath, I see the ₹75 level as an area of potential support, as it has shown itself to be supportive several times in the past. Furthermore, I think that the ₹76 level above will be resistance. Ultimately, this is a market that seems to be settling in a one rupee range. This means that eventually, we should get some type of explosive movement, but right now we do not have much in the way of volatility that can be traded for any significant gains.

A lot of what will move this market is going to be risk appetite in general, as the Indian rupee is most certainly a prominent emerging market currency. There is a longer-term shortage of US dollars when it comes to debt in places like India, so I do think long term we will continue to see some type of strength. However, the intermediate-term set up suggests that if we break down below the ₹75 level, it is likely that we will be looking towards the ₹74 level underneath, which has been significant support and is backed up by the 61.8% Fibonacci retracement level.

On the upside, if we were to break above the ₹76 level, then it is likely that the market goes looking towards the ₹77 level. There is a significant amount of resistance that extends to the ₹77.50 level, which should keep the market somewhat under wraps. However, if the market ends up breaking above that range, I think we should look towards much bigger gains, perhaps as high as a move towards the ₹80 level.

Short term, do not be surprised if we bounce back and forth in order to try to build up some type of momentum, but at this point, it looks as if we have some clear levels to trade off of, on the breakout. Ultimately, this is a market that I think gives us an opportunity to get involved with the bigger trade if we simply wait and react to the eventual move that is setting up.