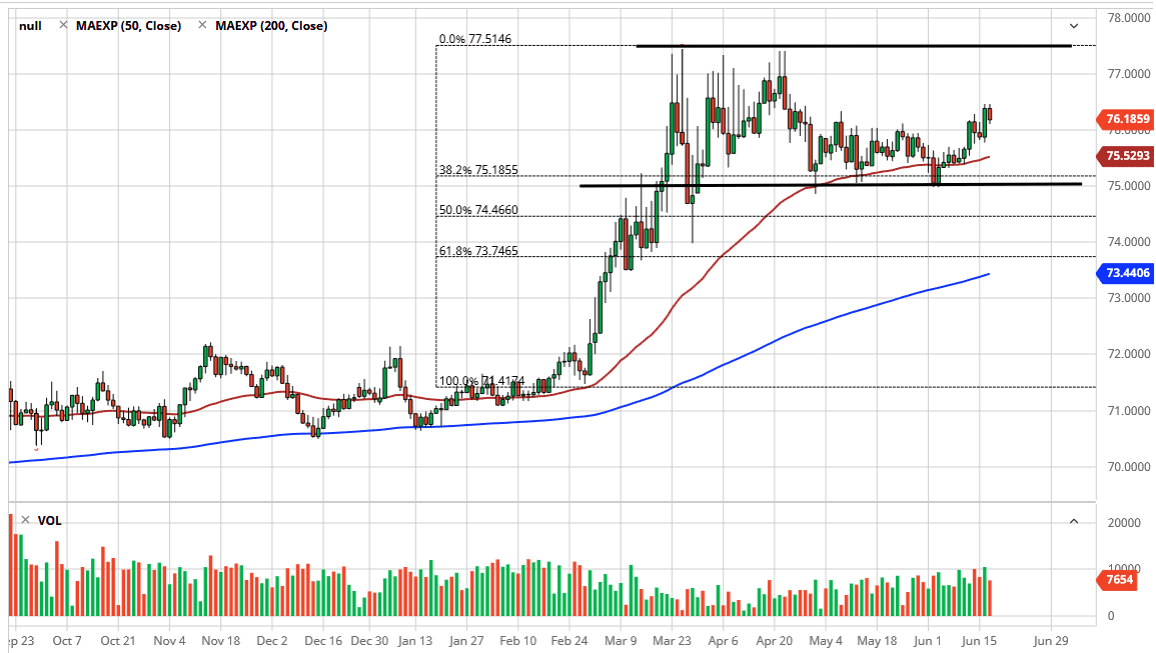

The US dollar has pulled back a bit against the Indian rupee during the Wednesday session, but quite frankly on Tuesday, we had broken out just enough to get through some minor resistance. When looking at the prism of the longer term, the market breaking above the ₹76 level was somewhat important. The 50 day EMA is just below, and that is starting to slope higher, so I think it is only a matter of time before we go looking towards the ₹77 level above. Ultimately, the market will continue to find plenty of buyers on dips but that does not necessarily mean that it will be easy to trade in this market.

Recently, we have seen a spike in coronavirus infections at various places around the world, not the least of which is China. India is right next door, so obviously, people will be a bit concerned about the new wave of infections. Furthermore, the economic numbers out of India have not been good, but that is not hard to imagine in the environment that we had been in recently. If there is going to be a bit of fear out there then it makes sense that the US dollar would continue to gain a bit of strength against most currencies, not to mention the fact that we are talking about an emerging market currency.

On the upside, I think there is a massive amount of resistance between the ₹77 level and the ₹77.50 level. If we were to somehow break above there, then it is likely that the market could go higher, and based upon the measurement of the potential rectangle, we would be looking at a move to the ₹80 level, which would make quite a bit of sense considering that it is, of course, a large, round, psychologically significant figure and would probably have a lot of people taking profit anyway.

On the downside, I do believe that the ₹95 level will continue to offer plenty of support, as it has been so reliable as of late. Nonetheless, the market has slope higher over the last two weeks, and that does suggest that we may not even get back down to that level. If we did, I would fully anticipate a bounce though. Even if we do break down below there, I think there is plenty of support all the way down to the ₹74 level after that.