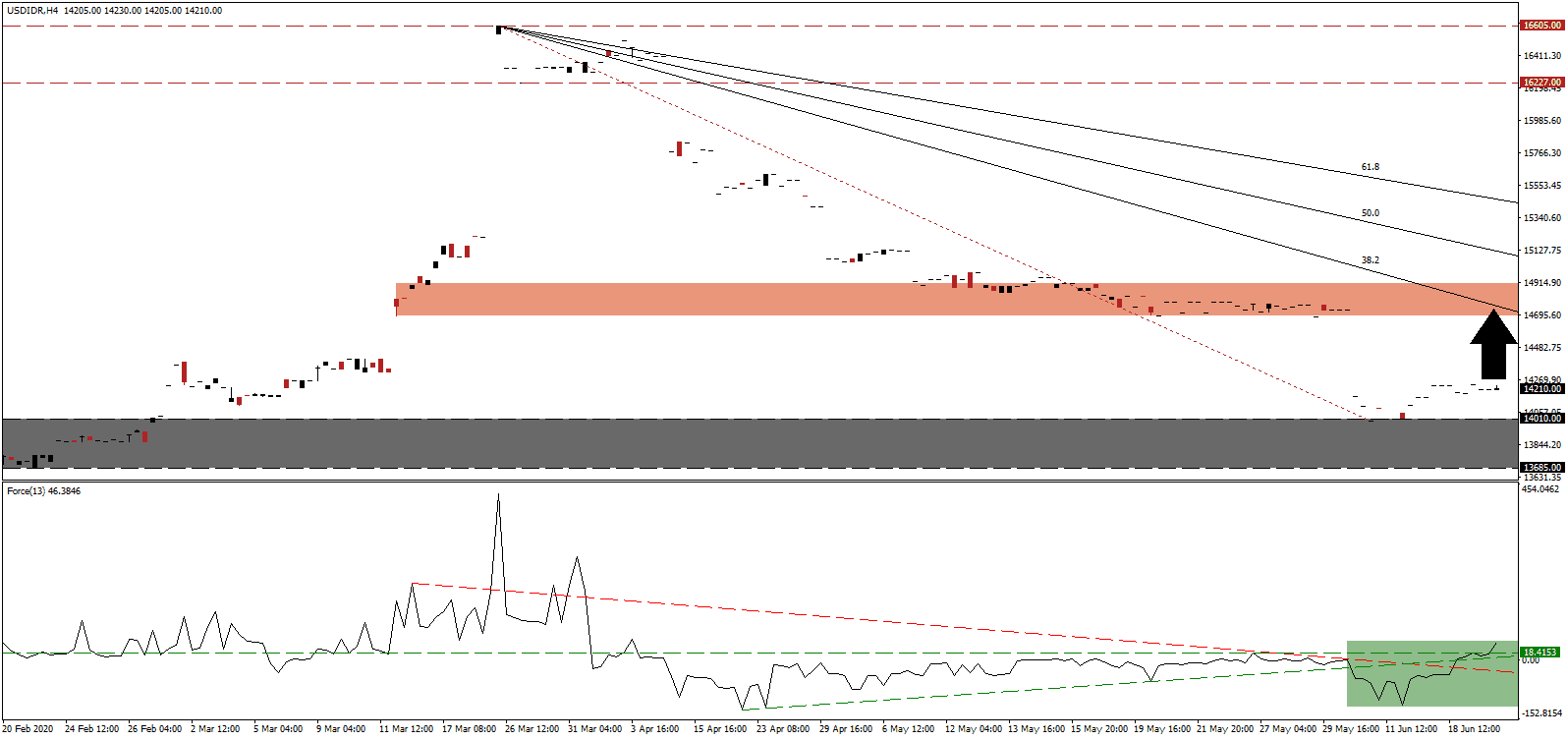

Indonesia is faced with a string of downward revisions to its 2020 GDP, resulting from the Covid-19 pandemic. The Asian Development Bank forecasts a 1.0% contraction this year, and while benign as compared to what developed economies, it will represent the weakest performance since the 1998 Asian financial crisis. Indonesia is the most infected Southeast Asian country, and despite warnings that it has not reached peak-infection, the government is rushing to ease lockdown restrictions and opening borders. After a massive price gap to the downside took the USD/IDR, a thinly traded currency pair, from its short-term resistance zone into its support zone, a brief counter-trend rally is expected.

The Force Index, a next-generation technical indicator, confirms the build-up in bullish momentum after recording a marginally higher high. It allowed for a breakout above its descending resistance level, leading to a push above its ascending support level. The subsequent upside pressure sufficed for a conversion of its horizontal resistance level into support, as marked by the green rectangle. Bulls regained complete control of the USD/IDR after this technical indicator advanced into positive territory.

While the Indonesian government implemented an Rp695.2 trillion assistance package, its most recent forecast includes 3.0 to 5.2 million job losses related to the Covid-19 pandemic. It further estimates between 1.8 to 4.8 million will slip into poverty in 2020. First-quarter GDP growth slowed to just shy of 3.0%, the slowest rate since 2001. Finance Minister Sri Mulyani Indrawati did note a 3.1% second-quarter GDP contraction is probable. The USD/IDR stabilized at the top range of its support zone located between 13,685 and 14,010, as marked by the grey rectangle. Due to inflation, the Indonesian Rupiah has not sub-units.

Adding to concerns for the economy is the foreign capital outflow, which the Bank of Indonesia estimates at Rp125.0 trillion. Together with household spending, which plunged due to the nationwide lockdown, it accounts for approximately 70% of GDP. With the majority of Indonesians employed in agriculture, retail, processing, and construction, the threat of an accelerated spread of the virus persists. The USD/IDR is positioned to spike into its short-term resistance zone located between 14,690 and 14,905, as identified by the grey rectangle, where it will face its descending 38.2 Fibonacci Retracement Fan Resistance Level. An extended breakout remains unlikely due to ongoing bearish pressures in the US Dollar.

USD/IDR Technical Trading Set-Up - Brief Counter-Trend Rally Scenario

Short Entry @ 14,210

Take Profit @ 14,690

Stop Loss @ 13,990

Downside Potential: 480 pips

Upside Risk: 220 pips

Risk/Reward Ratio: 2.18

A breakdown in the Force Index below its descending resistance level, serving as temporary support, may extend the correction in the USD/IDR with a new breakdown sequence. The rise in new infections across the US in conjunction with more debt-funded stimulus is expanding downside pressures in the US Dollar. Volatility in this currency pair, accustomed to price gaps amid low volume, is anticipated to remain elevated. Price action will challenge its next support zone between 13,560 and 13,600.

USD/IDR Technical Trading Set-Up - Breakdown Scenario

Long Entry @ 13,860

Take Profit @ 13,560

Stop Loss @ 13,990

Upside Potential: 300 pips

Downside Risk: 130 pips

Risk/Reward Ratio: 2.31