Following the testimony of Dr. Anthony Fauci, the Director of the National Institute of Allergy and Infectious Diseases (NIAID) and member of the White House Covid-19 taskforce, to Congress yesterday, the US Dollar came under selling pressure. He did warn against the surge in new infections as the country is lifting lockdown measures. While a total lockdown may be avoided, he did suggest a rollback for the gradual reopening of the economy which could become necessary unless the trend reverses. He described the country is a mixed bag, with some areas doing well and others falling behind. It added to downside pressure on the USD/IDR, potentially ending the breakout attempt above its support zone.

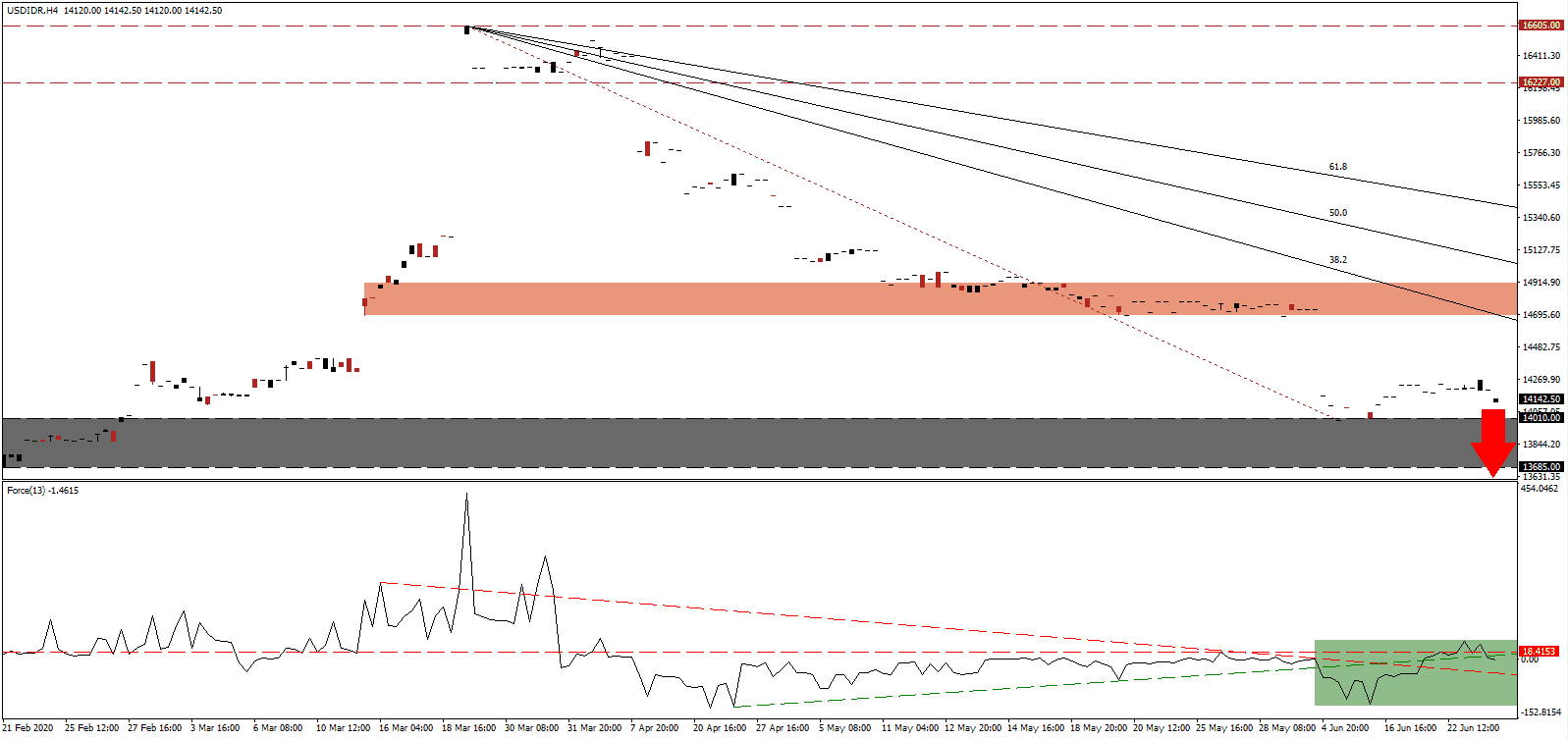

The Force Index, a next-generation technical indicator, shows the rise in bearish momentum with a swift conversion of the horizontal support level into resistance. Following the breakdown below its ascending support level, as marked by the green rectangle, downside pressures expanded notably. It also took this technical indicator into negative territory, placing bears in control of the USD/IDR. A collapse below the descending resistance level, serving as temporary support, is anticipated to spark a broader sell-off in this currency pair.

There appears to be a growing divide within the US between Republican and Democratic governors. The former are eager to push forward with easing restrictions, while the latter remains more cautious. Political motivation ahead of the November presidential election may fulfill a partial role in the difference to the Covid-19 response. Adding to a problematic situation is the growing dismissal and ignorance of advice given by healthcare officials. The short-term resistance zone located between 14,690 and 14,905, as identified by the red rectangle, is pending a downward revision after the descending 38.2 Fibonacci Retracement Fan Resistance Level crossed below it, in conjunction with a rise in bearish momentum. It confirms the growing breakdown pressures on the USD/IDR.

Indonesia faces significant issues related to the Covid-19 pandemic. The implemented Rp695.2 trillion economic assistance package won’t prevent an estimated 1.8 to 4.8 million Indonesian from slipping into poverty. While Finance Minister Sri Mulyani Indrawati did confirm expectations for a 3.1% second-quarter GDP contraction, West Java Governor Ridwan Kamil urged the government to decentralize the economy away from Jakarta and spread it across provinces. Such a move may unlock untapped economic potential in the post-Covid-19 world. The USD/IDR is positioned for a breakdown below its support zone located between 13,685 and 14,010, as marked by the grey rectangle. Price action will challenge its next support zone between 13,560 and 13,600.

USD/IDR Technical Trading Set-Up - Breakdown Scenario

Long Entry @ 14,140

Take Profit @ 13,560

Stop Loss @ 14,300

Upside Potential: 580 pips

Downside Risk: 160 pips

Risk/Reward Ratio: 3.63

Should the Force Index reclaim its ascending support level, the USD/IDR is likely to attempt an advance. This thinly traded currency pair is expected to witness ongoing volatility and low trading volumes, as evident in the most recent price gap to the downside. Forex traders are advised to remain cautious, but the upside potential remains limited to its 38.2 Fibonacci Retracement Fan Resistance Level, favored to enforce the bearish chart pattern.

USD/IDR Technical Trading Set-Up - Limited Reversal Scenario

Short Entry @ 14,400

Take Profit @ 14,650

Stop Loss @ 14,300

Downside Potential: 250 pips

Upside Risk: 100 pips

Risk/Reward Ratio: 2.50