Brazil and the US are leading the total global Covid-19 count, as well as new daily infections. US President Trump suggested to slow the rate of testing to prevent official data from expanding, a move vastly criticized, dangerous, and counter-productive. The ongoing rush to lift restrictions implemented to slow the spread of the virus is adding to the uncontrolled spread of the virus. It harms economic activity, creating a more substantial long-term problem. Warnings over May’s surprise employment data being an outlier, vulnerable to a referred nightmare scenario for the US economy, are ignored. While the USD/BRL spiked higher, resulting in a minor upward revision of its short-term resistance zone, bullish momentum collapsed, suggesting a resumption of the dominant bearish trend.

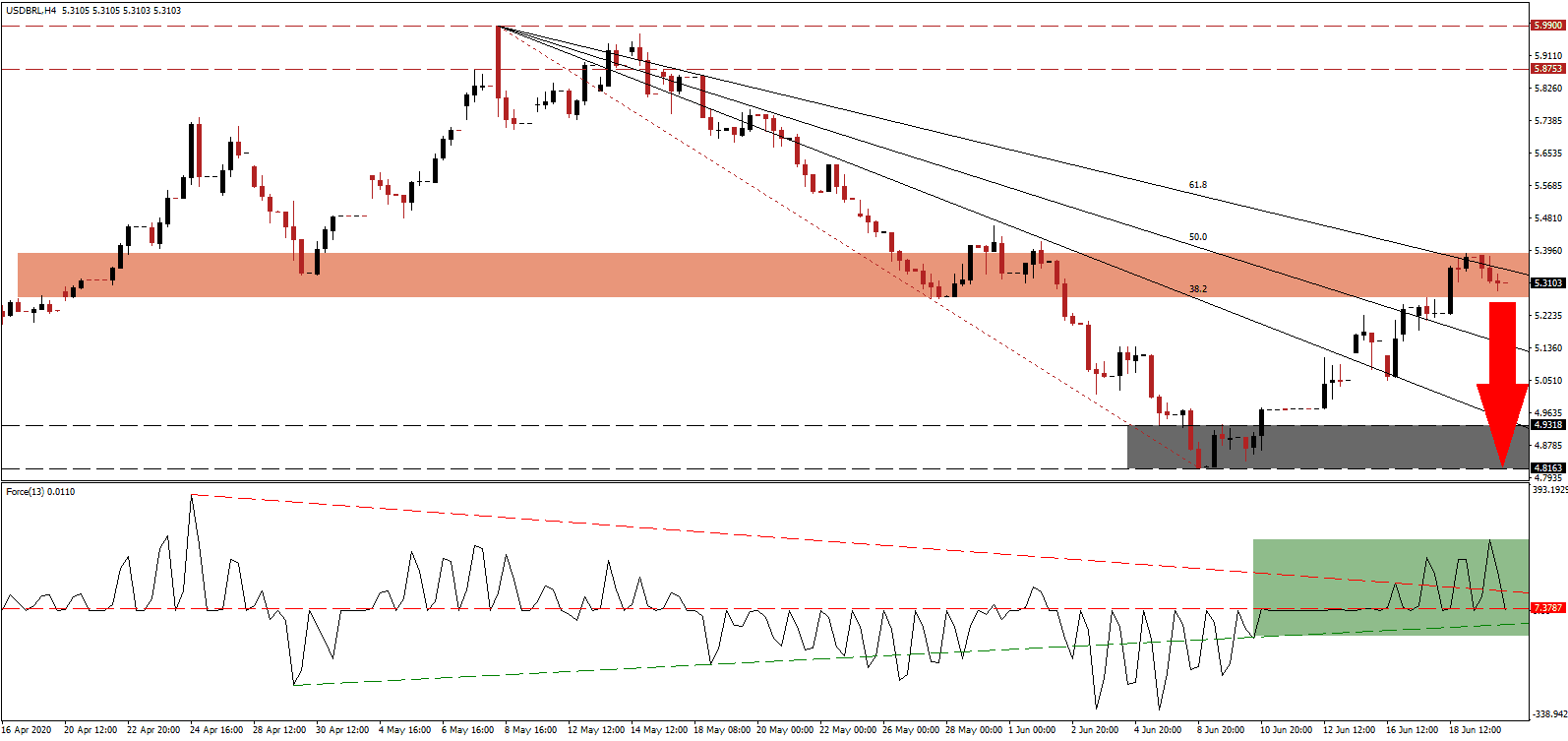

The Force Index, a next-generation technical indicator, initially spiked to create a higher high before correcting below its descending resistance level, as marked by the green rectangle. It is now challenging its horizontal resistance level, after converting it from support. Given the proximity of the ascending support level, this technical indicator is favored to plunge through it and into negative territory, granting bears complete control of the USD/BRL.

While Brazil presumably reached the bottom of the current Covid-19 induced economic crisis between April and May, confirmed by outgoing Brazilian Treasury Secretary Mansueto Almeida, a slow economic recovery is likely to materialize. He also advised that the focus of the government should be an overhaul of the tax system, acknowledging challenged to reach consensus on broad reforms. The USD/BRL was rejected by its descending 61.8 Fibonacci Retracement Fan Resistance Level, passing through the short-term resistance zone located between 5.2695 and 5.3865, as identified by the red rectangle.

Despite the ongoing Covid-19 pandemic, Brazil’s essential pension reform passes last year is easing future stress on finances. Past administrations relied heavily on debt, a pattern President Bolsonaro is determined to end. Brazil has also produced a current account surplus, while Chinese demand for commodities is adding economic support. With more reforms anticipated, the economy is on the proper track for long-term prosperity. The US is presently on the opposite path, adding to a pending profit-taking sell-off in the USD/BRL. It is expected to pressure price action into its support zone located between 4.8163 and 4.9318, as marked by the grey rectangle. A breakdown extension remains a distinct possibility.

USD/BRL Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 5.3100

Take Profit @ 4.8100

Stop Loss @ 5.4600

Downside Potential: 5,000 pips

Upside Risk: 1,500 pips

Risk/Reward Ratio: 3.33

Should the Force Index spike higher, inspired by its ascending support level, the USD/BRL may attempt a second breakout. Forex traders are advised to consider any advance as a selling opportunity amid the worsening outlook for the US economy, in conjunction with a bullish outlook on Brazil. Price action will face its next resistance zone between 5.8753 and 5.9900.

USD/BRL Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 5.6100

Take Profit @ 5.9100

Stop Loss @ 5.4600

Upside Potential: 3,000 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 2.00