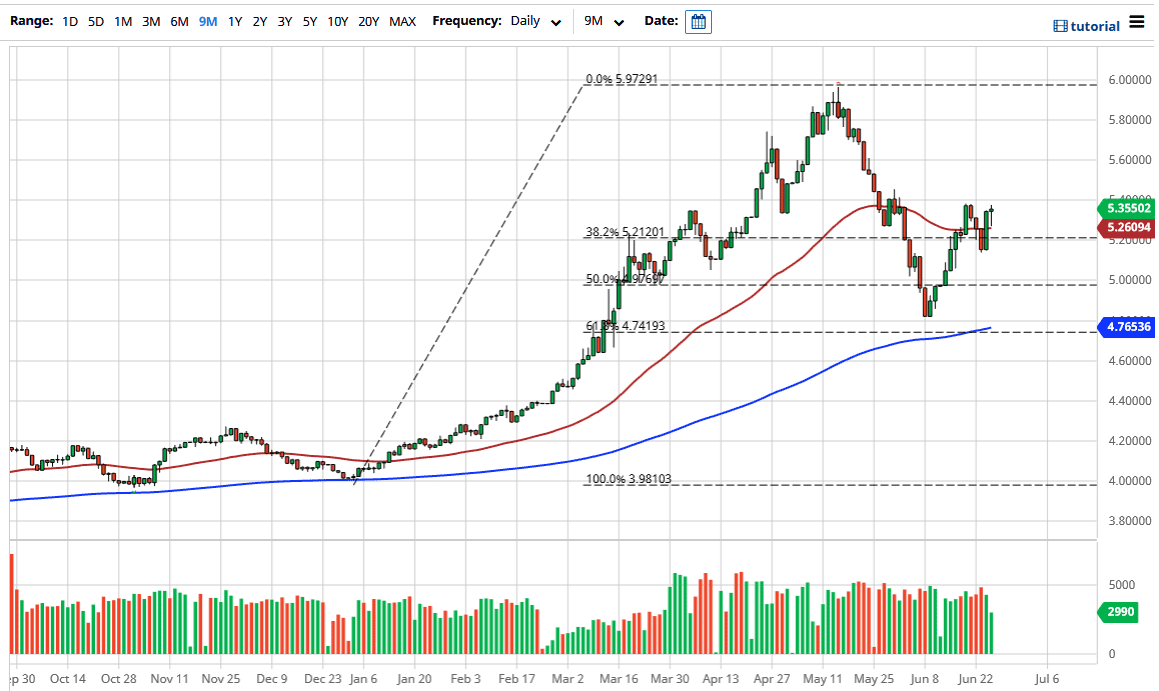

The US dollar initially pulled back a bit during the trading session on Thursday, reaching down towards the 50 day EMA. However, the market has found enough support underneath the turn around and form a big hammer, which is sitting on top of this 50 day EMA which suggests that the buyers are willing to come into the market and push the US dollar higher against the Brazilian Real.

Keep in mind that Brazil, and to a lesser extent Mexico, offer a way to play the Latin America gain or loss of economic strength, so paying attention to the Brazilian Real is crucial as to see how the world sees South America in general. The coronavirus has been running rampant in Brazil and other countries in South America, so it does make sense that the Brazilian Real gets hammered. With the virus spreading like wildfire to the point where the government is not even collecting numbers, that does not bode well for how the Brazilian Real should work. Looking at the chart, I believe that the 5.40 level is going to continue to offer short-term resistance, but the fact that we have pulled back and formed a hammer from that level after bouncing off the 50 day EMA tells me that we are pushing as hard as we can do break out eventually.

Once we get that breakout, and I do believe that it is likely to happen, the market is more than likely to go towards the 5.6 level next, followed by the 5.8 level, and then eventually the 6.0 level. The market has been forming a bit of a bullish flag as of late, after pulling back towards the 61.8% Fibonacci retracement level. Furthermore, the 200 day EMA is sitting just below there and rising, so that is another reason to think that perhaps buyers would be involved. The 6.0 Real level is a massive ceiling, so I think getting above there is going to take some doing, which would almost certainly be a reaction to a major “risk off” type of situation. The US dollar against the Brazilian Real could very well signify how the world is feeling about emerging market commodity based economies, which could be under serious threat if the global growth situation continues to look incredibly soft and weak.