Brazil became the epicenter of the global Covid-19 pandemic. Total confirmed cases trail only the US, while it leads statistics in new daily infections. While Latin America’s largest economy is faced with identical challenges as most markets, it stands apart in its current account deficit. Accustomed to deficiencies, Brazil may record a surplus in 2020. In April alone, the government reported its biggest excess in history at $3.8 billion. It was due to Brazilians unable to travel, spending money domestically on essentials. This trend is likely to continue over the next few months, adding a distinct bearish catalyst to the USD/BRL. A minor breakout, powered by the rise in bullishness, is expected to precede a more massive sell-off in this currency pair.

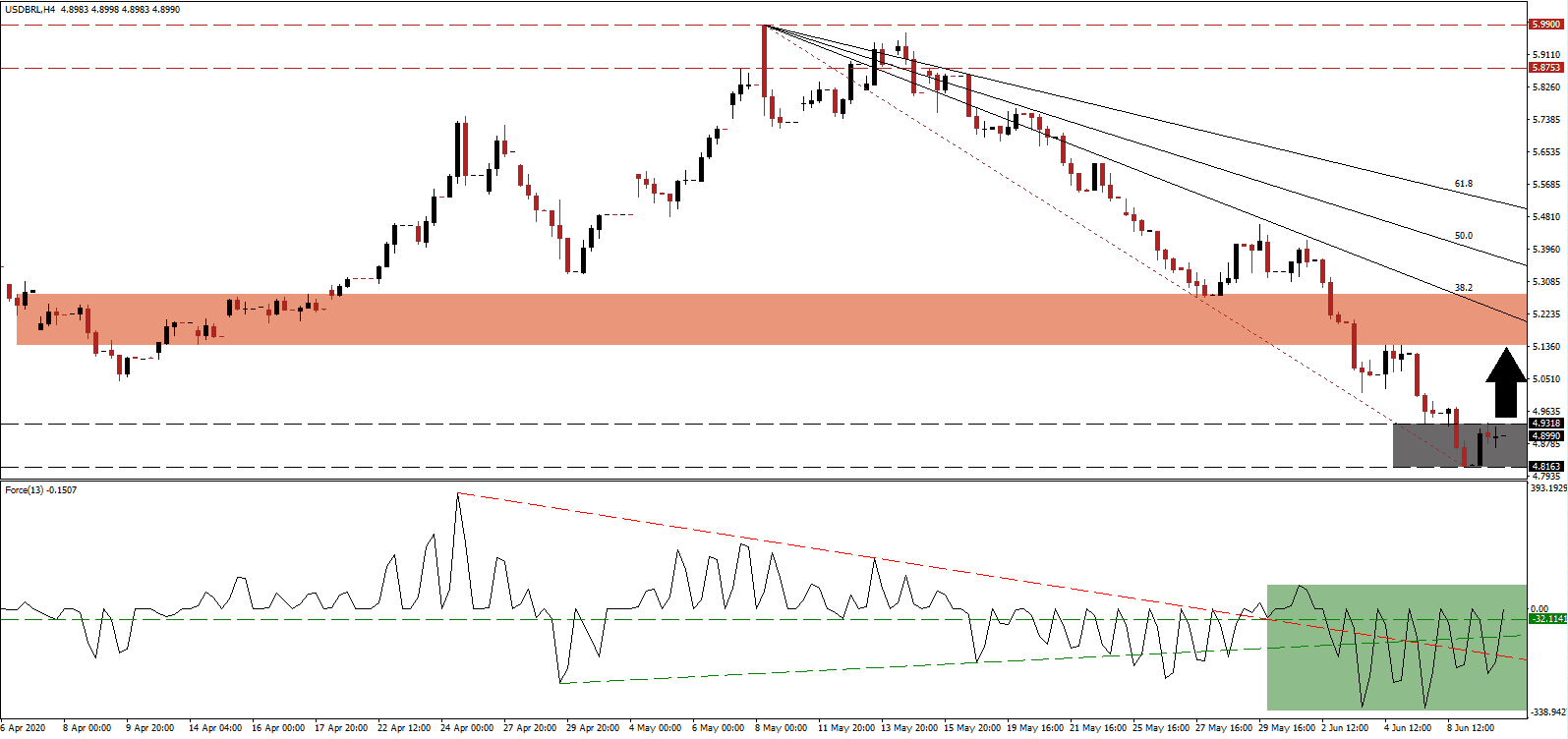

The Force Index, a next-generation technical indicator, advanced off of a multi-month low and pushed above its descending resistance level. It was followed by a breakout above its ascending support level, as marked by the green rectangle, and conversion of the horizontal resistance level into support. Bears remain in control of the USD/BRL with this technical indicator below the 0 center-line, but a brief breakout remains a possibility before reverting to the downside.

Forecasts call for a 6.0% GDP contraction in Brazil for 2020, denting the impact of a potential current account surplus due to a collapse in imports. Adding another bullish catalyst to the Brazilian Real is the surge in demand for soft commodities by China, Brazil’s primary trading partner. The worsening relationship between the US and China could result in more trade with Brazil, as evident in the soy market. Any breakout attempt in the USD/BRL should be viewed as an excellent selling opportunity, with the upside potential limited to its short-term resistance zone. It is presently located between 5.1407 and 5.2741, as marked by the red rectangle, and poised for a downward revision, reflecting bearishness in price action.

Due to the improvement in the current account deficit, Brazil does not require assistance from the US-based International Monetary Fund, which already bailed out Chile, Colombia, Mexico, and Peru in Latin America. The descending 38.2 Fibonacci Retracement Fan Resistance Level is anticipated to enforce the long-term correction and eventually inspire a breakdown in the USD/BRL below its current support zone located between 4.8163 and 4.9318, as identified by the grey rectangle. Today’s US Federal Reserve meeting may provide the next catalyst, depending on the central bank’s economic outlook. It could invalidate the pending breakout and commence an accelerated sell-off.

USD/BRL Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 4.9000

Take Profit @ 5.1400

Stop Loss @ 4.7700

Upside Potential: 2,400 pips

Downside Risk: 1,300 pips

Risk/Reward Ratio: 1.85

Should the Force Index drop below its ascending support level, the USD/BRL is well-positioned to extend its correction. The next support zone awaits price action between 4.3819 and 4.4525, with more downside potential. Forex traders are advised to take advantage of any temporary price spike with new net short positions. Magnifying the downside potential in this currency pair is increasing bearish fundamental progress out of the US.

USD/BRL Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 4.7000

Take Profit @ 4.3800

Stop Loss @ 4.7700

Downside Potential: 3,200 pips

Upside Risk: 700 pips

Risk/Reward Ratio: 4.57