Brazilian Treasury Secretary Mansueto Almeida updated the 2020 public sector primary deficit outlook to reflect an increase of up to R$800 billion, exceeding 11% of GDP, which is expected to contract between 6.0% and 7.0%. It is above the official government projections for a deficit of R$700 billion and a GDP drop of 4.7%. Including interest payments, the nominal public sector deficit could reach 17.0% of GDP. On a positive note for the currency, he confirmed that all planned expenditures are scheduled for this fiscal year. The USD/BRL faced a price spike into the top range of its short-term resistance zone, as fear over the resurgence of the Covid-19 globally gave a short-term boost to the US Dollar.

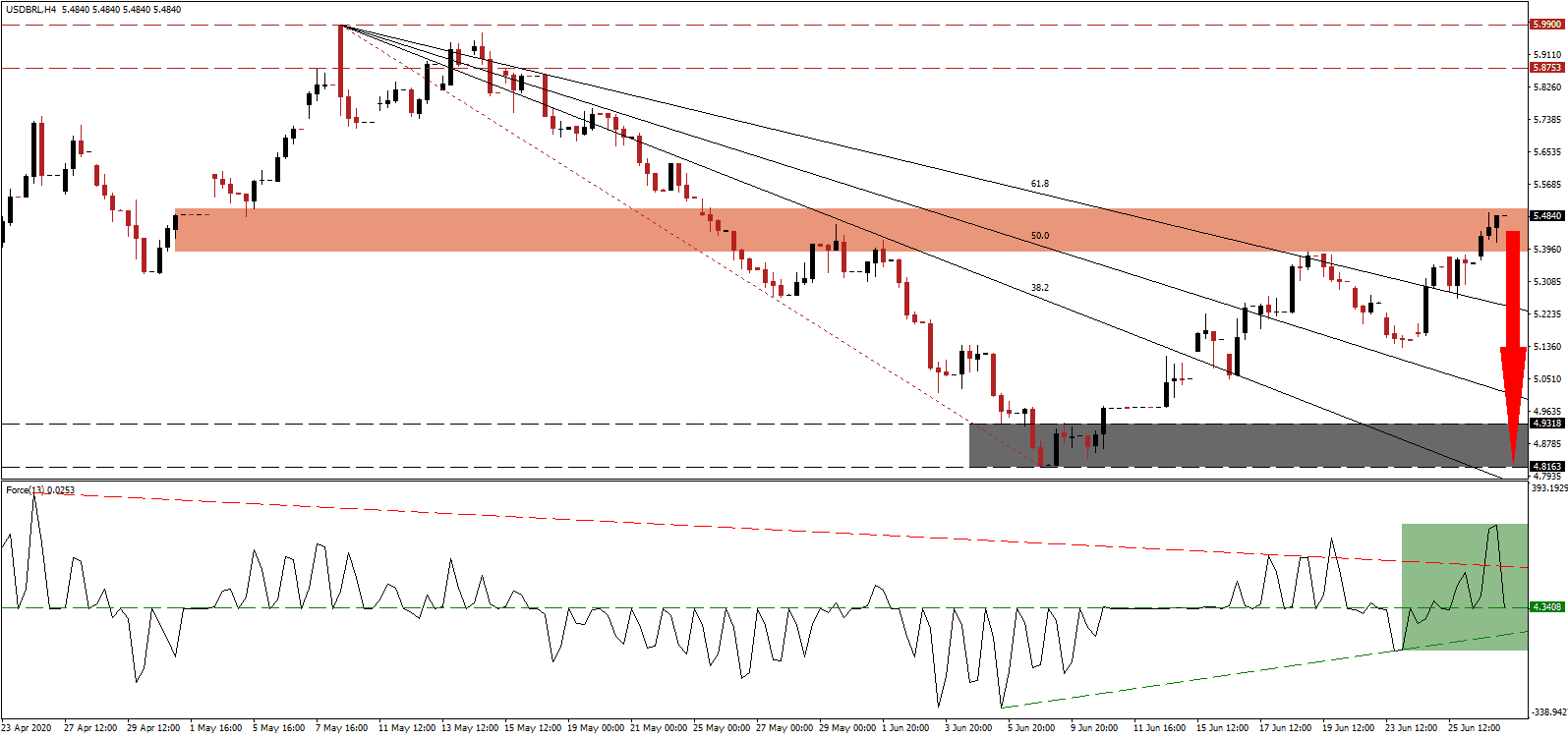

The Force Index, a next-generation technical indicator, accelerated to a higher high together with this currency pair but swiftly collapsed below its descending resistance level, as marked by the green rectangle. It has now approached its horizontal support level from where a push lower is favored to materialize, given the magnitude of the expansion in bearish momentum. A move in this technical indicator below the 0 center-line and a subsequent breakdown below its ascending support level will place bears in control over the USD/BRL.

Providing a long-term bullish catalyst to Brazil is the ongoing push by the government of Jair Bolsonaro to privatize the economy and reform the tax code. It maintains the course for Latin America’s largest economy to regain investment-grade status. One essential issue to address is the deforestation of the Amazon. A group of international investors managing over $3.7 trillion in assets sent a letter to the government, urging to reverse the present policy. It helped the price spike in the USD/BRL into its upward adjusted short-term resistance zone located between 5.3865 and 5.5012, as identified by the red rectangle.

While Forex traders have rushed to the liquidity of the US Dollar as a fear-trade, the economic prospects and outlook are deteriorating quickly. Texas, which led the rush to reopen the economy prematurely, is forced to roll-back the process due to the surge in new Covid-19 infection and a worrisome increase in the positivity rate of tests. The US is expected to announce more debt, expanding bearish pressures on its currency. The USD/BRL is positioned for a collapse below its descending 61.8 Fibonacci Retracement Fan Support Level. It will clear the path for a breakdown into its support zone located between 4.8163 and 4.9318, as marked by the grey rectangle.

USD/BRL Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 5.4850

Take Profit @ 4.8150

Stop Loss @ 5.6500

Downside Potential: 6,700 pips

Upside Risk: 1,650 pips

Risk/Reward Ratio: 4.06

A breakout in the Force Index above its descending resistance level may inspire the USD/BRL to extend higher. Forex traders are recommended to take advantage of any advance with new net short positions, as the economic condition in the US is worsening after the expected bounce higher from the April low. Price action will challenge its next resistance zone between 5.8753 and 5.9900.

USD/BRL Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 5.7700

Take Profit @ 5.9700

Stop Loss @ 5.6500

Upside Potential: 2,000 pips

Downside Risk: 1,200 pips

Risk/Reward Ratio: 1.67