Argentina is on track to record its third consecutive year of GDP contraction in 2020. The International Monetary Fund predicts a 5.7% drop this year, following declines of 2.5% and 2.2 in 2018 and 2019, respectively. A study by the World Bank highlights that Argentina spent 33% of the time after 1950 in a recession. It is second in the world, trailing merely the Democratic Republic of Congo. Inflation is running at 50%, positioning the Argentine Peso as the worst emerging market currency for the fourth consecutive year. It's fueled the rally in the USD/ARS, but bullish momentum collapsed after price action reached its resistance zone, suggesting a counter-trend sell-off is likely to follow.

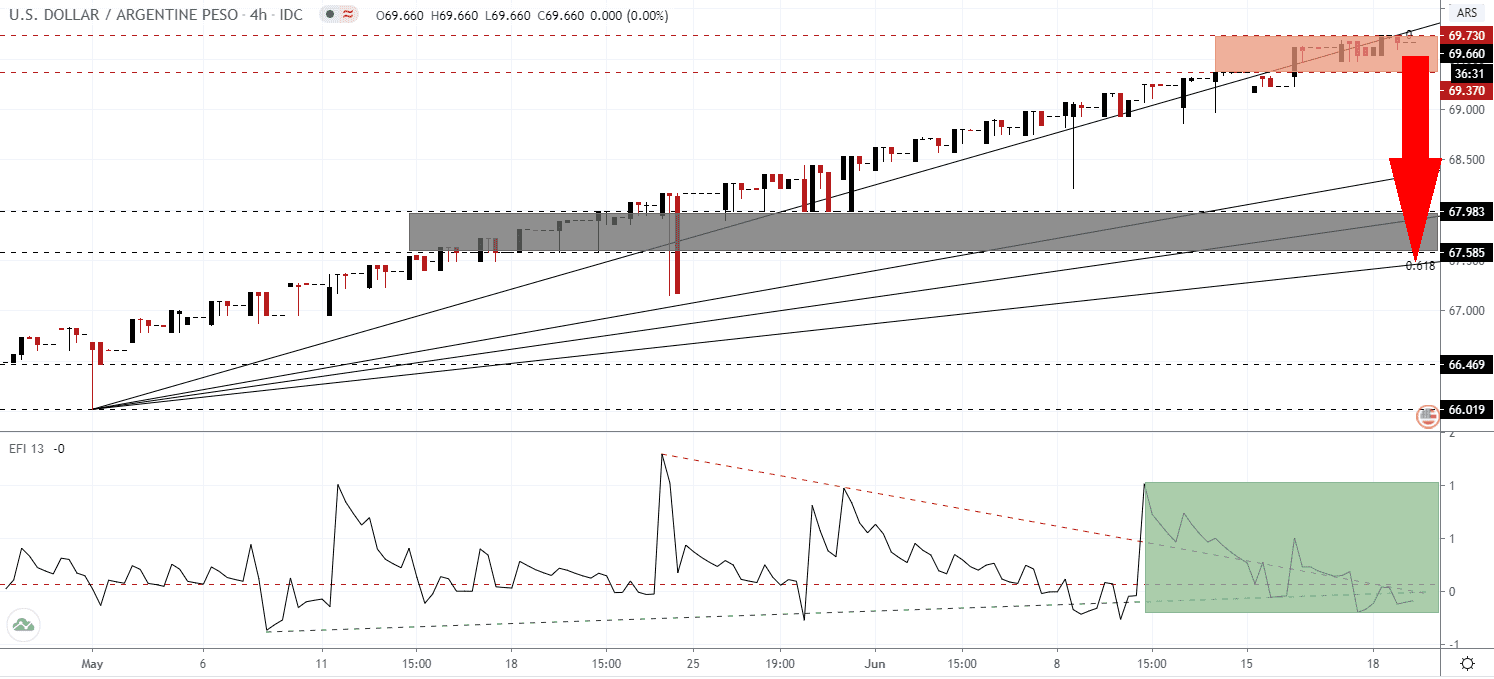

The Force Index, a next-generation technical indicator, offers an early warning that a price action reversal is imminent. While this currency pair drifted higher, the Force Index corrected notably, forming a negative divergence. It led to the conversion of the horizontal support level into resistance, as marked by the green rectangle. The breakdown below the ascending support level increased bearish momentum, and the descending resistance level magnifies breakdown pressures. Bears are in complete control of the USD/ARS since this technical indicator crossed below the 0 center-line.

Unsustainable debt has plagued Argentina for decades. Former President Macri attempted to settle with debtors after the voluntary 2014 default. While he implemented pro-market reforms, the debt-to-GDP ratio surged to 93.0%, the highest level since 2004. His successor, President Alberto Fernández, is now renegotiating $65 billion of debt, continuing the well-established sequence. With both sides inching closer to an agreement, a temporary profit-taking sell-off in the USD/ARS remains a possibility, if price action completes a breakdown below its resistance zone located between 69.370 and 69.730, as identified by the red rectangle.

Per the Minister of Economy Martín Guzmán, Argentine creditors failed to understand the reality his country faces. The Covid-19 pandemic is intensifying persistent economic problems. Uncertainty of how much of his predecessor's market-friendly policies President Fernández will roll back adds to complicated debt negotiations. Negative progress out of the US adds to short-term breakdown pressures in the USD/ARS, positioned to correct into its short-term support zone located between 67.585 and 67.983, as marked by the grey rectangle. The ascending 61.8 Fibonacci Retracement Fan Support Level enforces it.

USD/ARS Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 69.650

Take Profit @ 67.650

Stop Loss @ 70.000

Downside Potential: 2,000 pips

Upside Risk: 350 pips

Risk/Reward Ratio: 5.71

In the event the Force Index reclaims its ascending support level, the USD/ARS is likely to be pressured into a breakout attempt. Despite ongoing economic issues out of Argentina, US data suggests a significantly slower recovery with a genuine risk of a W-shaped performance ahead. Forex traders are advised to exercise caution. Price action will challenge its next resistance zone between 70.604 and 71.310, a new all-time high.

USD/ARS Technical Trading Set-Up - Breakout Scenario

Long Entry @ 70.400

Take Profit @ 71.300

Stop Loss @ 70.000

Upside Potential: 900 pips

Downside Risk: 400 pips

Risk/Reward Ratio: 2.25