Saying the Argentine Peso is in trouble is too easy as the Argentina government continues to give critics plenty of ammunition. As the populists try to govern, financial institutions and domestic companies appear to be suffering worse and the population within the nation is battling a currency that is losing value on a steady basis.

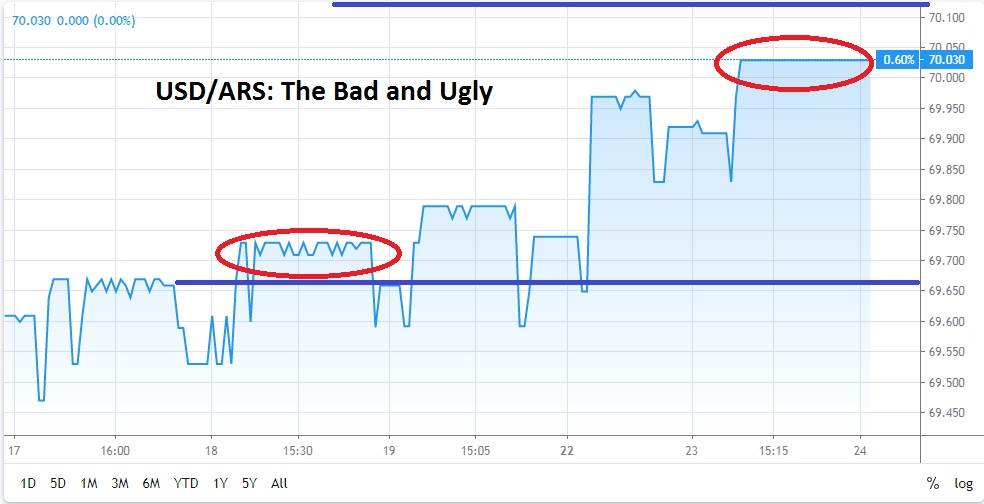

Current resistance for the USD/ARS technically appears to be the 70.100 level, but speculators must also take into consideration the values they are trading on forex platforms are the rates the Argentine government and its financial institutions officially seek. And ‘seek’ is the key word, because the Argentine government is trying to control the value of the Argentine Peso with mandates that are failing.

While the official transaction cost of the Argentine Peso for the world and forex platforms indicates a value of approximately 70.000 ARS for every US Dollar, this is not the real ‘cash’ exchange rate. Like a virtual game played only on a computer, the official exchange rate is not being practiced on the street. The black market – or blue market as it is sometimes referred to in Argentina offers a completely different exchange rate for the USD/ARS.

The value of the Argentina Peso on the black market is much different than the official government rate. If a person seeks to exchange US Dollars in cash at a black market shop in Argentina they can expect to receive a considerably greater amount of Argentine Pesos. Indications via conversations with Argentinians suggest a person who seeks to trade US Dollars for Argentine Pesos depending on the amount being exchanged can get a rate of exchange close to 100.000. This clearly demonstrates the official government rate does not have any real validity within the ‘real’ cash market and means the Argentina Peso is much weaker than its government admits.

Trading the USD/ARS is vulnerable to government intervention which may not be transparent under the current political conditions. However, speculators seeking buying positions of the USD/ARS on forex platforms cannot be faulted, because the black market exchange rate of the USD/ARS suggest the official rate being communicated by the government is a fairy tale. To be clear remain long the US Dollar against the Argentine Peso when it is possible.

Argentine Peso Short Term Outlook:

Current Resistance: 70.100

Current Support: 69.500

High Target: 72.000

Low Target: 69.000