Silver markets have broken down significantly during the trading session on Wednesday, breaking below the $18 level. The $18 level of course had been previous resistance, so now it makes sense that it is trying to offer support. Furthermore, the block of trading that occurred between $17.20 and $18 is rather thick, so I would anticipate that there is some interest in the market right here. With that being said, it is worth noting that at the end of the day we get a little bit of a bounce, showing signs of life.

The candlestick of course is relatively negative, but I think that there is enough buying pressure underneath to keep this market higher. After all, central banks continue to push the loose monetary policy around the world, and that of course has a certain amount of bullish pressure running into the metals market. If we were to break down below the $17.20 level, then the market is likely to continue to go down to the $17 level. Below there, then the market is likely to go down to the $16 level.

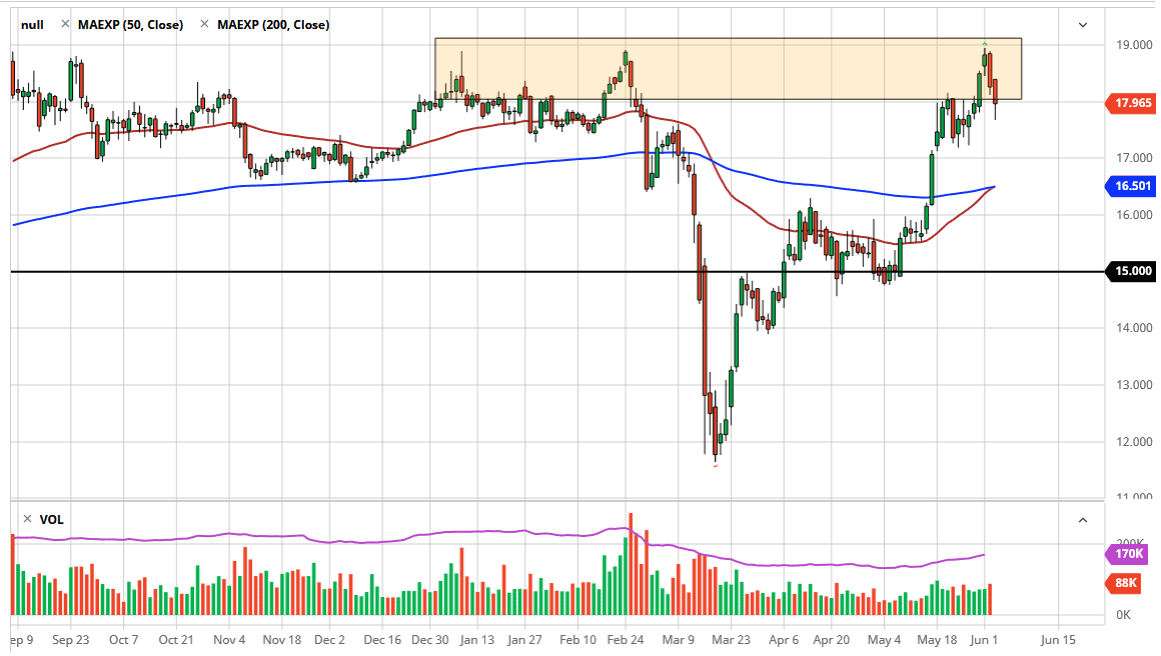

Looking at the moving averages, the 50 day EMA is starting to cross the 200 day EMA forming the “golden cross.” Having said that, the “golden cross” is quite often late, as it is a major lagging indicator. Regardless though, I think that the 200 day EMA which is colored in blue could offer support, but I think that the 50 day EMA will get there quick enough to offer support as well. To the upside, the $19 level above is resistance, and we can break above there it is likely that the market goes to the $20 level. The $20 level of course has a significant amount of psychological importance attached to it, so I would anticipate that sellers would be in that area of course we could get a bit of news flow in that area as well. If we can break above the $20 level, then silver will take straight off to the stratosphere, kind of like stocks have done recently. To the downside, I believe that the $17 level, $16 level, and even the $15 level all offer potential buying opportunities for longer-term traders, but make sure that you do not over levered yourself, because it can cause major issues. Silver is a wild ride at times, so caution is the better part of valor.