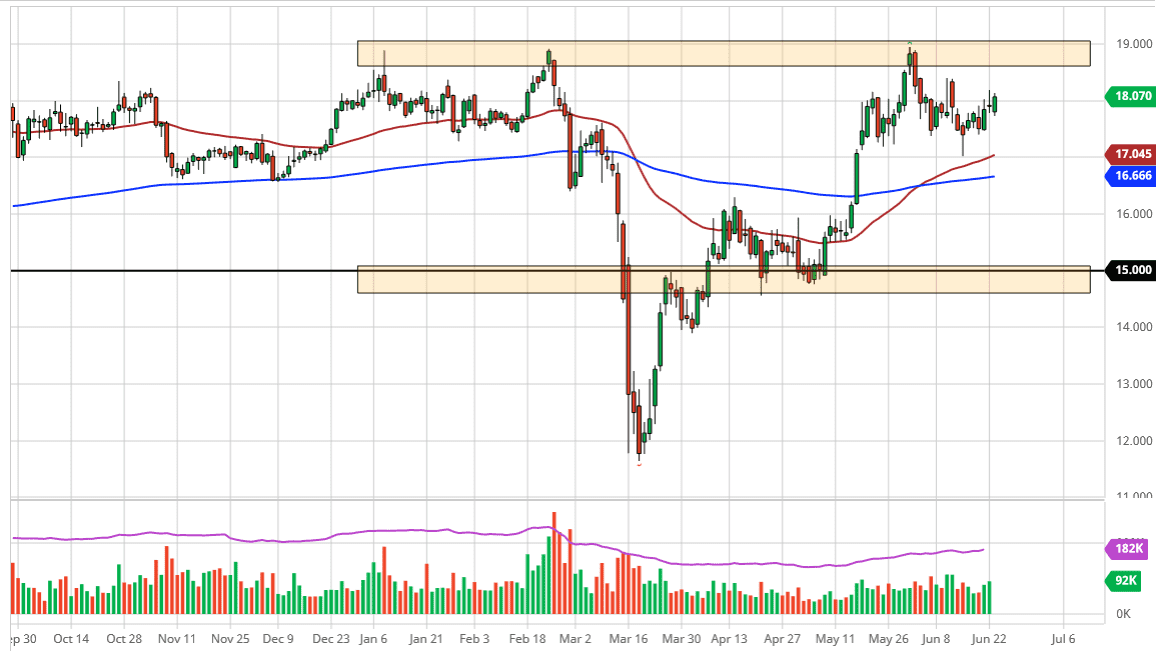

Silver markets have rallied again during the trading session on Tuesday, as we have crossed above the $18 level. This is an area that of course attracts a certain amount of attention due to the fact that it is a large, round, psychologically significant figure. Furthermore, this is a market that I think eventually has to resolve the fact that central banks around the world continue to flood the market with liquidity, and that of course is negative for fiat currencies and therefore positive for precious metals. With that being the case, the market is likely to go looking towards the upside, perhaps reaching towards the recent highs near the $19 level.

To the downside, I think there are plenty of buyers down near the 50 day EMA which is closer to the $17 level. That is essentially the short-term “floor” in the market, so if we were to break down below there it would change the attitude of the trading environment completely, but in the short term I do not think that happens anytime soon. What is even more interesting is that the shooting star that had formed on Monday is being threatened to the upside and if we break above there then it is likely would go looking towards the $18.50 level, and then possibly the $19.00 level.

In general, the market is likely to go back and forth, trying to build up enough momentum to finally take off to the upside. Once it does, and if we can break above the $19.00 level it is likely that we go looking towards the $20 level. The $20 level is crucial to pay attention to, as it is an area that has been the gateway to much higher pricing in the past. During the last financial crisis, the market shot above the $20 level before reaching all the way towards the $50 level to the upside. The market will continue to see a lot of noise but ultimately, I do think that we will settle on going higher. Gold is worth being paid attention to, as it will drive this market right along with it. Keep in mind that silver unfortunately has an industrial component to it, so it is probably going to continue to see a bit of a drag due to that.