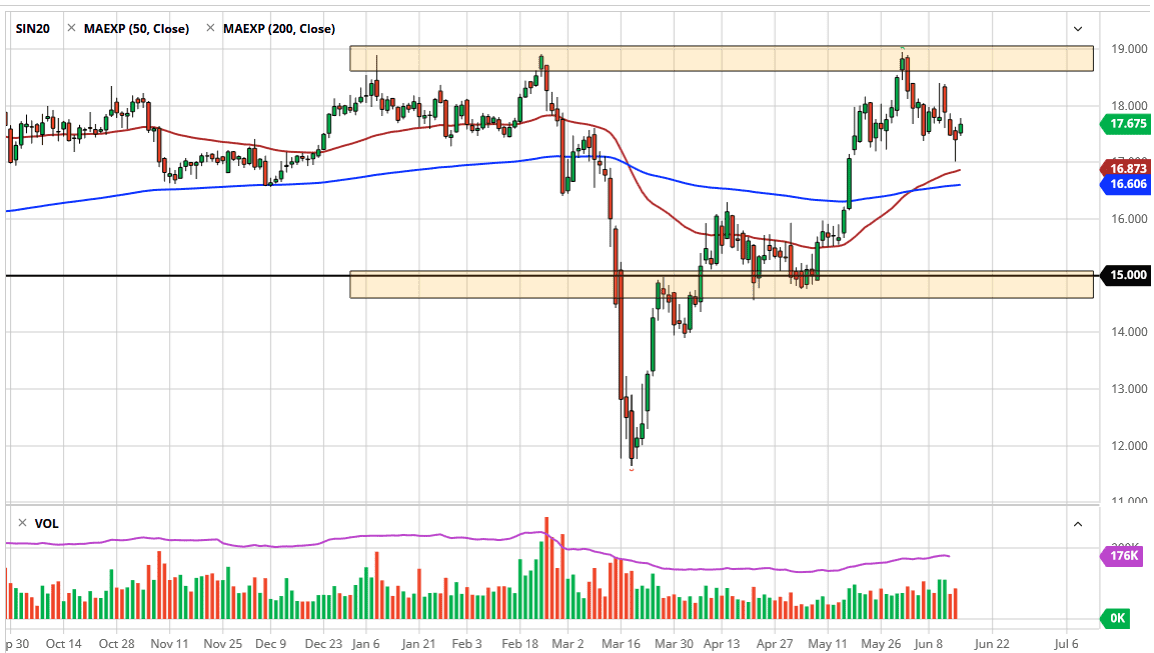

The silver market has rallied a bit to kick off the Tuesday session, breaking above the top of the hammer from the Monday session. The $17 level did offer a significant amount of support, and by turning around the way we have, it certainly shows that we are going to continue to see buyers on dips. This makes sense because the precious metals markets have been rather strong. Granted, silver has to deal with the industrial demand question, but it still retains some of that precious metals attitude.

The 50 day EMA sits just below the $17 level, so that should continue to offer plenty of buyers, and could push this market back towards the $19 level. The $19 level has had significant resistance more than once and has seen a lot of pressure on multiple attempts to break out above it. With this in mind, I recognize that the market probably has a lot to do in order to continue going higher and therefore I think dips in the market will continue to be attractive as buying opportunities. I believe that the $17 level is the most obvious short-term support level, and it should be paid close attention to, due to the fact that it has been important more than once. As long as we can stay above, there it is more of a “buy on the dips” mentality going forward.

A breakdown below the 50 day EMA probably opens up a move down to the 200 day EMA which is currently trading at the $16.60 level, as well as the $16 level under there. Between $16 and $15 under there, we should see plenty of support based upon the fact that we had so much consolidation in that area. Ultimately, I have no scenario in which I’m willing to sell silver but I do recognize that the industrial demand part of the equation is something that people will be paying quite a bit of attention to as it certainly will be a bit of a drag on this market. If you are looking to play the precious metal straight, I still think that gold will continue to be the best way forward, although it should be noted that the silver market will be dragged right along in the same overall direction. I do not sell either metal right now, or do I think that eventually, they both will break out.