The recent pessimistic view from the US Federal Reserve and the renewed global geopolitical tensions, after tensions on the borders between China and India and between the two Koreas and the emergence of new hotbeds of Covid-19 infection with, coinciding with the reopening of global economies in coexistence with the epidemic are all combined factors that contributed in correcting the price of gold up to $1730 an ounce Before settling around the $1727 per ounce in the beginning of today’s trading, before the Central Bank of Switzerland and the Bank of England announced their monetary policy decisions.

Gold will remain a safe haven of choice for investors in times of uncertainty.

The yellow metal got support from Federal Reserve Chairman Jerome Powell's comments that despite some upbeat US economic data, the uncertainty still surrounds the timing of the country's economic recovery. In a testimony prepared for the Senate Banking Committee on Tuesday, Powell admitted that some economic indicators indicated a stabilization in activity and others suggested a "modest recovery", but "there remains a great deal of uncertainty about the timing and strength of this recovery."

He added that the Federal Reserve is committed to using a full set of tools to ensure that the recovery from the recession will be as strong as possible.

For economic data. US retail sales data for May showed that sales activity jumped 17.7%, according to official data. Economists had expected an increase of 8.5%. The report notes that the US retail trade started to recover as the economy began to reopen after a record drop in sales in the previous two months due to the Coronavirus pandemic. Industrial production data revealed a rise of - 1.4% in May.

On the other hand, a report stated that North Korea detonated an inter-Korean liaison office in the western border town of Kaesong, indicating an escalation of tensions in the region between South Korea and North Korea.

As for the monetary policy of the US Central Bank, which affects the dollar level and consequently gold prices, some members of the Senate Banking Committee expressed concern to Federal Reserve Chairman Jerome Powell about the purchase of assets and the size of the bank's balance sheet. Senator John Kennedy, a Louisiana Republican, asked Powell how long it would take to cut the $7 trillion of the Federal Reserve "to an amount that was not global."

Powell responded by saying that these purchases do not reduce credit margins or help the Treasury finance federal debt. "I don't see that we want to run across the bond market like an elephant," Powell said, referring to the $250 billion separate Federal Reserve program to buy corporate bonds. "We just want to be there if things go wrong on the performance of the economy," Powell added.

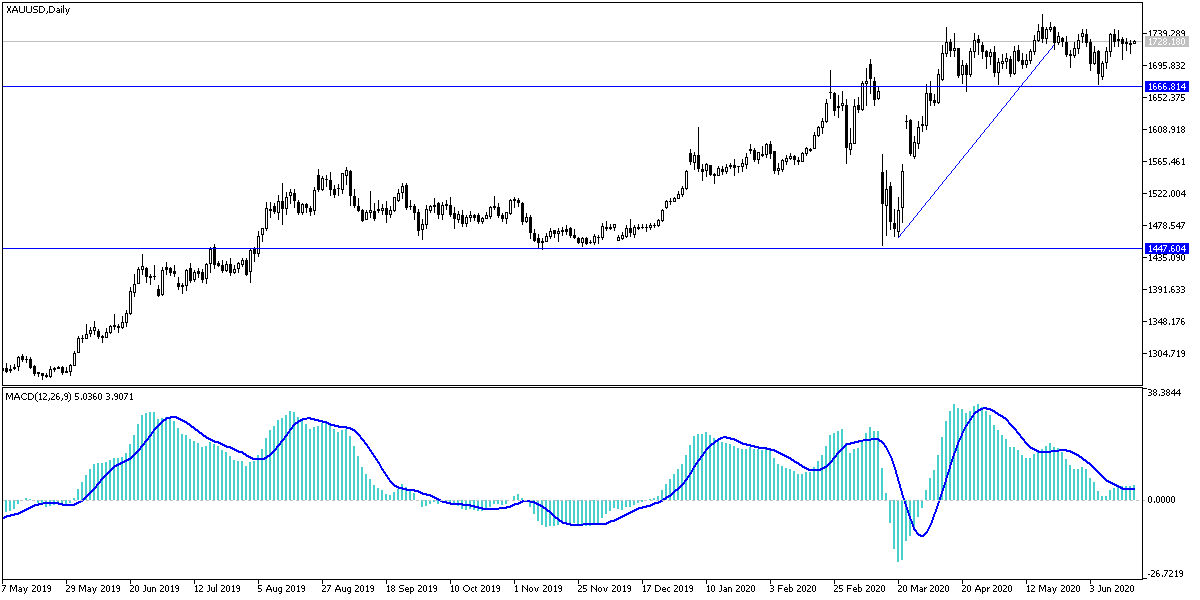

According to the gold technical analysis: I do not see any change in my technical outlook for the gold performance, as the trend remains up as long as it remains stable above the $1700 resistance. I see resistance levels at 1738, 1749, and 1765 as the most important for the bulls' control over the current bullish performance. There will be no threat to the current bull control without moving below the $1700 support. I still prefer to buy gold from every bearish level. And on the daily chart it seems clear that there is stability in a limited range for several trading sessions, which foreshadows a strong and violent movement ahead, which will be determined by global geopolitical tensions, the extent of investor risk appetite and the path of the Corona pandemic.

As for the economic calendar data today: Gold prices will interact with the announcement of monetary policy from both the Swiss Central Bank and the Bank of England. The US data includes weekly unemployed claims the Philadelphia industrial index.