An ascending week compensated the losses of the previous week. This is what happened to the gold price, as it bounced up to the $1745 resistance, and closed the week’s transactions around the $1730 level, and settled around $1720 an ounce at the time of writing. Renewed fears of a second wave of the Corona epidemic contributed to severe losses to global stock markets, and thus stronger gains for safe havens led by gold and the Japanese yen. Weak industrial production data from the Eurozone and UK GDP have raised concerns about the global economy and contributed to increased demand for gold. During last week’s trading, gold prices increased by 3.2%.

According to a report from the University of Michigan, US consumer sentiment improved in June, after it tumbled in March and April, and modestly rebounded in May. The preliminary report showed that the consumer confidence index for June rose to a reading of 78.6 from 72.3 in May and 71.8 in April. Economists had expected the index to rise to 75.0. On the other hand, a report from the Ministry of Labor stated that US import prices increased by 1% in May, after falling - 2.6% in April. Economists had expected import prices to rise 0.6%. The rebound in import prices came with fuel prices rising 20.5% in May, after a 31% drop the previous month.

Excluding the jump in fuel prices, import prices increased by only 0.1% in May after falling 0.5% in April.

By the end of last Friday's session, gold price had fallen, under pressure from the US stocks recovery, the USD strength and bond yields. But concerns about the economic impact of a renewed COVID-19 epidemic still support holding onto its gains. Gold bullion investors, which have been boosted by government stimulus measures and global central banks, warn that stronger momentum may be required to go beyond than the $1,700 psychological resistance.

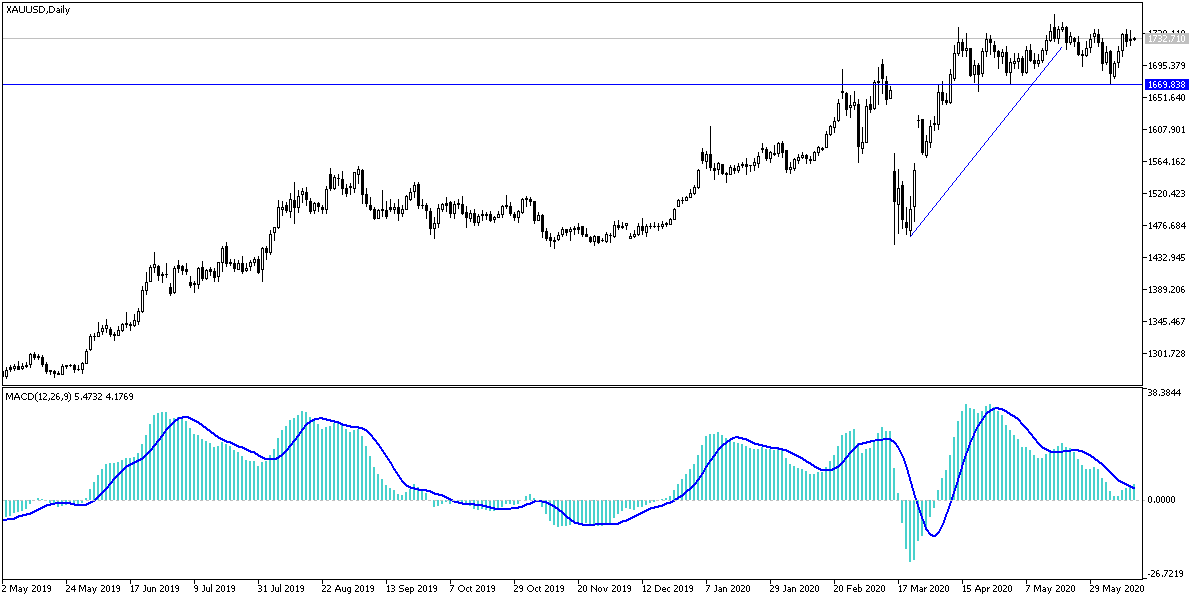

According to gold technical analysis: Although the gold gains stopped at the end of last week's trading, the general trend still supports the possibility of achieving more gains in the medium and long term, especially with renewed fears of a second wave of the Corona pandemic, which may increase pressure on the rest of the global economy. As long as the price of gold is above the $1700 psychological resistance, the trend will remain bullish and the bulls will gain more control, if prices move toward the resistance levels at 1742, 1755 and 1770, respectively. In contrast, the closest support levels for gold are now 1722, 1715 and 1700, respectively. I still prefer to buy gold from every bearish level. Gold gain factors as a safe haven are constant and increasing.

As for the economic calendar data today: Besides risk appetite, there will be interaction with the announcement of Chinese data, which includes industrial production, the index of investment in fixed assets and retail sales. Then the announcement of the trade balance in the Eurozone.