For three trading sessions in a row, the gold price is back to correct upwards and compensate for its recent losses, which extended to the $1671 support at the end of trading last week. Gains of the current bounce pushed the price of the yellow metal towards the $1720 level dolla, amid cautious anticipation until the announcement of the US inflation figures and what the US Federal Reserve will announce today. Gold prices have risen to coincide with the decline in global stock markets after the World Bank warned of the sharp contraction of the global economy, and today the Fed is widely expected to be very pessimistic despite the surprisingly strong employment report for May. It will be a difficult budget task for the bank to remain supportive as companies reopen after being closed for months.

The U.S. central bank has considered negative interest rate policy since late 2019 but does not want to go in this direction.

The price of gold was supported by a weak dollar. Where the US dollar index, DXY, fell to 96.23. Thus gold futures closed up $16.80, or about 1%, at $1721.90 an ounce. Silver futures for July ended lower at $17.794 an ounce, while copper futures for July settled $0.0335 or 1.3% higher at $2.5990 a pound.

In its recent global economic outlook, the World Bank has warned that the global economy will contract - 5.2% this year, marking the deepest recession since World War II. The World Bank Group said in its latest report that economic activity in developed economies is expected to contract by -7% in 2020 as domestic demand, supply, trade and finance are severely disrupted. The US economy is expected to contract - 6.1% this year, while the Eurozne is likely to see a contraction by - 9.1%.

On US economic news, a Commerce Department report said that wholesale inventories in the United States increased slightly less than expected in April. The report said that wholesale stocks rose 0.3% in the month after falling by a revised 1.1% in March. Economists had expected wholesale inventories to rise 0.4%, compared to the 0.8% drop reported in the previous month.

For American stocks. The Dow Jones closed lower yesterday by 300 points, while the Nasdaq recorded a new record close after the benchmark index of technology companies shares briefly traded above the 10,000 mark amid growing economic optimism. The Dow Jones industrial average fell 1.1% to end the trade at 27.272.30, beating the path of its rise for six straight trading sessions. The S&P500 fell -0.78% to close at 3,207.18 points. In contrast, the Nasdaq Composite Index rose to close at 9,953.75, after briefly touching an intraday high at 10002.50. A report released on Tuesday by US small business owners in May showed that they were more optimistic about the economic recovery and witnessed a shift to the view that the stagnation caused by the Coronavirus would be "short-lived." Accordingly, the National Federation of Independent Business said that the optimism of small companies in the American economy rose 4.5 points last month to 94.4. The increase was twice that of Wall Street.

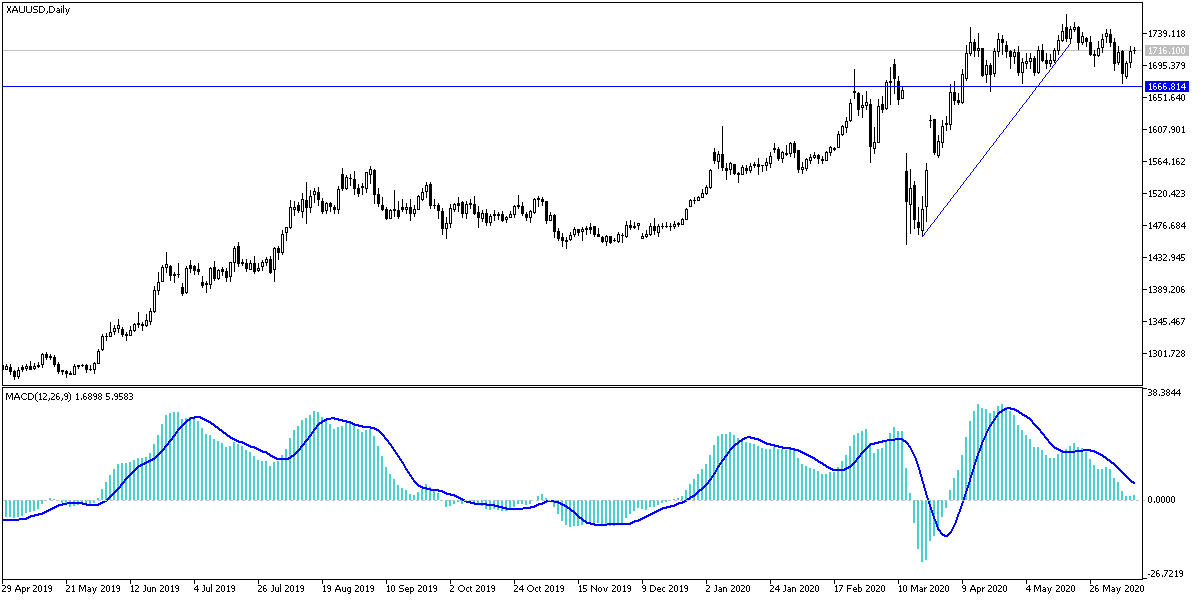

According to gold technical analysis: As expected before, I now confirm that the stability of the yellow metal above the $1700 psychological resistance will continue to support the bulls to move the price to higher levels, and the closest ones are currently 1725, 1740 and 1765, respectively. On the other hand, obtaining support from the US inflation figures and the Federal Reserve policy will push investor’ risk appetite, thus gold will give up its gains and will move downward towards the support levels 1700, 1692 and 1680 again. In general I still prefer to buy gold from every lower level, as the gains factors continue.