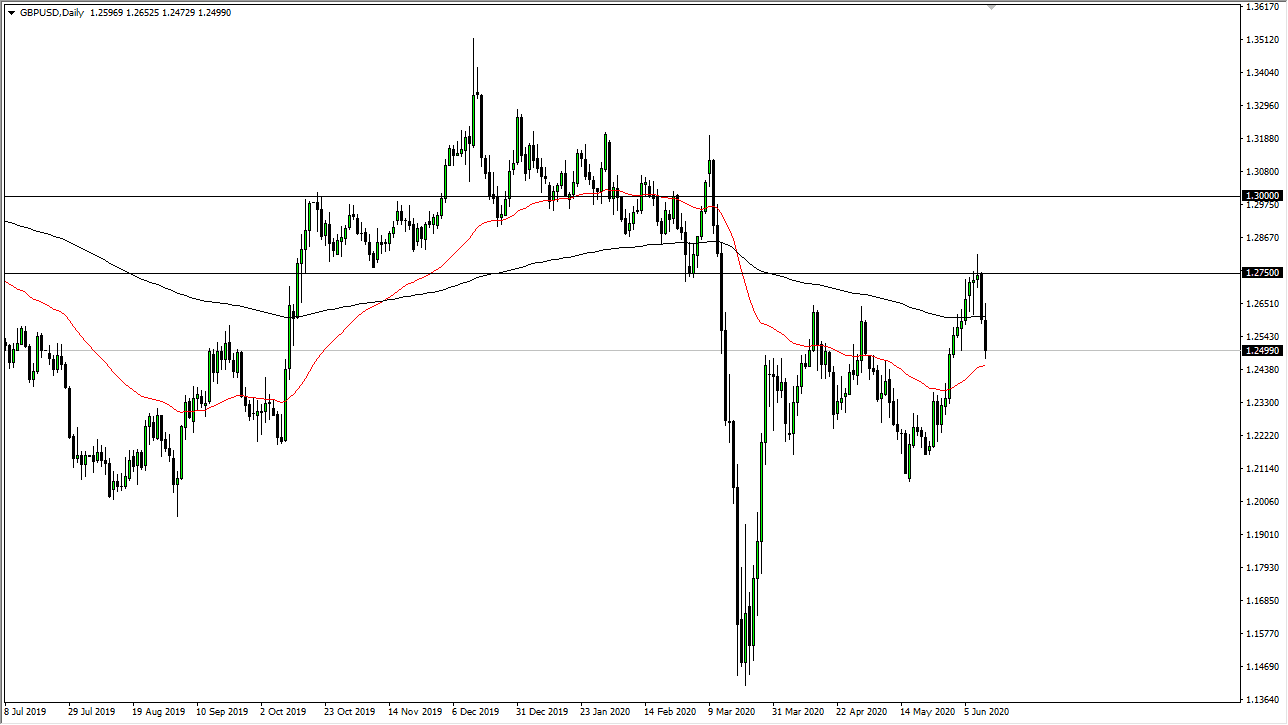

The British pound initially tried to rally during the trading session on Friday, breaking above the 200 day EMA. The market has fallen significantly from there to reach down towards 1.25 level at the end of the session. The 50 day EMA underneath continues to offer support, but if we get a significant move lower than the 1.25 handle, that could send this market much lower. The 1.25 level of course attracts a lot of attention, so where we go next will be determined by the reaction.

Going into the weekend, I do not know that we are necessarily going to break down significantly, but the Monday candlestick is going to be crucial. If we do get a close significantly below the 1.25 handle, it is very likely that we go down to the 1.2250 level, perhaps even lower than that. On the other side of the equation, if we get a significant bounce from here, then the market probably goes looking towards the 1.2750 level above. Ultimately, I think that Monday will be a major “decision day”, and this could allow for a little bit more in the way of a longer-term trade.

The US dollar did show quite a bit of strength towards the back half of the week, so it will be interesting to see if that can continue into the next week. The biggest question at this point is going to be whether or not there is any type of news flow over the weekend that exacerbates his move. It very well could happen, so it is worth paying attention to. If there is anything that is even remotely “risk off” then it is likely that we will see the US dollar strength significantly, especially against the British pound which does not have much reason to be a rally in the way it has of the last several months. However, momentum is an interesting thing as it tends to continue so if we get a bounce I would not hesitate to start buying either. If there is one thing that the last few months have taught us, it is that price is much more important than any “reason” so at this point it is crucial to pay attention to what price is doing, not necessarily what the fundamental reasoning for a move in one direction or the other is. Ultimately, this is a market that is when you have to simply react, and not think through.