The weakening of the US dollar and risk appetite contribute to stronger gains for the GBP/USD pair, pushing it to the 1.2730 resistance. This is its highest level in more than two and a half months. As the US jobs report shows that the US economy actually added jobs throughout the month of May, there was news that the European Union and the United Kingdom were still committed to more trade negotiations, adding to the optimism and supporting the gains of sterling against other major currencies.

UK chief negotiator David Frost stated that he is actively working with the European Commission to organize a series of face-to-face meetings to break the current deadlock in the negotiations. This is a major development because it indicates that there are no imminent deadlines under which the two sides must agree on a trade agreement after Britain leaves the European Union. Markets are giving negotiators the benefit of the doubt in the possibility of concluding a deal before the end of the year.

"Progress is still limited but talks have been mostly positive," Frost said in his statement. He then went on to explain, “Negotiations will continue and we will remain committed to a successful outcome. We are ready to work hard to see if at least a broad outline of a balanced agreement covering all issues can be reached soon".

British Prime Minister Boris Johnson has indicated that he might move off the table in June if the deal appears unlikely to be ready before the end of the year, so the extension was modest support to the British pound.

US job data suggests that the prospect of a so-called V-shaped recovery for the US economy is really possible, and it will break something off to ease concerns about the global economic crisis caused by the coronavirus.

Extending the Brexit talks could get rid of the direct headwind to the British Pound and enable it to participate more in the continued recovery of risk assets that were strengthened when the Bureau of Labor Statistics announced a sudden increase in US employment in May. But the talks are still deadlocked and still pose a direct threat to the British currency.

The European Union continues its quest for what can be said to be a new colonial relationship that will maintain its influence and control at a time when the British government is seeking to end it. At the same time, they are giving “efficiency” in areas such as taxes where it did not have a voice even when the state was an official member. The European Union refers to the Brexit Agreement and the Political Declaration that Prime Minister Boris Johnson held as his own deals in late 2019 and was approved by the British Parliament in January. The Johnson team, however, said on Friday; the basics of being an independent nation are not a negotiating position.

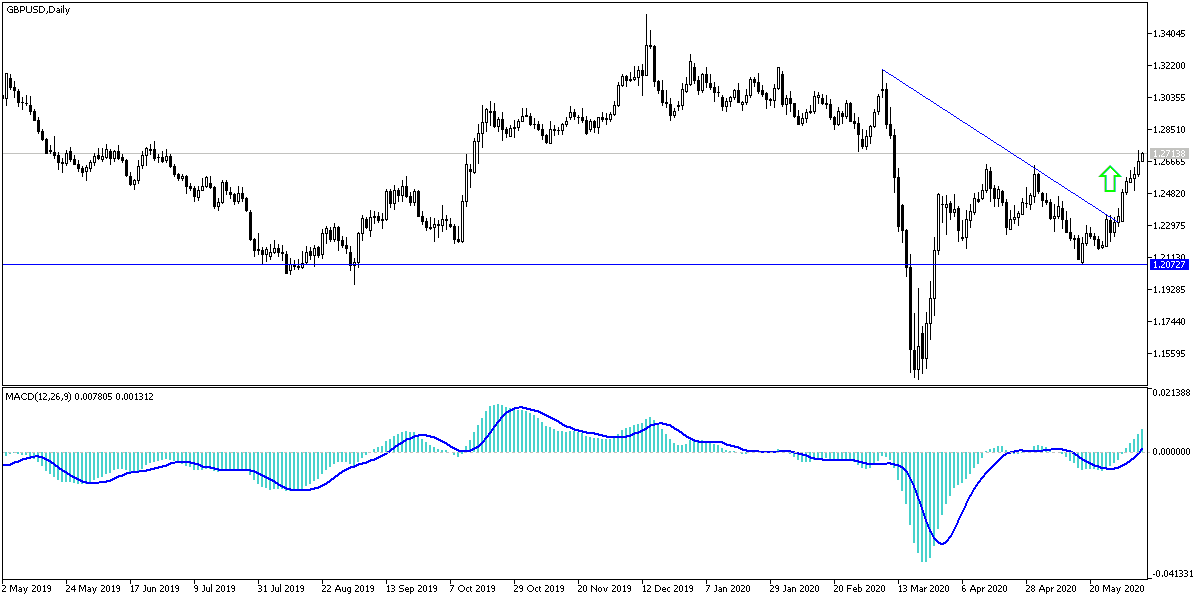

According to the technical analysis of the pair: Gains of the GBP/USD pair may face the threat of confirmation by both Brexit sides of matters between them reaching a dead end. Accordingly, one might consider selling the pair from the resistance levels of 1.2675, 1.2730, and 1.2800, respectively. Bears will be able to control performance if the pair moves towards the 1.2480 support again. The risk appetite may stop Sterling's losses for some time.

Today's economic calendar does not contain any important data from Britain or the United States of America.