Sterling pairs are awaiting the Bank of England monetary policy decisions today, especially with strong indications that it is the closest to adopting negative interest rates at any time as one of the bank's options to stimulate the British economy, which is facing strong shocks from the Corona pandemic. Prior to that, and since the beginning of the week’s trading, the GBP/USD pair is in a bearish corrective performance that pushed it to the 1.2510 support before settling around the 1.2555 level at the beginning of Thursday's trading. And gains in the beginning of Monday's trading did not exceed the 1.2688 resistance. Analysts expect an increase in the QE program to reach 100 billion pounds.

The bank had already announced a new £200bn of QE program in March, and it will be an additional boost to the bank’s efforts to support the deeply depressed British economy due to the closing of the covid-19. Markets expected a £100bn increase in the QE program, and to keep the base interest rate at 0.10%.

The risks to the pound may increase from the bank announcing a package in excess of 100 billion pounds, or proposing an additional interest rate cut to 0% or less in the coming months. The green light for further intervention by the Bank of England came after the release of yesterday's inflation figures which showed CPI inflation dropping to its lowest level since 2016, and with the prospect of a rise above 1.0% in 2020 seems relatively low according to economists. Some believe that the inflation rate may drop to 0%.

Inflation is perhaps the BOE's biggest obstacle when it comes to cutting interest rates and offering more stimulus plans, and with all the signs of a prolonged low inflation period in the UK, the Bank of England will feel that it has plenty of room to ease the policy further. Bank of England members discussed the issuance of negative interest rates at various points in May in a clear attempt to prepare markets to a possible cut below zero.

This conversation, along with concerns about trade negotiations over Britain’s exit from the European Union, could have contributed to the weakening of the British pound in May. However, the bank backed away from the threat of a rate cut below 0%, as Bank of England chief economist Andy Haldane indicated that such an outcome may not be necessary due to signs of improvement in the economy. Therefore, talking about negative interest rates is likely to frighten the markets and lead to possible and strong losses for the British pound.

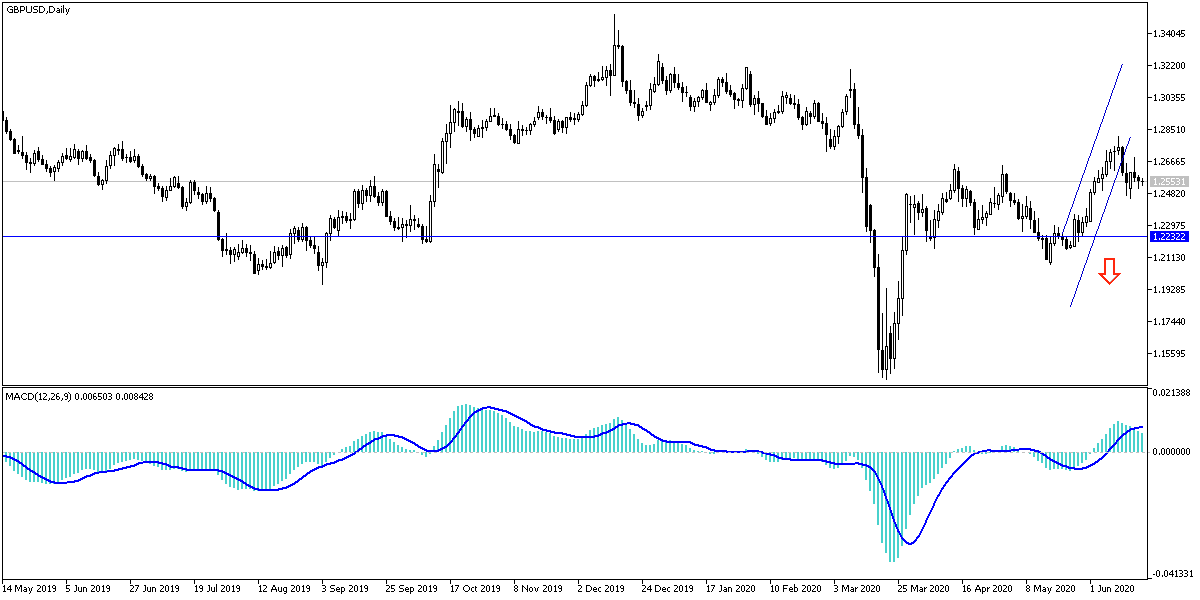

According to the technical analysis of the pair: According to the GBP/USD performance on the gr daily chart, 1.2455 support will remain an important separation between the uptrend that still exists until now, and the downtrend that is still possible in case the Bank of England disappointed the markets and increased concern From the future of Brexit. In general I still prefer to sell the pair from every upper level.

As for the economic calendar data today: All focus will of course be first on the Bank of England announcing its monetary policy, then the US data, weekly jobless claims, and the Philadelphia Industrial Index reading.