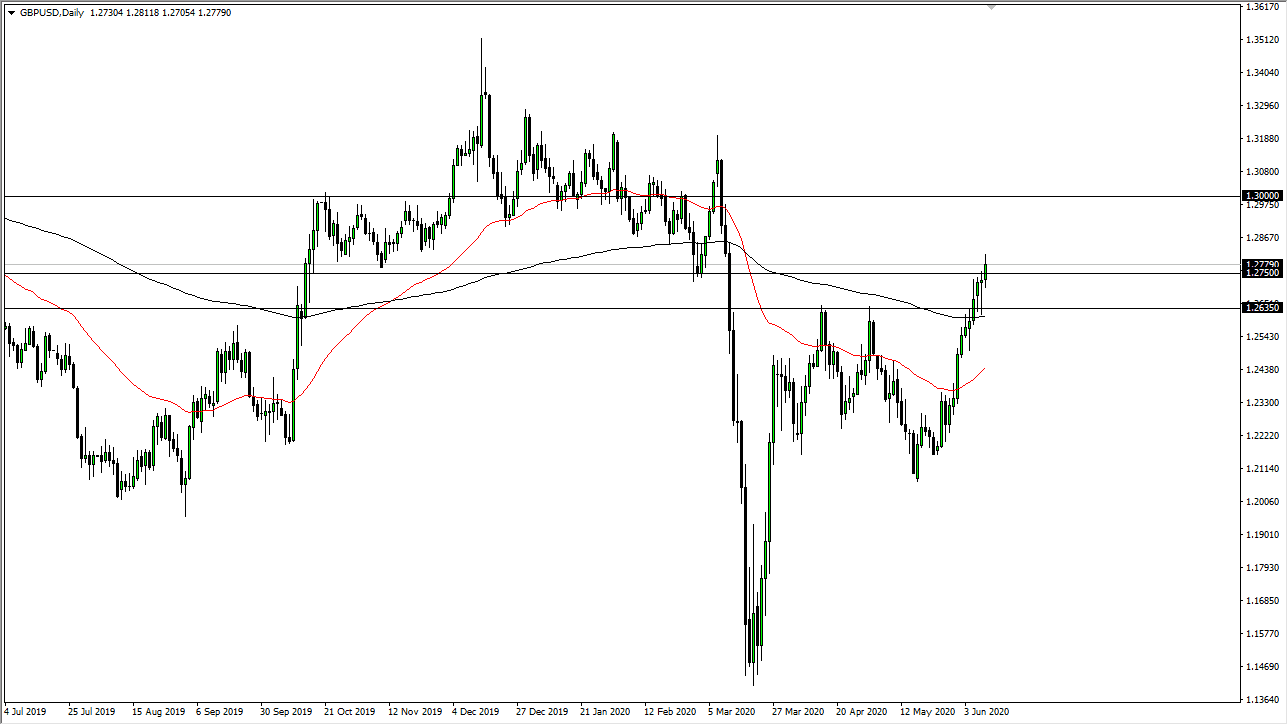

The British pound has pierced a major resistance during the trading session on Wednesday but has given back quite a bit of the gains in a sign of uncertainty. At this point, breaking above the 1.2750 level is a sign that we are going to go higher in theory, but at this point in time it is obvious that we are going to go straight up in the air. After all, this is a market that that has been very bullish, and of course the US dollar has been pummeled. However, there seems to be a bit of hesitation at this point so I think we may get a little bit of “back infiltrating”, meaning that there will be short-term dips that traders continue to get involved in. With that, I think that the market eventually wants to go higher, and of course after the Federal Reserve suggesting that they were going to continue with quantitative easing, that should work against the value of the US dollar.

However, it is obvious that there are a lot of concerns out there around the world, and that could have people looking at the US dollar for safety. This is going to be an exceedingly difficult couple of weeks, as the market has certainly gotten ahead of itself as far as risk appetite is concerned. If the market were to turn around a break down below the 200 day EMA, that could lead to something bigger at lower levels. After all, the 200 day EMA should in theory be supportive, so if it does not support the market, then it is obviously an exceptionally smooth. If we can break above the highs of the session on Wednesday, then we continue the grind towards the 1.30 level. That will take serious time though, because obviously we have not had the explosion to the upside like a lot of people would have been hoping for. I have to wonder at this point whether or not Jerome Powell has disappointed the markets with his lack of cheaper money still. Yes, bond purchases continue but at the end of the day Wall Street has become completely addicted to cheap money, and one would have to think that the currency markets are the same. Expect a lot of choppy volatility, and of course noisy trading. I believe we will eventually get some clarity, but we are not quite there yet.