The British pound fell initially during the trading session on Wednesday, as we have seen a bit of a “risk off” move early in the day but was turned around as we are close to a significant support level. This is a market that has a lot of moving pieces that people will be paying attention to, not the least of which is the fact that it looks like we are going to have a “hard Brexit” in the future, or at least have much more likelihood of that happening.

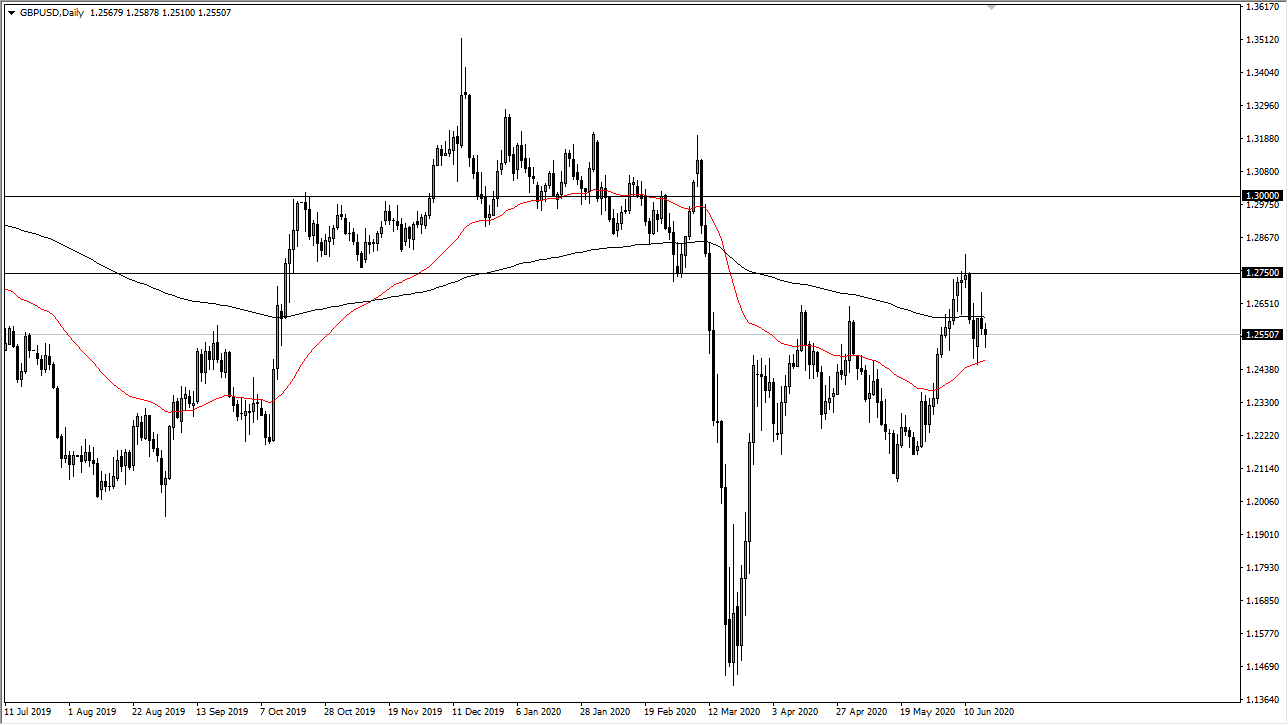

When you look at the candlestick, we are sitting between the 50 day EMA on the bottom, and the 200 day EMA just above. These moving averages are starting to squeeze together even more, and therefore it looks as if the market is eventually going to pop in one direction or the other. The hammer for the trading session is somewhat supportive or bullish, just as the shooting star from the previous session is somewhat resistive. Because of this, it looks like we are going to go back and forth, and I think we are going to continue to hang around the 200 day EMA in general, which means that the 1.2550 level might be a bit of a magnet for price.

If we do break above the 200 day EMA it is likely that we could go looking towards 1.2750 level, an area that cause quite a bit of resistance previously. On the other hand, if we break down below the 50 day EMA then I think it opens up a move down to the 1.2250 level given enough time. I do think that it is likely that we could see some selling pressure but quite frankly this is a market that is all over the place and as a result I would be a bit cautious about putting a lot of money to work. After all, the British pound has rallied, despite the fact that nothing economic could be driving this pair higher other than the Federal Reserve trying to kill the greenback. That being said, the Bank of England suggested recently that negative interest rates were not out of the question, so that in theory would kill the Sterling, but it will be interesting to see when the market shifts what happens next. Ultimately, I think we are going to see more chop going back and forth and therefore it is going to be difficult sailing.