The British pound has broken down significantly during the trading session on Thursday as we continue to see a lot of concerns about the British economy. The Bank of England added another 100 billion pounds of stimulus and look ripe to do even more in August. With that, it is likely that the market will continue to short the reddish pound overall, as it has gotten a bit ahead of itself. Furthermore, there are a lot of things to worry about from the global supply chain and the reinfection rate of coronavirus around the world is something that is certainly starting to be covered by news agencies. In other words, we could see the beginning of a bigger “risk off” type of set up.

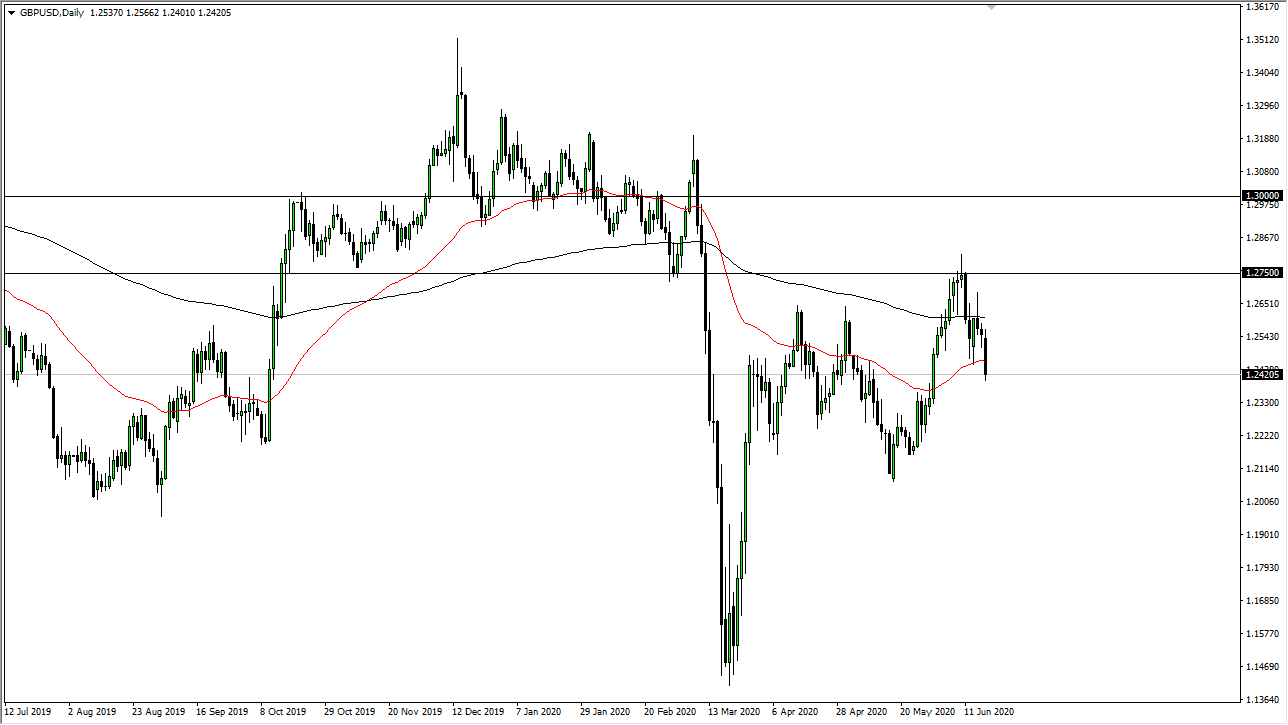

Ultimately, we had seen the British pound break down a bit heading into the Bank of England decision during the day, and then accelerate to the downside afterward. We did not break down below the 1.24 level though, so I think that is going to continue to be a bit of a barrier. Once we break through there though, then we start to see the British pound reach towards 1.2250 level which is my target over the next several sessions. The question is whether or not we will do that heading into the weekend?

I do not necessarily believe that we are going to break down right away, and I do not necessarily know that we see some type of massive selloff heading into the weekend. I think at this point we are starting to see a bit of a grind lower, and that of course will take quite a bit of momentum. Rallies at this point should continue to be faded, at least not until we break above the 1.26 level, which I do not see happening anytime soon. At this point in time, it looks likely that the downward pressure will continue.

Now that we are below the 50 day EMA, certain technical traders will be shorting the British pound just because of that. It should be noted that the 50 day EMA and the 200 day EMA are both relatively flat, so it is not as if it is out of the realm of possibility that we simply bounce around between the 1.2250 level and the 1.2750 level. Ultimately, I think this is simply a reversion to the mean that it is just waiting to happen.