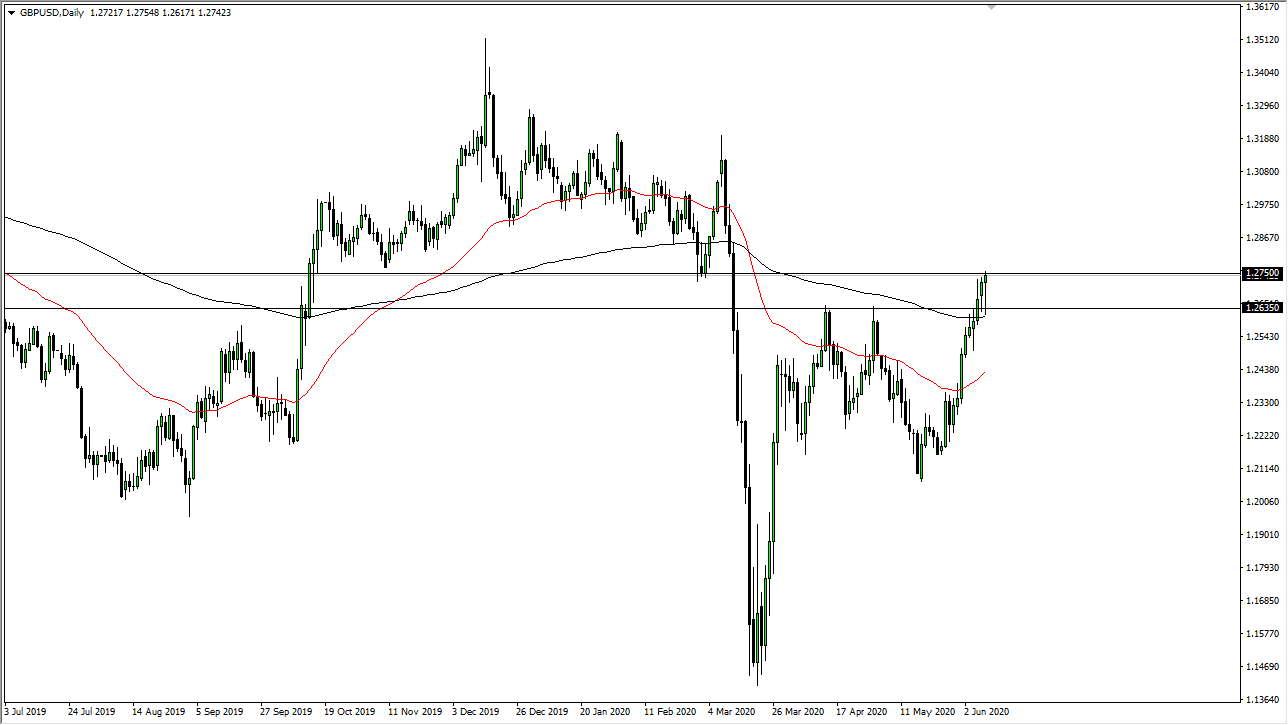

The British pound has broken down a bit during the trading session initially on Tuesday, reaching towards the 200 day EMA. The 1.2635 level underneath should continue to cause support, and the fact that the market formed a hammer could suggest perhaps that we are going to see buyers coming in on dips. If we can break above the 1.2750 level above, then the market is likely to go looking towards 1.30 level. That is my main thesis right now, assuming that the Federal Reserve is going to “play ball” as per usual.

If we were to turn around a break down below the 200 day EMA, we probably go looking towards the 1.25 level at that point. This has almost nothing to do with the United Kingdom and everything to do with the Federal Reserve printing as much currency as possible. The loose monetary policy coming out of the Federal Reserve continues to work against the value of the US dollar, and it is almost impossible to see a scenario where the greenback rises over the longer term, which of course is by design.

With all that being said, near 2 PM Eastern Standard Time, we will get the statement coming out of the Federal Reserve which if domination of could send this pair straight up in the air. Obviously, we have recently made a major breakout so it makes sense that we should continue to see buyers jump in. Having said that, it might be kind of quiet between now and that announcement and less people trying to get in front of the announcement, which can happen at times. Ultimately, I think that this is a market that will eventually reach towards the 1.30 level now that we had broken above previous resistance and slice right through it like it was not even there. The short British pound trade has been one of the most common ones, so I think there are still a lot of traders out there that need to cover given a chance. This is a market that I think will continue to see a lot of noise, but that is going to be the case with everything at this point. Market conditions continue to deteriorate for anything involving a longer-term trade but perhaps Jerome Powell will do something to help that situation. Ultimately, I do not like putting huge positions on, because everything is so upside down at the moment.