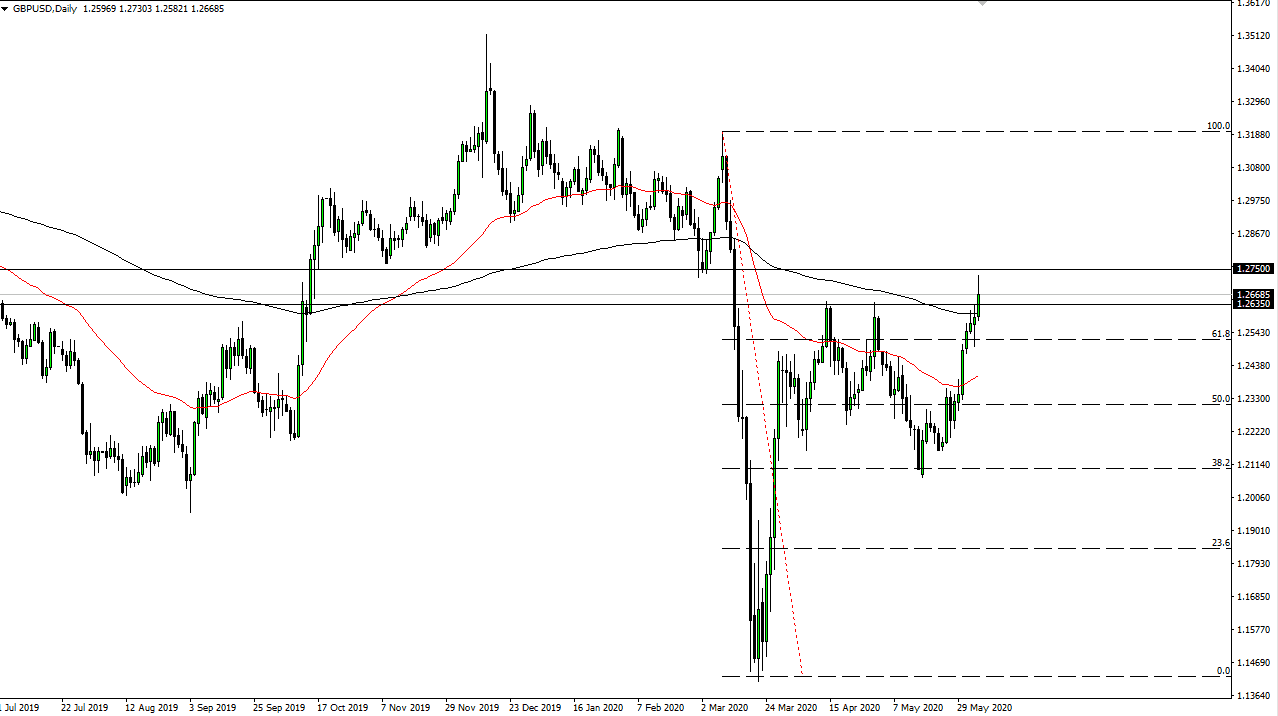

The British pound has rallied significantly during the trading session on Friday, breaking above the crucial 1.2650 level and the 200 day EMA. At this point, it looks as if the market is shying away from the 1.2750 level, an area that has been crucial more than once, not only as support and resistance, but also an area where we have seen a lot of flips back and forth.

This is a market that I think continues to see a lot of volatility and if we break down below the 200 day EMA, we could then reached towards the 1.25 handle, and then if we break down below there it is likely that we continue to go even lower. The market will be a situation where you need to be careful, because obviously we have been bullish, but one has to wonder how long it takes before traders start to focus on the Brexit situation, which of course is not getting any better. At the same time, the jobs number coming out much better than anticipated could fit into a dollar positive narrative again, as the market may see the United States quite a bit more attractive. Furthermore, the 10 year rates are shooting up in the air and it is only a matter of time before the trading community start to look at the idea of those treasuries as a potential opportunity.

On the other hand, the market was to break above the 1.2750 level, then it is likely to go looking towards the 1.30 level. Ultimately, that is an area that I think will attract a lot of attention as well. I think that at this point will probably need to see the market pull back, even if it was very bullish. The one thing that is truly lifting the market in favor of buying would be the 200 day EMA being underneath, so it is likely that the longer-term buyers are starting step in. However, if the market does break down is likely that we could see an acceleration due to the fact that people may be starting to worry about whether or not the United Kingdom has any type of deal when they leave the European Union. With all that, it is difficult to get overly bullish of the British pound, but price is price, and that is the only thing that matters at the end of the day.