The US job numbers, which came stronger than expected, contributed to stopping the USD losses, and accordingly, the EUR/USD price fell from the 1.1383 resistance, its highest level in three months, and closed the week's trading around the 1.1278 level. We have indicated many times that the pair has reached strong overbought areas and the downward correction can take place anytime. Even with the United States adding some jobs in May, the number of people working in federal, state and local governments decreased by 585,000. Total job losses among public sector workers have reached more than 1.5 million since March, according to seasonally adjusted federal jobs data released last Friday. Accordingly, the number of government employees is now at the lowest level since 2001, and most of the cuts are at the local level.

On Friday, the US jobs report showed an increase of 2.5 million instead of an expected loss of millions more, complicating the prospects for talks on additional stimulus plans. The Democrats looked at the jobs report and saw the job losses for 600,000 government employees, so it will likely increase more if Washington does not help the cash-hungry and local government. Despite the positive jobs news, unemployment across the country is at 13%, so the looming promise of an additional $600 a week promises unemployment benefits to provide a catalyst for employment and keep the job market from collapsing.

After weeks of terrible expectations by economists that US unemployment in May could reach 20% or more, the news that the economy added 2.5 million jobs last month is surprising and evidence that the US employment collapse probably reached the bottom in April, When the rate reached 14.7%. Most economists had expected to reemployment this summer as closure items were increasingly lifted and people resumed shopping and eating out, albeit gradually.

In contrast. The European Central Bank has cut its growth and inflation forecast for this year, and the Eurozone economy is expected to shrink sharply as the coronavirus, or Covid-19, severely hurts economic activity. European Central Bank President Christine Lagarde presented the latest set of macroeconomic forecasts for European Central Bank employees. For this year, European Central Bank officials forecast a contraction of 8.7 percent versus a 0.8 percent growth in the previous round in March. However, growth projections were raised for the next two years. Growth projections for 2021 increased to 5.2 percent from 1.3 percent, and forecasts for 2022 increased to 3.3 percent from 1.4 percent.

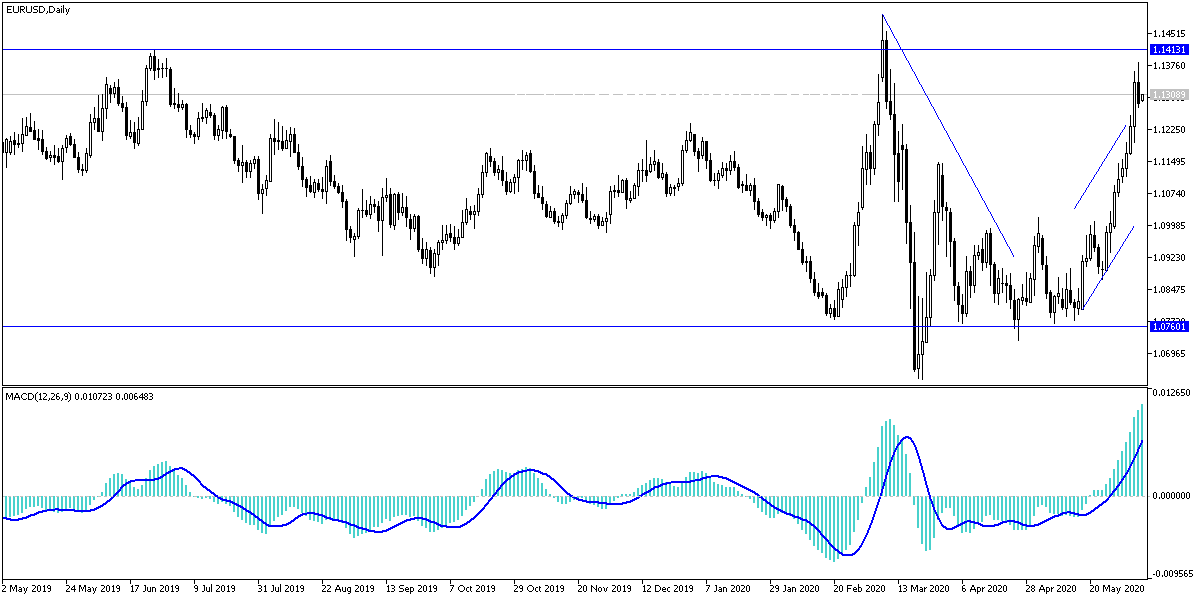

According to the technical analysis of the pair: Despite the recent correction at last Friday's session, the EUR/USD pair is still in the range of its upward channel, and there will be no return to the bear's control of the performance unless the pair moves below the 1.1145 support. The return to stability above the 1.1300 resistance will have the bullish performance to rise more powerful. Technical indicators still give signals for overbought areas and at the same time, I still prefer to sell the pair from every higher level.

As for the economic calendar data today: German industrial production and the Sentix index of investor confidence in the Eurozone will be announced. Later, there will be statements by the governor of the European Central Bank. There are no significant US economic releases today.