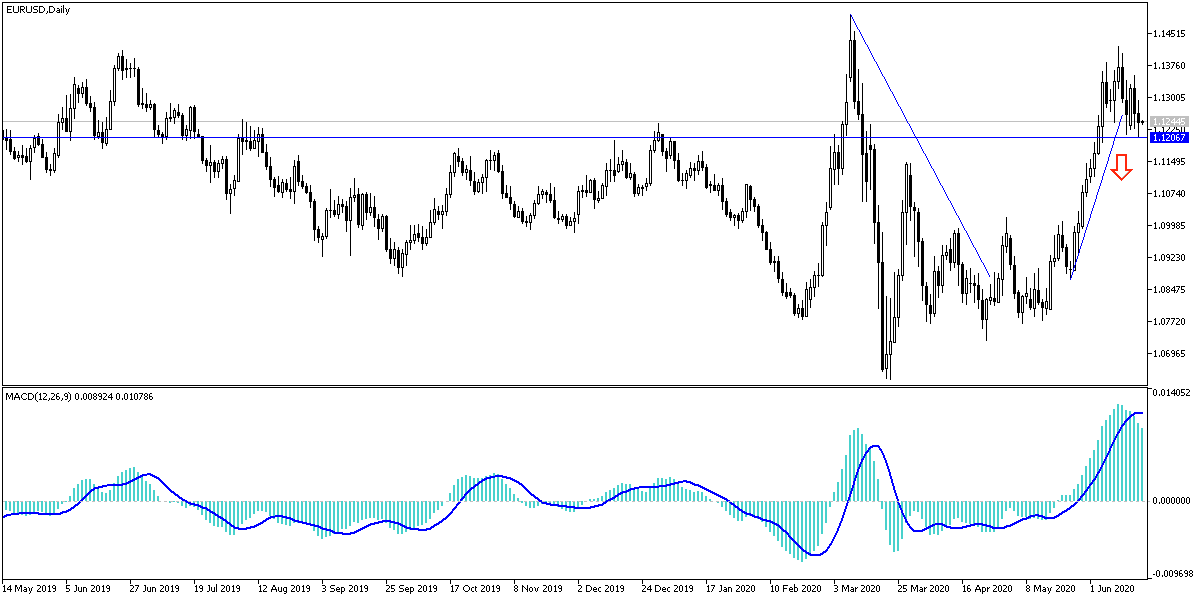

As we expected, the single European currency will continue to face pressures due to markets' doubts about the possibility of passing stimulus plans by the European Union leaders, and this situation negatively affects any EUR/USD. As at the beginning of this week’s trading, it shot towards the 1.1353 resistance, and it dropped quickly to the 1.1207 support before settling around the 1.1244 level at the time of writing. The pair collapsed in a risk thirsty market ahead of an important meeting of European Union leaders, and the Euro fell throughout the Wednesday session, diverging from the stock markets that had recovered previous losses related to a new outbreak of Covid-19 infection, and thus settled below $1.13.

The pair retreated to coincide with a sharp increase in U.S. retail sales for the month of May, when it reversed almost double-digit gains after the depreciation witnessed in April. Tuesday's data is a further evidence that the recovery in the US is already underway, an idea that was first given credibility by the May jobs report which showed an increase of more than 2 million new or recovered jobs, compared to expectation of losing more than 7 million jobs.

With the recent performance of the pair, ABN Amro Bank expects that there are several reasons to stop the pair’s uptrend at the present time. First, the US economic data surprised the bullish trend and investors began to notice this. Accordingly, they evaluated the US dollar, not as a safe haven, but as a periodic currency. Investors may start to believe that the future of the US economy is improving more than that of the Eurozone.

ABN Amro believes that the latest US data creates scope for superior economic performance in the Eurozone and for the dollar to regain some of its previous cyclical characteristics. The bank expects the EUR/USD to drop to 1.05 during the summer, before slowly increasing to 1.12 in time for the end of the year. It also indicates that the new coronavirus outbreak in Beijing and parts of the United States, indicates that it could encourage renewed demand for safe havens, which would favor the US dollar.

Meanwhile, the Euro could run the risk of being disappointed by the pandemic economic recovery fund, planned to be discussed by European Union leaders on Friday.

Investor appetite for the Euro has improved significantly since May 18, when France and Germany backed the market with a proposal to share up to 500 billion Euros of grants among member states struggling to cover the cost of the coronavirus, which pushed the EUR/USD from 1.08 and placed it on the path of last week's high at 1.1433, its highest in three months.

The French/German proposal is greater than 750 billion Euros for the European Commission and will be discussed by European Union leaders on Friday.

On the economic level. Final data from Eurostat showed that Eurozone inflation approaching recession in May, as initially estimated, to its lowest level since 2016. Inflation slowed to 0.1 percent from 0.3 percent in April. The rate was in line with the estimate published on May 29. This was the lowest level since June 2016. In the same period last year, inflation was 1.2 percent. Core inflation remained well below the ECB target "below, but close to 2 percent".

According to the technical analysis of the pair: The continuation of the current EUR/USD correction may cross the 1.1200support barrier, and if that happens, the bears will be able to move the pair to stronger support levels, and the closest ones are currently 1.1185, 1.1100 and 1.1045, respectively. On the other hand, thepair will not return to the path of his ascending channel without breaching the 1.1400 resistance again.

As for the economic calendar data today: Content of the European Central Bank’s monthly report is expected. From the United States, weekly jobless claims and the Philadelphia industrial index reading will be announced.