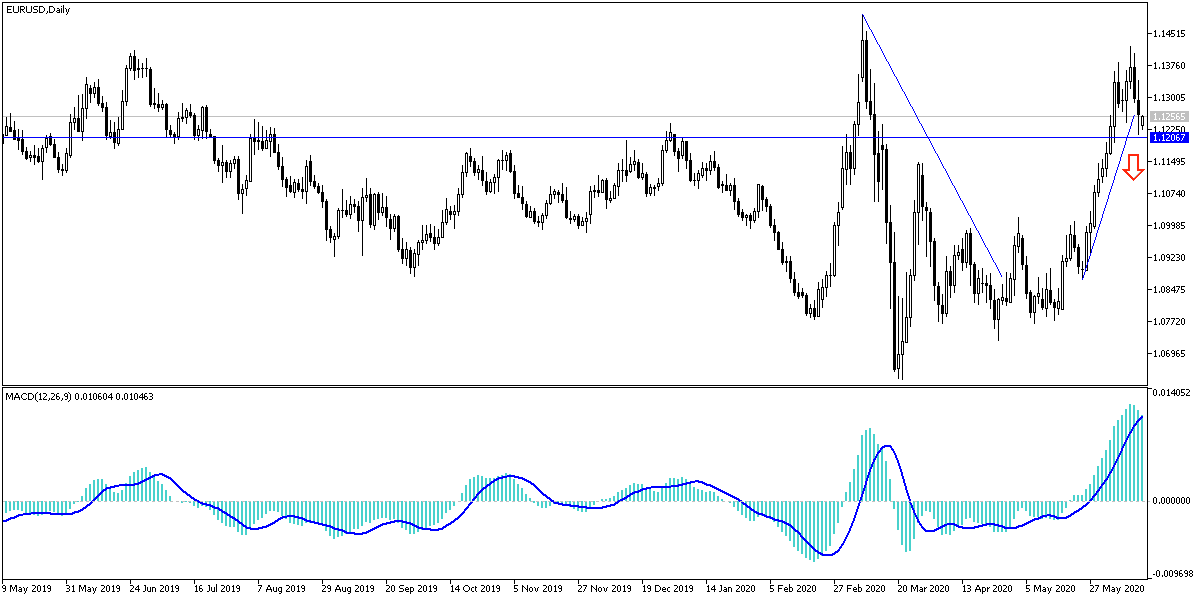

For three consecutive trading sessions, the EUR/USD pair is moving in a downward correction range that pushed it towards the 1.1212 support at the end of last week’s trading, before closing trading around the 1.1260 level, and the correction came amid sell-offs from the 1.1422 resistance, its highest level in three Months. The European single currency got more support from investor’s risk appetite, but this support quickly evaporated with the registration of new COVID-19 with the re-opening of global economies, which increased fears of a second wave of infections. This situation contributed to gains for the US dollar as a safe haven, even with the pessimistic expectations from the Federal Reserve at its meeting last week.

Global stock indices and investor sentiment dictating their paths, have become the main drivers of the Forex currency market since the Corvid-19 virus closed the global economy in March, especially when risk-backed and commodity-backed currencies are moving against safe havens such as the USD, JPY and CHF. The Euro has had a love-hate relationship with risk appetite for years, but it has also risen alongside European and American stock indexes over the past three months.

Gains in the Euro and stocks coincided with the unprecedented efforts of the global central banks to help economies face the effects of the shutdown to contain the spread of the virus. Along with a feeling among economists and analysts who lean towards a "V-shaped recovery" of the damage caused by the virus. This was positive for the EUR, but as more data becomes available in the coming weeks, and the relative progress made towards recovery is determined, price movements can become more accurate again.

Unlike some other currencies, the Euro was not only driven by the recent rally in stock markets, because events on the ground in Europe gave investors hope that the continent's economic recovery will be faster and more successful than previous crises. Where politicians began, at least, to talk about a collective financial response, albeit temporary, which would support national support measures if approved, while the response of the European Central Bank was also rapid and unpredictable.

However, the Euro rose 2% in June and 5.7% since it tumbled to $1.08 on May 18, and Eurozone leaders will discuss the European Union’s proposal for a recovery fund this week, which could reset the market focus on the various difficult divisions so far between Member States.

Meanwhile, analysts are watching the coronavirus infection figures in the United after some recently opened states have seen their COVID-19 infection numbers rise in recent days. White House officials have indicated that they consider "closure" as an appropriate response, but this will not necessarily prevent Americans themselves from social distancing, or that markets do not retract over other signs of a new outbreak.

According to the technical analysis of the pair: On the 4 hours graph there is a head and shoulders formation for the EUR/USD performance, and stability below the 1.1200 support will increase the downward momentum to test stronger and closer support levels including 1.1185 and 1.1100 and 1.1055, with the last level confirming the extent of the downward reversal force. On the other hand, the return to breach the 1.1385 resistance will support the bulls in pushing the pair to higher levels.

As for the economic calendar data today: The Eurozone trade balance will be announced, then the US Empire State index will be announced.