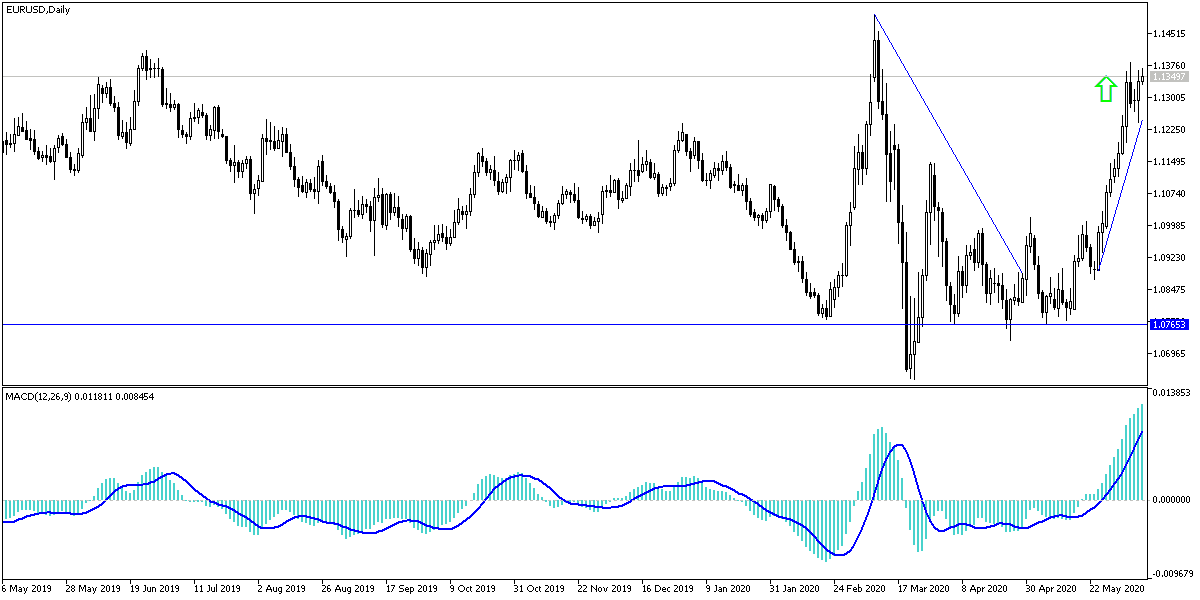

Profit-taking sales at the EUR/USD stopped at the 1.1240 support, and with markets focusing on what the US Federal Reserve will announce in its monetary policy update, as well as the announcement of US inflation figures, the pressure increased again on the US dollar, so the opportunity was better for the pair to correct upward to the 1.1363 resistance before settling around the 1.1330 level at the beginning of trading on Wednesday, which is the most important of all days of the week. The European single currency received support to return to stability above the 1.1300 resistance despite the fact that the risk appetite remained weak after the main stock indices recorded new highs in the previous session and as investors were looking forward to what Jerome Powell and his team will announce, which will support the market movements during the coming days.

Adding to the push of the Euro, the European Statistics Agency announced that it had revised its estimates for the Eurozone Q1 GDP upwards, and the European economy had shrunk by -3.1% year on year in the first quarter when it previously announced a contraction of -3.2%. The quarterly decline was also revised from -3.8% to -3.6%. The European single currency may receive additional support if there are any indications that the four countries (Netherlands, Austria, Sweden and Denmark) are easing their stance against the Economic Recovery Fund for the bloc countries, and will be funding in large part by grants instead of loans. European Union finance ministers will meet on Thursday to discuss a 750 billion Euro recovery package from the European Union.

The Organization for Economic Cooperation and Development estimates the purchasing power parity of the EUR/USD pair at 1.40. Other various fair value estimates have made it around 1.25. We do not expect to see either of these levels in the foreseeable future, but news from the European Central Bank and European Commission should support the rise of the Euro. In addition, the risk appetite in the market has been fueled by an enormous amount of financial and monetary incentives that have prompted investors to abandon the US dollar as a safe haven.

Analysts' expectations are still increasing with regards to the downside risks on the Euro, following the support of the larger-than-expected policy from the European Central Bank last week and the European Commission's proposals to provide more stimulus. Rabobank's team is estimating the Euro to drop a low of 1.05 against the dollar later this year, but they see it now at 1.14 in three months before falling to 1.09 in six months.

In general, the proposals of the European Economic Recovery Fund should be approved unanimously as part of the EU budget for the next seven years, which is always controversial and it is expected that the progress of the negotiations will continue during the summer.

According to the technical analysis of the pair: The return of the EUR/USD to the vicinity of the 1.1383 resistance, its highest level in three months, will support more gains for the pair to launch towards higher resistance levels, which support the strength of the trend reversal. The nearest resistance levels are currently 1.1390 and 1.1445 and 1.1530. On the downside, as expected before, the pair's return to stability below the 1.1240 support will support the bear's control to launch towards stronger support levels and thus abandon the current bullish notion.

As for the economic calendar data today: All focus will be on the US session data, with the announcement first of the US consumer price index and then the announcement of monetary policy decisions from the US Federal Reserve Bank, and later the press conference of Governor Jerome Powell.