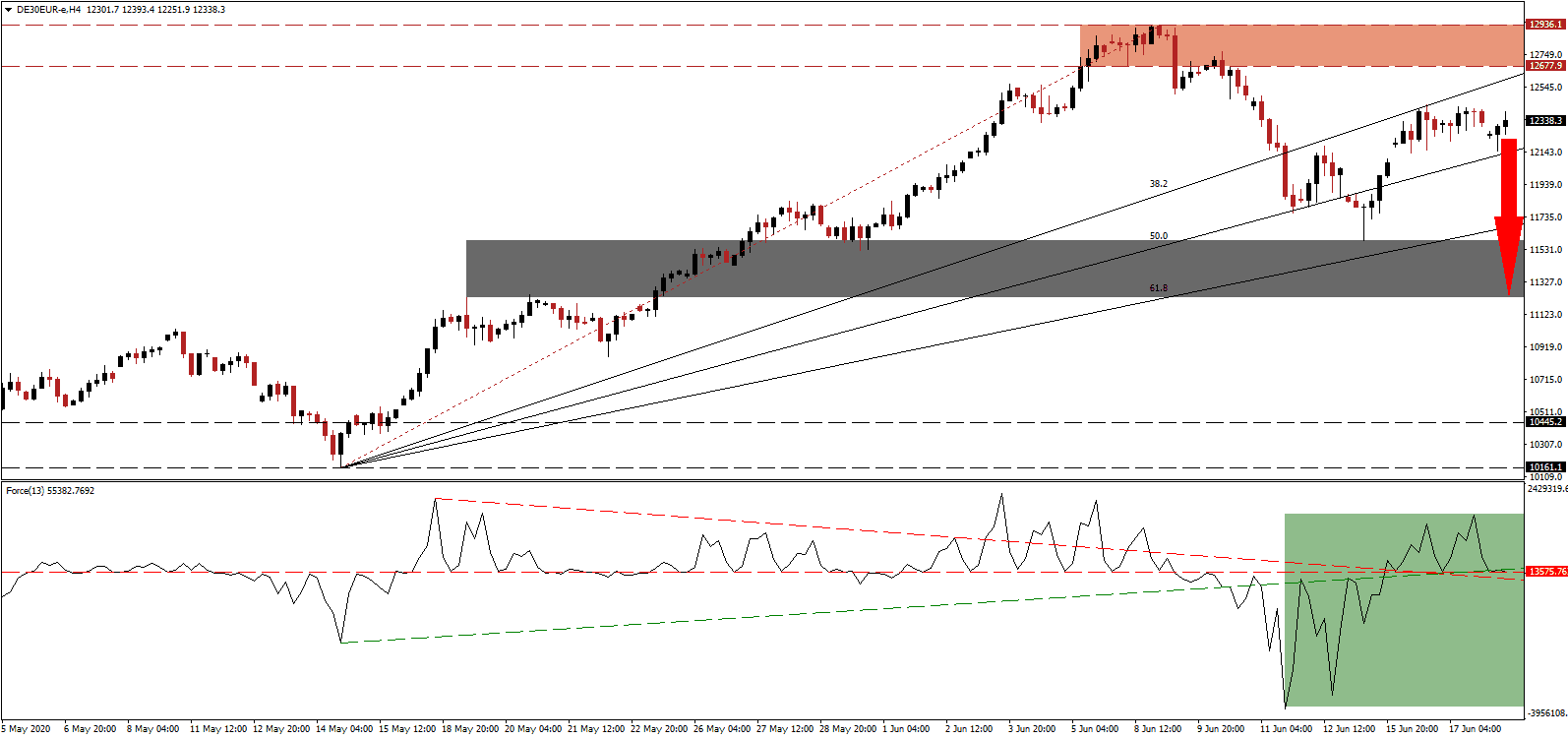

Germany implemented a nationwide lockdown in response to the Covid-19 pandemic in March. The European Union’s largest economy posted a 2.2 GDP contraction in the first quarter, confirming a technical recession started, as the fourth-quarter 2019 data was revised to reflect a 0.1% decrease. Federal Ministry for Economic Affairs and Energy did warn that the second-quarter will be significantly worse while maintaining its forecast for a 6.3% drop for 2020. While the DAX 30 was able to recover from its breakdown below its resistance zone, renewed selling pressure is poised to result in a lower high.

The Force Index, a next-generation technical indicator, confirmed the lack of bullish momentum and retreated after setting a lower high of its own. It has now moved below its ascending support level, and is in the process of completing the conversion of its horizontal support level into resistance, as marked by the green rectangle. A breakdown below its descending resistance level will enhance downside pressures, with bears in a holding pattern for this technical indicator to collapse into negative territory to regain control of the DAX 30.

Reopening of borders within the European Union, which commenced on Monday, is labeled as a potential second stimulus for the German export-oriented economy. Any benefit could be short-lived until the global economy returns to pre-Covid-19 levels, not expected until 2022 at the earliest. A new wave of infections could accompany the unchecked transit of goods and people, resulting in more depressive economic data. The DAX 30 remains in a dominant bearish chart pattern following the breakdown below its resistance zone between 12,677.9 and 12,936.1, as identified by the red rectangle.

Borrowing by the German government for 2020 is anticipated to exceed €218 billion in 2020, per Chancellor Merkel’s budget chief Rehberg. It will turn the 1.5% budget surplus of 2019 into a 7.25% deficit this year, spiking the debt-to-GDP ratio to 77%. Germany has converted from Europe’s austerity champion to the most significant spender. The DAX 30 stalled after being rejected by its ascending 38.2 Fibonacci Retracement Fan Resistance Level. A reversal into its short-term support zone located between 11,230.1 and 11,589.1, as marked by the grey rectangle, is favored, with more downside probable.

DAX 30 Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 12,330.0

Take Profit @ 11,230.0

Stop Loss @ 12,600.0

Downside Potential: 11,000 pips

Upside Risk: 2,700 pips

Risk/Reward Ratio: 4.07

In the event the Force Index reclaims its ascending support level and accelerates to the upside, the DAX 30 could spike higher. With intensifying negative progress drive by the surge in global Covid-19 infections, any breakout attempt should be considered a selling opportunity. The upside potential remains confined to its resistance zone, located just beneath the key 13,000 psychological resistance level.

DAX 30 Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 12,730.0

Take Profit @ 12,930.0

Stop Loss @ 12,630.0

Upside Potential: 2,000 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 2.00