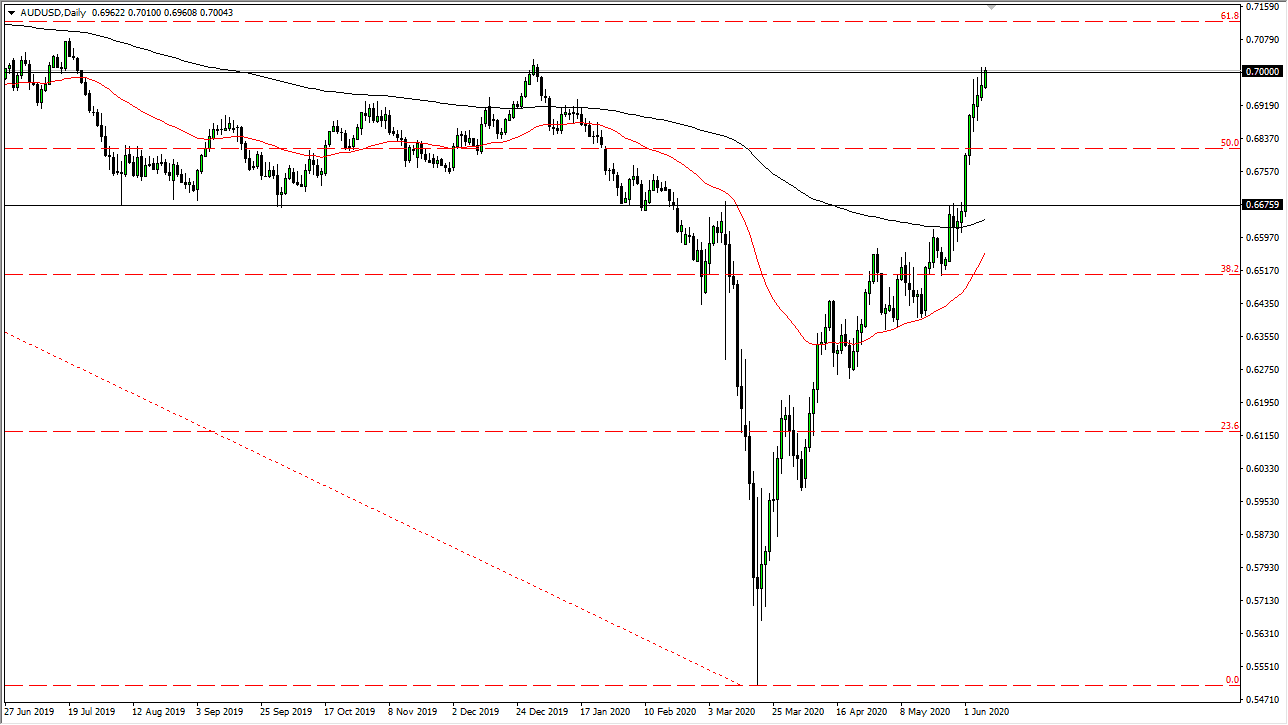

The Australian dollar has rallied on Monday, to test the top of the shooting star from Friday. While I did look like it has set up a perfect selling opportunity, the Australian dollar just will not rollover. With that in mind, it looks like traders are willing to step in and pick up the Aussie every time it dips for just the little bit, but it does look stretched at this point. I am overly cautious about jumping in and going long of a market with a huge position at this point. When you look at the longer-term charts, the 0.70 level is an area that has been important more than once. The fact that we have shot straight off of the floor and gotten here tells me that the market probably need some type of pullback at the very least in order to pick up the momentum going forward.

To the downside, I believe that the 0.6675 level would be a logical place for support, as it was the most recent break down below current trading. The 200 day EMA sits just below there as well, so it is highly likely that a lot of traders will be paying attention to this general vicinity. The 50 day EMA is starting to curl in the same direction, so once it crosses over its the so-called “golden cross” that some people pay attention to.

One thing is for sure, it seems like the market simply will not rollover, so we may get a bit of a “blow off top.” If the Australian dollar can break above the 0.71 handle, becomes a longer-term “buy-and-hold” type of scenario. Even if you are bullish of this market, it is much easier to buy on a pullback that it is to simply buy it as it explodes through the top. However, the way this market has been behaving you may not get that opportunity. One thing worth paying attention to though is the fact that the US Congress is sending a bill that essentially scolds China for the Uyghur Bill, and possibly escalating tensions between the United States and China, which would have a direct effect on this pair. However, so far people are willing to ignore that. You have to keep in mind that selling is an exceedingly difficult thing to do at this point until we get down below the 0.69 level. Buying is probably just as difficult at this point also.