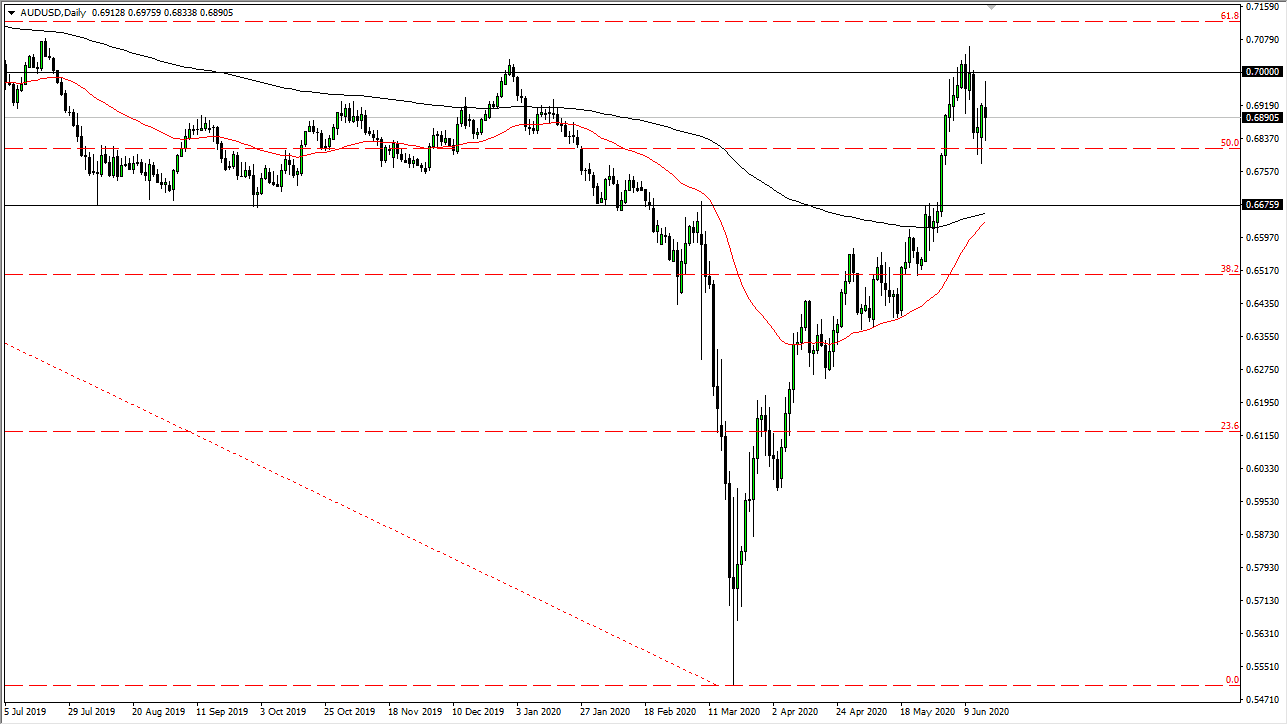

The Australian dollar has gone back and forth quite a bit during the trading session on Tuesday, as we initially tried to reach towards the 0.70 level but rolled over to show signs of exhaustion. The 0.70 level is a large, round, psychologically significant figure, and an area from which we broke down rather drastically in the recent trading. Beyond that, I think that the 0.70 level shows resistance all the way to the 0.71 handle. If we can break above that level, then it changes quite a few things.

On a breakout above the 0.71 handle, the market is likely to continue going much higher, and more of a “buy-and-hold” scenario. This of course will have more of a longer-term effect on the market as it could show the US dollar losing strength for quite some time. In fact, at that point I am looking at trying to reach all the way to the 0.80 level, which obviously is going to take a significant amount of time. This of course takes into account that perhaps it is a major “risk on environment”, or that the Federal Reserve has finally cracked and broke the US dollar. However, there is the alternate set up.

If the Australian dollar breaks down below the range of the Monday session, then it is likely that we will go down to the 0.6675 handle, which would show continuing US dollar strength. After all, we have seen a massive and sharp move to the upside over the last several months, after a complete panic which continued the longer term downtrend in this pair. Keep in mind that the Chinese economy is having to deal with more infections in Beijing, and they are starting to close down certain neighborhoods in that city. This will clearly have an effect on the Australian dollar and could have sellers jump in and eventually. It looks as if we are back to trading the virus again, which of course could cause quite a bit of volatility and therefore it is imperative that you trade with a reasonable size, and do not try to get overly levered in this type of environment as you can get hurt rather quickly. I think at this point it makes sense that we continue to see sellers on rallies, as a breakout to the upside would take a significant amount of effort, and that effort has been expended quite a bit over the last several weeks.