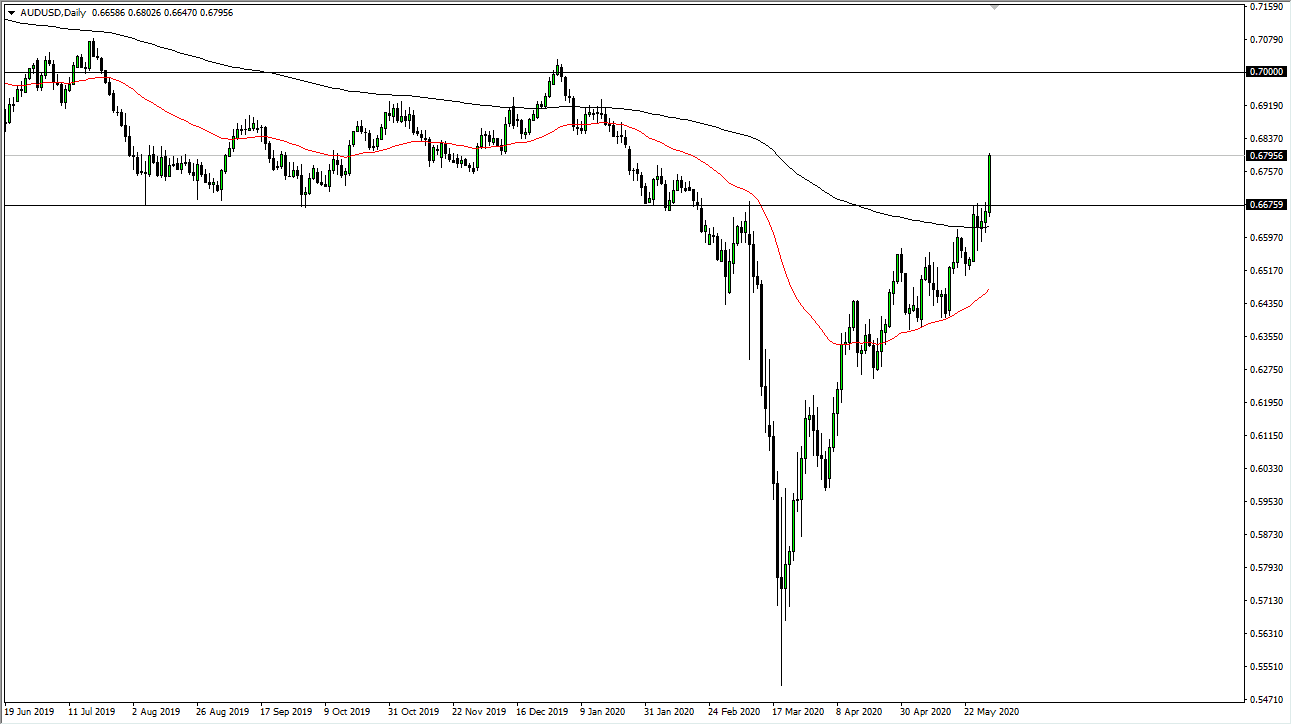

The Australian dollar broke out during the trading session on Monday, clearing the 0.67 level handily and even tested the 0.68 level. Because of this, it looks as if the currency market is still focused on the potential hope of China coming back to full strength. However, we also have the US/China trade situation getting worse and therefore I think that it is difficult to simply buy the Australian dollar and hold it. In the short term though, clearly the markets are completely ignoring everything other than the Federal Reserve trying to destroy the greenback, and with that in mind it makes sense that other currencies, even one that has a lot of trouble around it like the Aussie, will continue to find a bid.

The 0.70 level above is more than likely going to be the target. Having said that, the market failing in that area makes quite a bit of sense, it is a large, round, psychologically significant figure, and of course the Australian dollar cannot go straight up in the air forever. Think of it this way: the market was at 0.5550 just seven or eight weeks ago. We are now approaching 0.68. That is an astronomical move in the currency markets, and it has not exactly been the easiest move at times.

I think in the short term we probably continue to see the bullish melt, but eventually the market goes looking towards the US dollar for safety as the trade war will almost certainly continue to get worse, not better. Furthermore, I believe that the Australian economy is going to remain in recession if the Chinese continue to have issues selling to other countries, namely the United States. In fact, it should be noted that while the “risk on trading quote was going on during Wall Street trading, the volatility had picked up, not necessarily a bullish sign.

Having said that, the market does not seem to care, as it is all about taking as much risk as possible right now. We are almost certainly getting a bit “far too euphoric” when it comes to risk appetite and I do think something ugly is coming, but it is exceedingly difficult to sit on your hands when you know that things are very precarious. At this point, I think all it would take is the wrong tweet by the President out of the US to send this market rolling right back over.