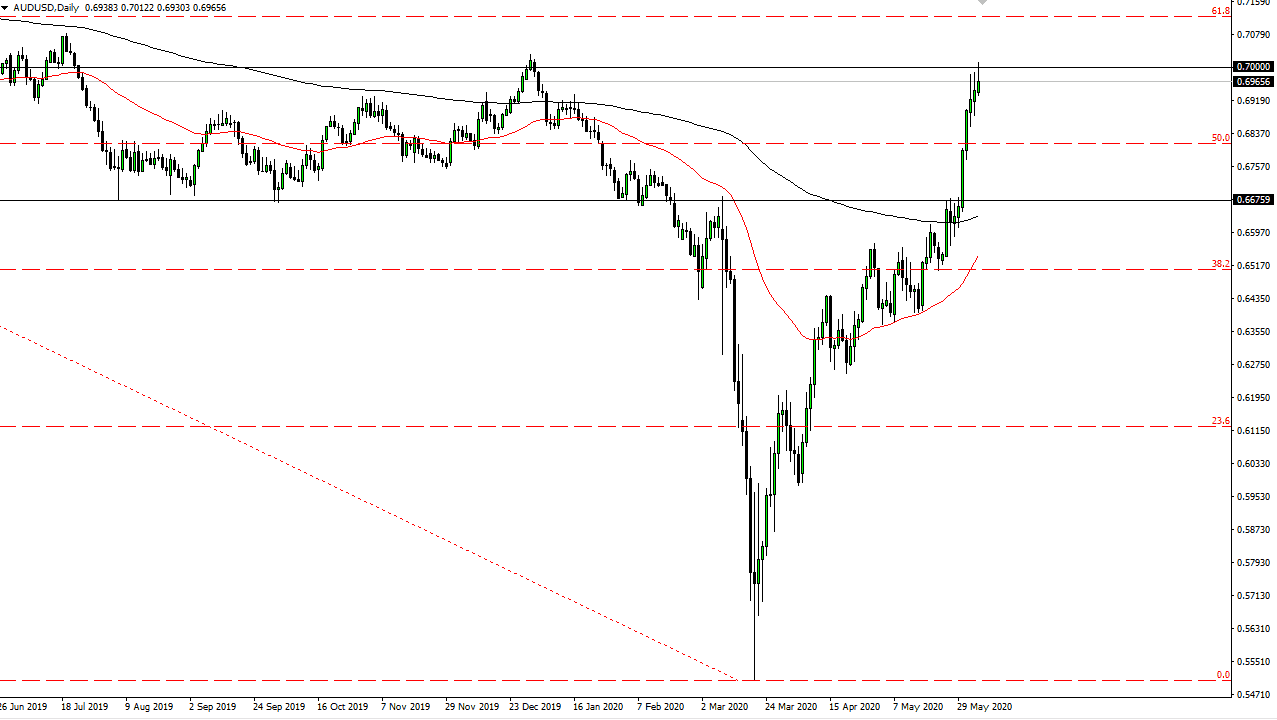

The Australian dollar rallied again during the trading session on Friday as the “risk on trade” continues to dominate. In fact, we have had a strong jobs number and that may have contributed a little bit during the day, but it the clothes it looks like the Australian dollar is more likely to form a shooting star than not. If that is going to be the case, then it is possible that we could turn around from here. The 0.70 level is an area that I think continues to be a major issue, as the market has pulled back a couple of times getting towards this area. This market looks exhausted.

When you look at the longer-term charts, the 0.70 level is an area that has been crucial for support and resistance over the years. The 0.70 level is an area where the market broke down rather significantly, right before a major crash down to the 0.55 handle. The market has bounced from there though, and now we are all the way back to the top of this fall. If that is going to be the case, it is highly likely that there should be a bit of an area of selling pressure.This is a scenario that looks a lot like a potential trend change than anything else. If we can break above the 0.71 level, it is likely that this becomes a “buy-and-hold” type of market and the Australian dollar takes off for good. However, if we fail at that level it would probably entice more sellers to come back in based upon the longer-term trend.

Keep in mind the Australian dollar is highly levered to the Asian economy, most specifically the Chinese economy and therefore it will rise and fall with the possibility of China rising or falling in general. Looking at this market it is likely that we are getting stretched and it is possible that we could pull back to the 0.6675 level rather quickly, as it was the scene of the most recent break out. The 200 day EMA is sitting in that same general vicinity as well. At this point, the market is likely to see support there as well due to that EMA. Looking at the wicks from the last three candlesticks, it does suggest we are running out of steam. I believe that next week will probably end up being very crucial for this pair, so keep an eye on any signs of weakness.