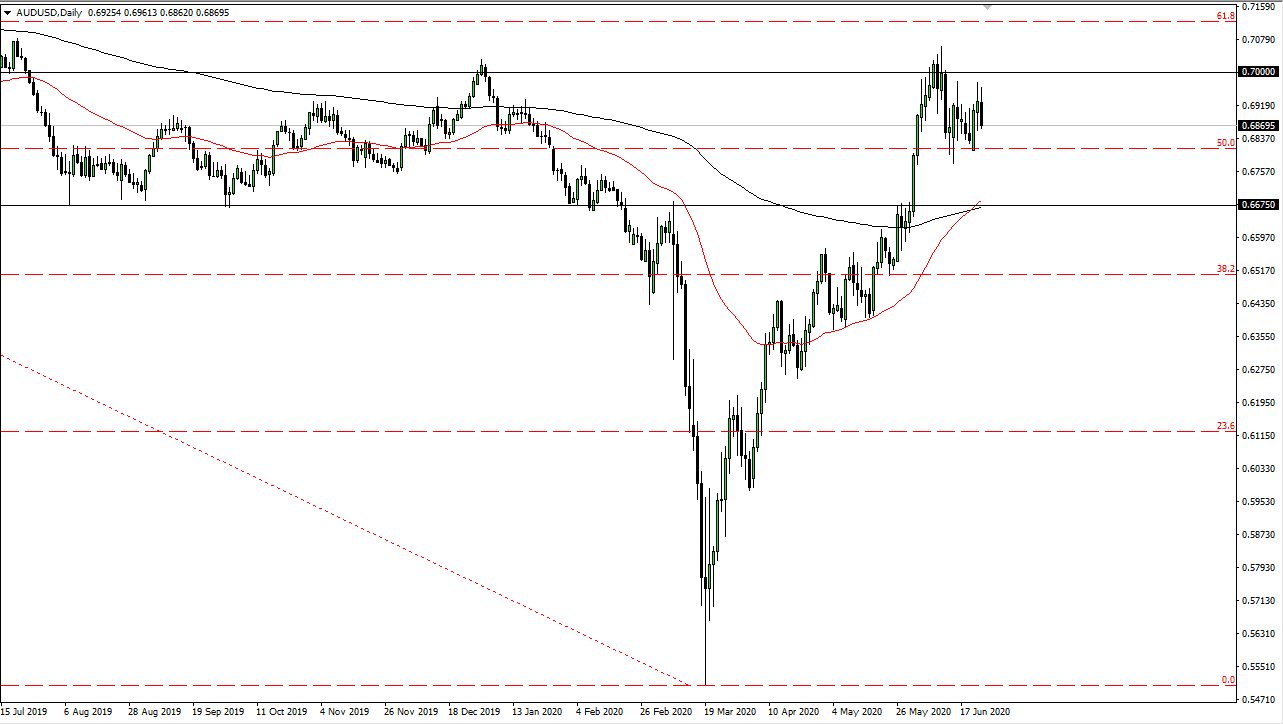

The Australian dollar has fallen hard during the trading session on Wednesday, as we continue to see a lot of noise in general. That being said, the market is likely to continue to look at the 0.70 level above, which is an area that is a large, round, psychologically significant figure, and to an area where we had seen the Australian dollar plunged drastically earlier this year. Now that we are facing that area, it tells me that we are likely to see a lot of troubles.

Rallies at this point continue to offer selling opportunities from what I can see, and therefore I am looking to sell closer to the 0.6975 level as I can fade signs of strength. The 0.70 level above is the beginning of massive resistance extending all the way to the 0.71 handle. If we were to break above, there it is an extraordinarily strong sign and sends this market straight up in the air for a longer-term “buy-and-hold” type of scenario.

I do not think that happens, at least not in this current environment but I am the first person to admit that I did not think we would be here to begin with. The 50 day EMA breaking above the 200 day EMA forms the “golden cross” which a lot of longer-term traders will pay attention to. I do not necessarily think that we are going to break through that level easily, which is near the 0.6675 handle, an area that has been important. If we break down below there that opens up a whole new plethora of issues for the Aussie dollar, which would more than likely be tied to the Chinese situation and fears about the global economy slowing down. It is worth noting that the infection rates are starting to pick up a bit and that of course has people concerned. With New York offering new restrictions on certain parts of America when it comes to an influx of people, which has people thinking about this as well. Regardless, I think the Australian dollar continues to be a “fade the rally” type of situation in the short term. I am looking for these rallies as an opportunity to pick up the US dollar “on the cheap”, at least until the attitude changes significantly. It is quite astonishing to me that the Aussie is still all the way up in this general area.