The Australian dollar has fell during most of the session on Tuesday but then saw buyers come into the market late. With that being the case, it looks as if traders are trying to front run the Federal Reserve, and its statement as to what it is going to do next. I do believe it is only a matter of time before we see traders react to a potential loosening of monetary policy coming out of the Federal Reserve. At this point, it is likely that we are going to continue to see a lot of reactions when it comes to the statements. I do think that it is only a matter of time before we see buyers come in as the US dollar is getting hammered. After all, the Federal Reserve has done everything it can to push traders away from the US dollar.

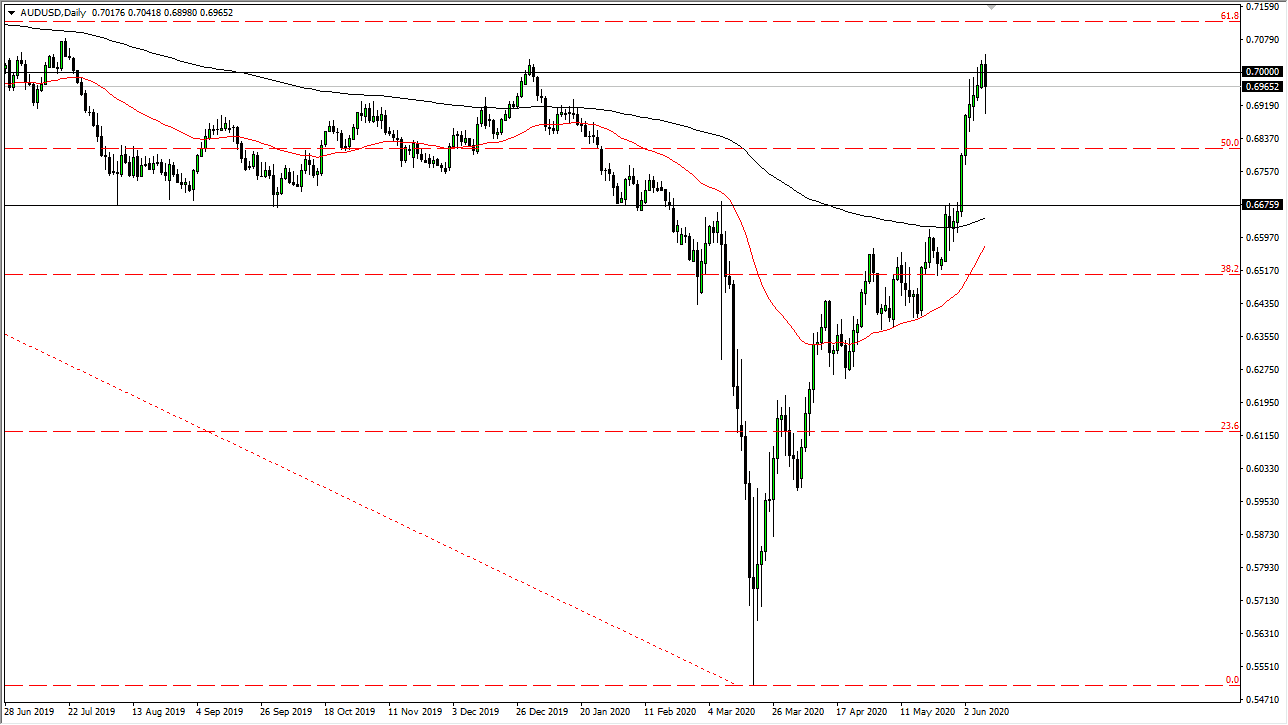

Looking at the shape this candlestick, it can either be an affirmation of the upward momentum, or if we break down below the bottom of it could be the absolute top of the Australian dollar as it would suggest a “hanging man” formation. That is an extremely negative formation, and quite often will send markets much lower. I think at this point, we are more than likely going to see Jerome Powell do everything he can to push the value of the US dollar lower, and of course the Australian dollar will get a boost not only due to the fact that it is not the US dollar, but also due to the fact that it is highly correlated to gold which I expect to explode to the upside relatively soon.

If we do break down, I think the market probably reaches towards the 0.6675 handle, an area that should be supportive due to the fact that the area was previous resistance, and then of course the 200 day EMA sitting just below could offer support as well. With that being the case, I do believe that the market will find buyers in that area. I think we are looking at a potential longer-term break out, but if we get the right combination of negative headlines, that could cause major issues for not only this pair but anything against the US dollar. As things stand right now, it looks like we are trying to break out and go much higher. However, that can change if stock market suddenly pay attention to the fact that the markets are going to have to deal with a much slower growth equation that we have in the past.