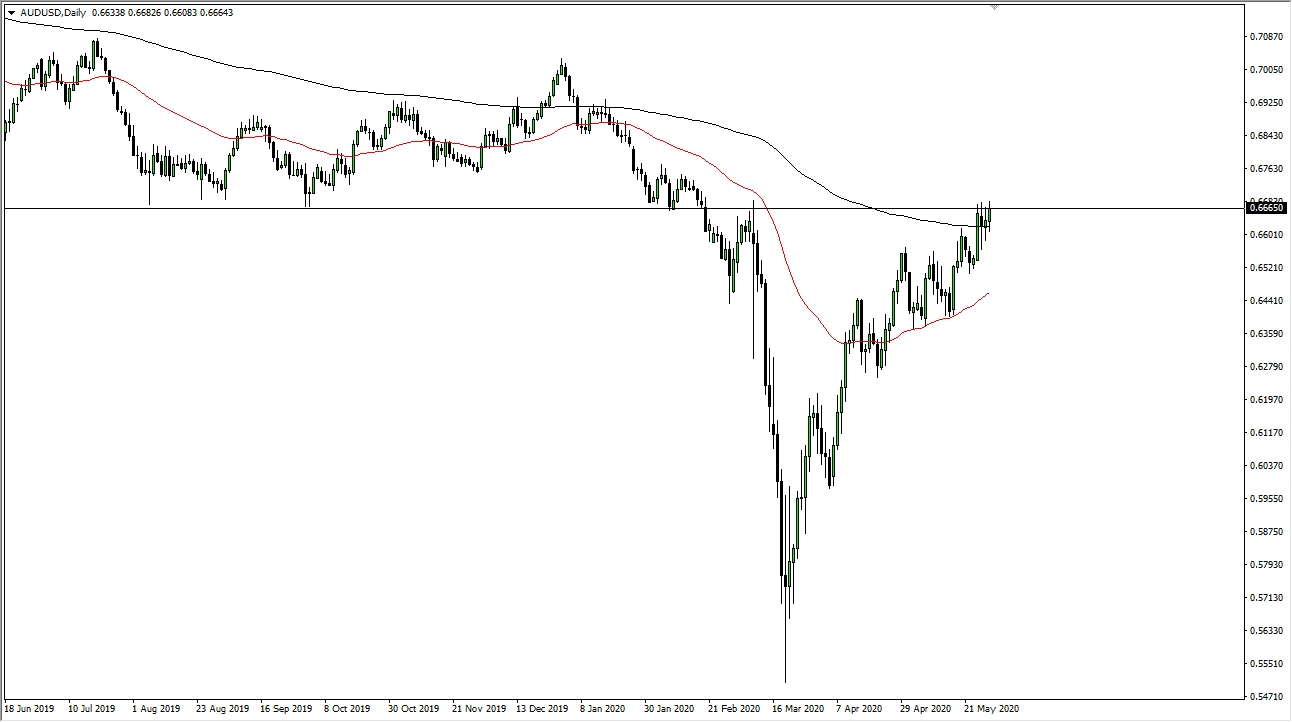

The Australian dollar pulled back just a bit during the trading session on Friday to dipped down below the 200 day EMA. However, we found buyers underneath to push this market higher, reaching towards the highs that we had made during the bulk of the week. Overall, the market looks as if it is trying to get to the 0.67 handle, an area that has caused a significant amount of resistance previously. If we were to break above that level, it could be a very bullish sign, and if we do break above there then we could get continued movement to the upside, perhaps towards the 0.70 level.

At this point in time, the market finds any type of exhaustion between here and there, it will probably try to rollover. The 200 day EMA offer support, but if we were to break down below there, and more importantly close the daily candlestick underneath there, then the market is likely to go down towards the 50 day EMA which is painted in red on the chart. The Australian dollar of course is extraordinarily strong as of late, but I do think that it is only a matter of time before something has to give.

Looking at this chart, it is definitely a bit overextended, but one thing that you can take away from it is that they are very resilient when it comes to buying this pair. The Australian dollar is sensitive to the situation in China, so that of course is something worth paying attention to. The market will continue to have plenty of reasons to chop around, as headlines will go back and forth about the United States and China as far as the trading relation is concerned. Things are getting a bit testier, and as it is an election year in the United States, it is likely that we will continue to see even more testy behavior. At this point in time, we are definitely seen quite a bit more risk to the downside than up, but we have to keep both scenarios in the back of our minds. The US dollar could get ran towards if we get a major “risk off event” as well. However, if people continue to buy into the narrative that the world economy is suddenly going to shoot higher and become much more aggressively bullish, then the Australian dollar should be a major benefactor.