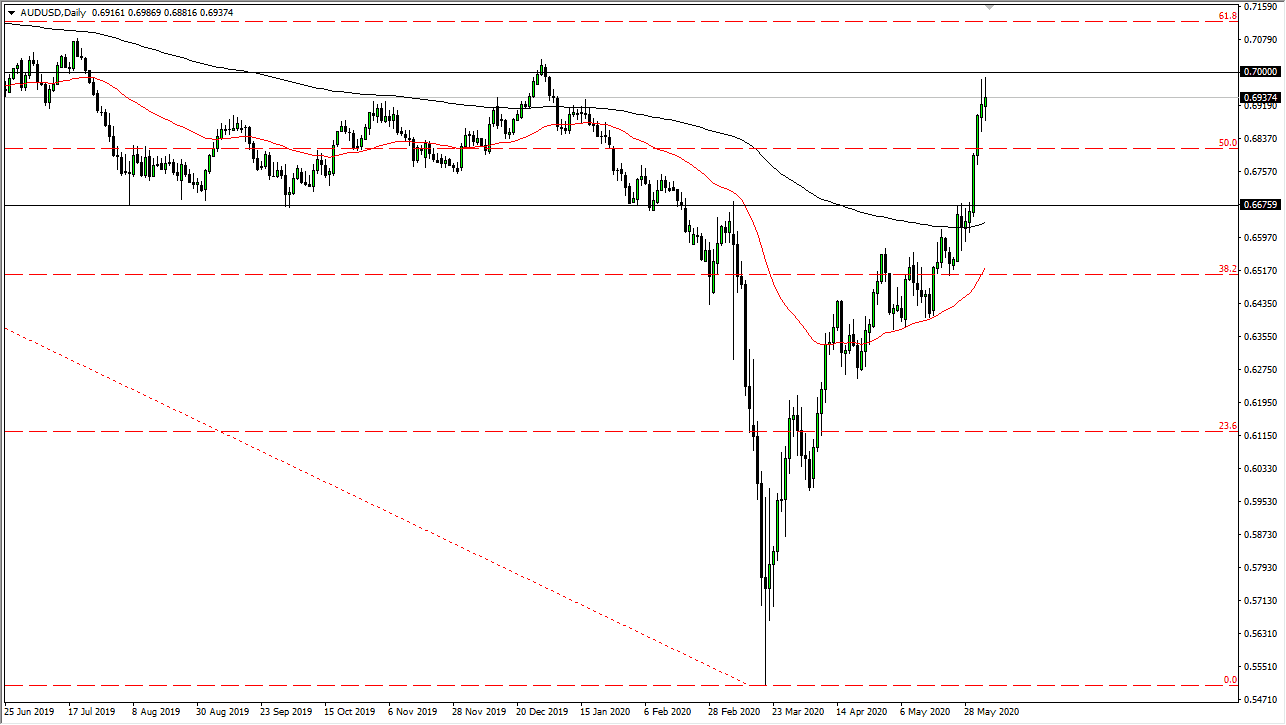

The Australian dollar has gone back and forth during the trading session again on Thursday, as the market awaits the jobs figure for Friday. The 0.70 level is an area that of course attracts a lot of attention, and we have seen for the second day in a row that there are sellers in this general vicinity. This does not necessarily mean that we cannot break higher, just that it seems very unlikely without some type of catalyst. The question now is whether or not that catalyst will be the jobs figure?

The market has certainly been very bullish for quite some time, but from the longer-term standpoint the 0.70 level is a massive resistance barrier. In fact, I believe that if we can get a solid move above the 0.70 level, it is likely that the trend has changed, and the market will continue to drive much higher over the longer term. That being said, it is exceedingly difficult to imagine a scenario where we simply slice through that level with no concerns, as it was the scene of a pretty significant break down.

When you look at the monthly chart, the 0.70 level becomes very obvious, and that of course is something that should be paid attention to as well. The fact that the last couple of daily candlestick’s are going to be shooting stars tells me quite a bit and therefore I think it is likely that we are going to continue to struggle to go higher. If we break down from here, it is highly likely that we go down to the 0.6675 level, which was the latest leg higher. That being said, this is probably more about the US dollar than it is the Australian dollar. Remember, the Australian dollar is overly sensitive to the Chinese economy and growth in that economy. Yes, it has reopened about demand certainly has shrank. While this has been a very massive move, when you zoom out look at the longer-term chart, it is clear that although this has been a massive move, on the longer-term chart it does not look that bullish in general, therefore I think that the market may run into some exhaustion rather soon. Having said that, we will have to see how Friday closes to make that decision, but I suspect exhaustion is starting to really take its toll on buyers.