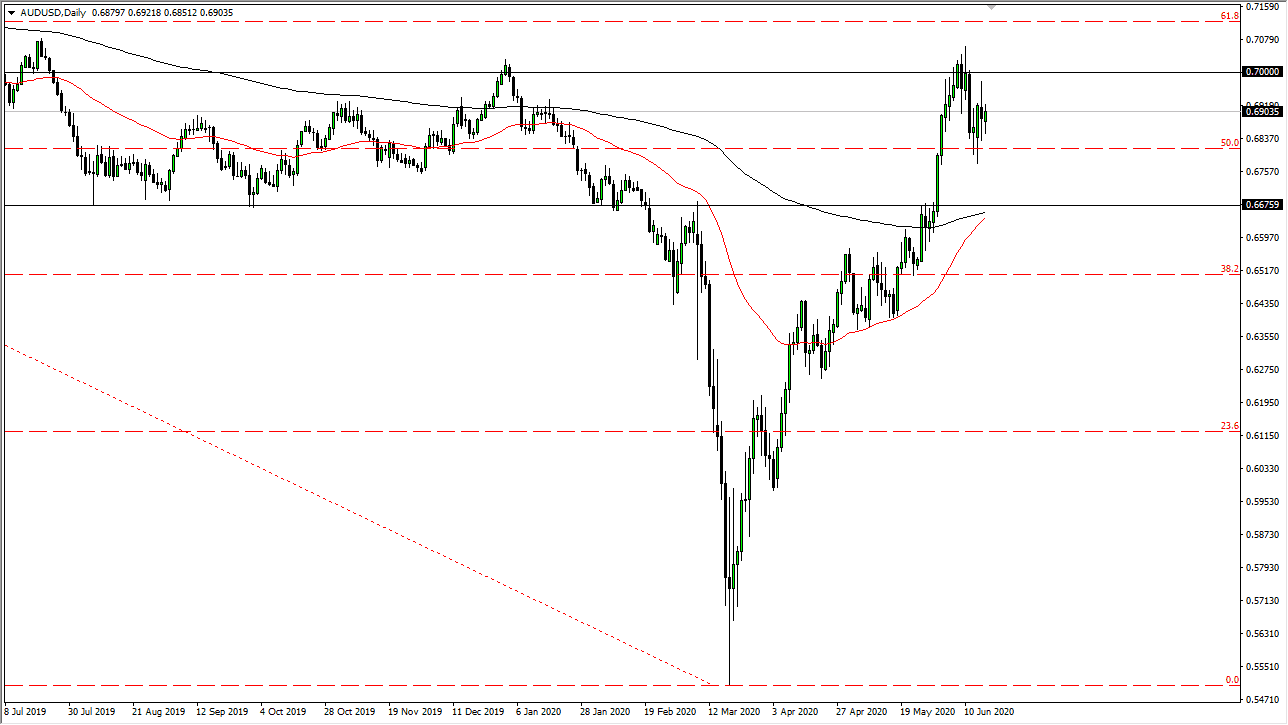

The Australian dollar has initially fallen during the trading session on Wednesday, but then found buyers underneath the turn the whole thing around. As the Aussie dollar continues to try to grind higher, we are starting to see a lot of volatility, especially as we try to get towards the 0.70 level. For me, that is an incredibly significant level that you should be paying attention to, because if we can break above that 100 PIP band of resistance extending to the 0.71 level, this pair will take off for a longer-term move. In the meantime, I like the idea of fading rallies to get close to that area and have been doing so honored offer several days. I am not looking for major moves now, just that this barrier continues to be the biggest effect in the market.

Underneath, we have the 50 day EMA trying to turn around a break above the 200 day EMA, both of which are just below the previous break out point at the 0.6675 handle. It is because of this that I think we will eventually go looking towards that general vicinity. After all, the resistance has not been retested, something that does not happen very often. I do believe that this market is probably one that you can sell on short-term rallies, but I am not necessarily looking to get too cute with it and with two big of a position to the downside.

One thing that most people are not thinking about is the fact that China is starting to lockdown certain parts of places like Beijing, and that of course will have a major effect on the Australian dollar. After all, the Aussies export quite a bit to China, so the connection to China has a major effect on the economy. In other words, if China starts to slow down and break apart, this will certainly put negative pressure on the Aussie dollar and have people running towards the US dollar in the safety bid, and of course in a bid to start buying paper at the US Treasury. I think the one thing you can probably count on is quite a bit of volatility, but that has been the norm in almost all markets that I have followed over the last several weeks. I do not think that we are going to get clarity in the short term, so I think a lot of back and forth with perhaps more of a downward glide is the best way to look at this potential move.