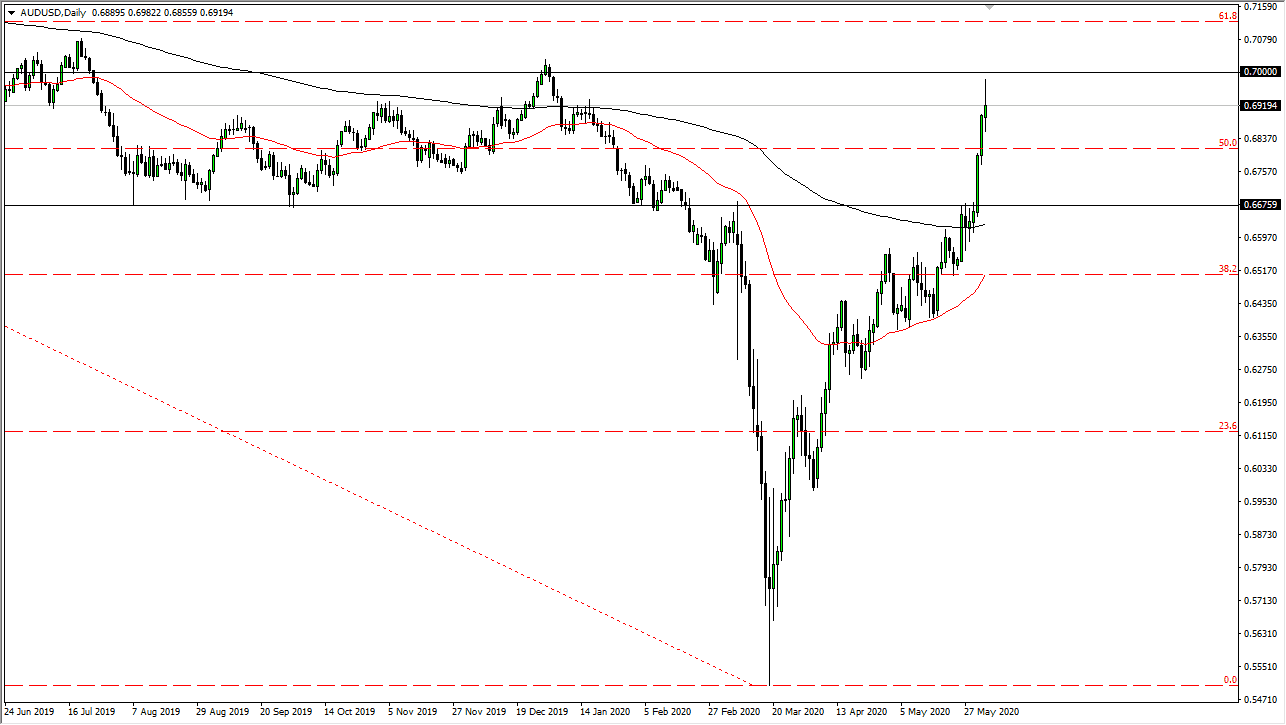

The Australian dollar has been all over the place during the trading session on Wednesday, as we approach the 0.70 level. The 0.70 level of course is a large, round, psychologically significant figure, so I think it makes quite a bit of sense that we struggle to get up here. Furthermore, the market has overextended itself by just about any metric you can use. While the Reserve Bank of Australia has suggested that the idea of negative interest rates are out of the question, this has been one of the main drivers of Australian dollar buying. Furthermore, as the economy has opened up rather substantially in China, the idea is that the Chinese will need more of the Australian commodities.

However, it is hard to imagine a scenario where we can go straight up in the air like this for much longer, considering that we have rallied 15 handles in just two months. Because of this, it looks likely that the market needs to pullback, probably at least five handles to get any type of normalcy, but these are not necessarily normal times. It appears to me that the Aussie dollar will continue to try to reach into the stratosphere, but I do not have any interest in trying to simply jump in at short this market, because quite frankly I have been hurt doing that more than once. Ultimately though, I do think that we will see some type of exhaustion.

A breakdown below the bottom of the candlestick for the trading session on Wednesday would signify that we could see some selling, perhaps down to the 0.6675 level. If we break down below there, then we are going to test the 200 day EMA which is just below it and could offer a bit of technical support. With all of that being said, we are most certainly overextended, and I would be interested in seeing what happens next when it comes to the US dollar in general. If we do get some type of shock to the system, perhaps even the US/China trade situation getting worse, then we could see the Australian dollar get hammered more than anything else. A breakout above the 0.70 level would signify a longer-term “buy-and-hold scenario, as it would be a major level to be overcome. If that happens, this could be a move that lasts for some time.