South Africa’s business community welcomes the further easing of lockdown restrictions, with the disease alert level set to decrease in June 1st to 3. It is expected to allow eight million employees to return to work. Critics of the nationwide lockdown have warned that if measures are not relaxed soon, citizens will face economic death rather than the virus. Pressures have mounted on President Ramaphosa to determine a proper and sustainable solution. While the long-term outlook for the USD/ZAR remains increasingly bearish, present conditions indicate a minor reversal led by a breakout above its support zone.

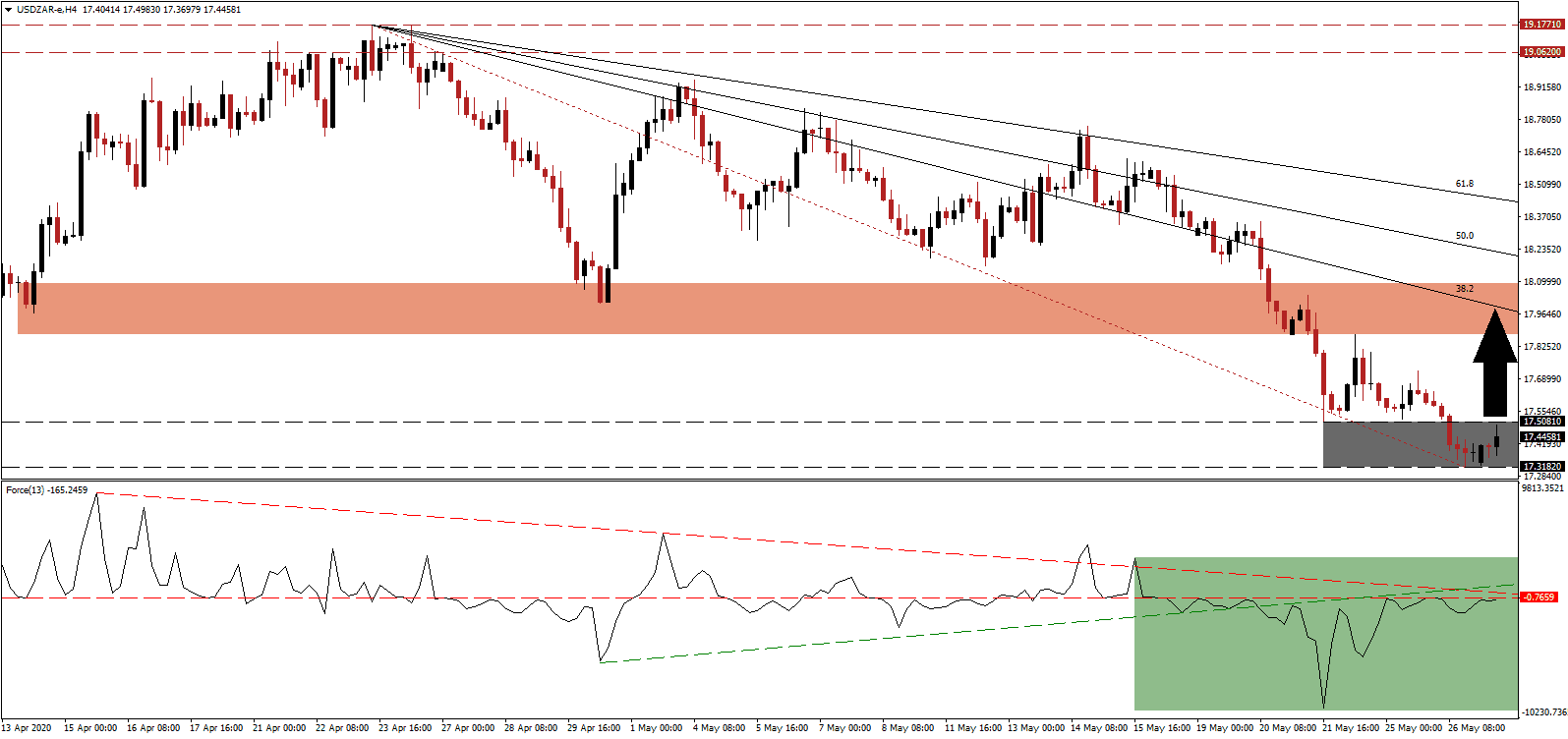

The Force Index, a next-generation technical indicator, points towards the build-up in bullish momentum after recording a new 2020 low. It remains below its horizontal resistance level with the descending resistance level adding to downside pressure, as marked by the green rectangle. A brief spike into its ascending support level is likely before a swift collapse can initiate more selling in the USD/ZAR. Bears are in control of price action with this technical indicator below the 0 center-line.

With the US failing to realize pressing changes to its debt-based economic model, South Africa seeks to take the Covid-19 pandemic as a platform to implement positive adjustments. They include reforms to the tax and labor law, while the Black Economic Empowerment Act (BEE), which failed to deliver as intended, is under scrutiny. Replacement with a more integrated development program has been proposed by political economist Moeletsi Mbeki. Finance minister Tito Mboweni confirmed the government’s responsibility to assist all in need, regardless of race. The dialogue creates conditions for change, but short-term breakout pressures in the USD/ZAR persist. Price action is favored to eclipse its support zone located between 17.3182 and 17.5081, as identified by the grey rectangle.

Reducing the upside potential in the pending counter-trend advance is the further deterioration in the Sino-American relationship. The US Dollar is additionally under pressure by the US Federal Reserve’s monetary policy and the potential of a second debt-funded stimulus. Forex traders are advised to monitor the descending 38.2 Fibonacci Retracement Fan Resistance Level, which is anticipated to enforce the dominant downtrend in the USD/ZAR. It is currently passing through the downward-adjusted short-term resistance zone located between 17.8759 and 18.0900, as marked by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Limited Counter-Trend Rally Scenario

Long Entry @ 17.4500

Take Profit @ 18.9000

Stop Loss @ 17.3000

Upside Potential: 4,500 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 3.00

Rejection in the Force Index by its descending resistance level is expected to bypass the limited counter-trend advance in the USD/ZAR. A brief recovery represents a healthy development in a broader downtrend, ensuring its longevity. Failure to enact one now positions price action for a more violent move in the future. Forex traders should use any advance as an opportunity to add to short positions. The next support zone is located between 17.1172 and 16.8949, with a breakdown extension probable.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 17.2000

Take Profit @ 16.9000

Stop Loss @ 17.3000

Downside Potential: 3,000 pips

Upside Risk: 1,000 pips

Risk/Reward Ratio: 3.00