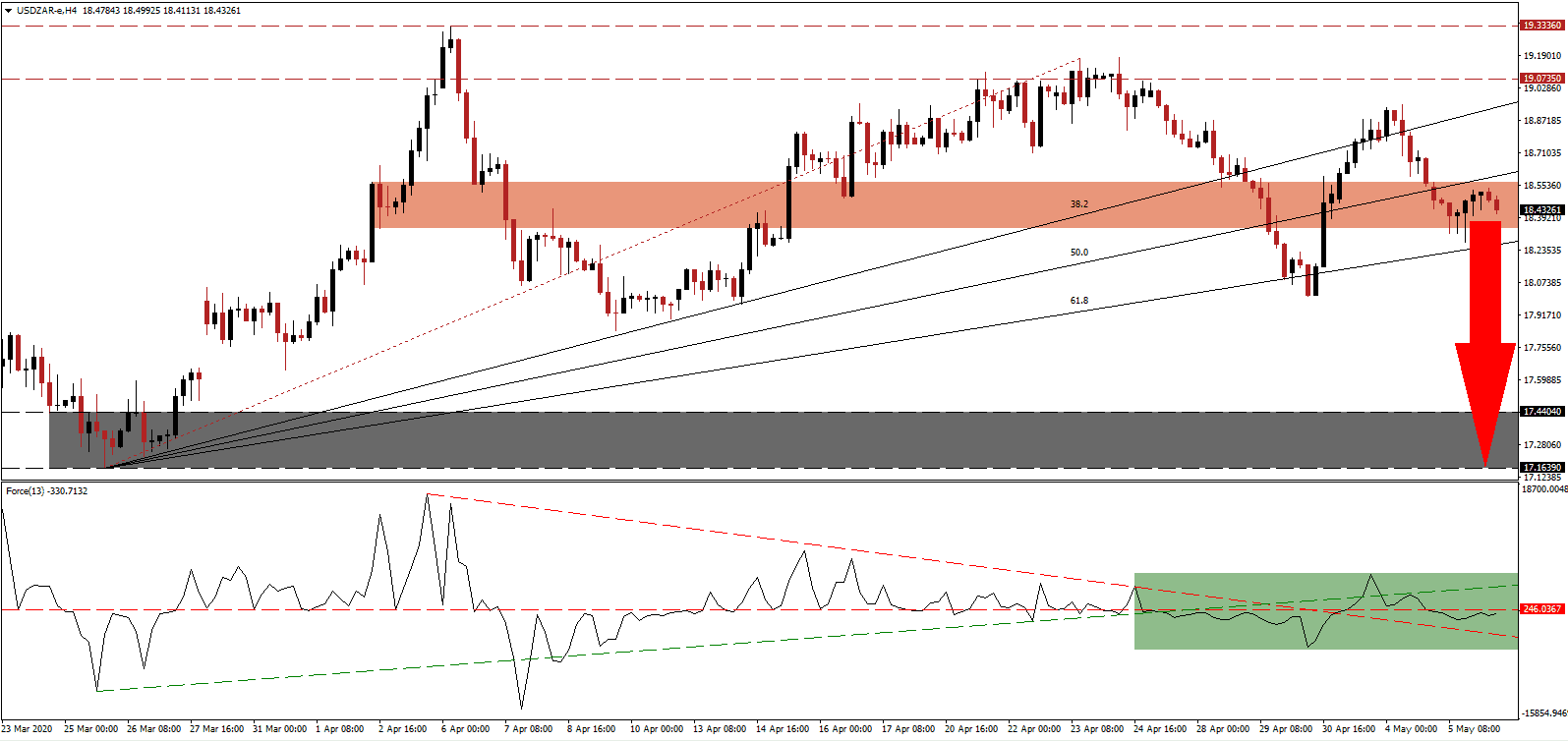

South Africa lowered its Covid-19 lockdown to level four, allowing approximately 1.5 million employees to return to work this week. Between 3.0 and 7.0 million are estimated to become unemployed, as the economic recovery is anticipated to be slow and lengthy. The government is debating required labor market reforms. Economists also press for changes to the tax code with a downward adjustment in the corporate tax rate while some advocacy groups call for a wealth tax to be implemented. The South African Rand paused its recovery amid growing uncertainty, but the established bullish trend remains intact. After the USD/ZAR bounced off of its ascending 61.8 Fibonacci Retracement Fan Support Level, a renewed push to the downside is favored.

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level, with the ascending support level and the descending resistance level reversing roles. Downside pressures are dominating, and the Force Index is positioned to extend its contraction. This technical indicator maintains its position below the 0 center-line in negative territory, suggesting bears are in control of the USD/ZAR. You can learn more about the Force Index here.

Deputy Finance Minister Masondo urged the South African Reserve Bank to increase the money supply and to purchase government bonds during the Covid-19 pandemic, duplicating short-term errors of developed economies. It raised concerns over central bank independence with a growing number of government officials attempting to influence monetary policy. The USD/ZAR is awaiting the next fundamental catalyst in its downward revised short-term resistance zone located between 18.3390 and 18.5678, as identified by the red rectangle.

Forex traders are recommended to monitor the 61.8 Fibonacci Retracement Fan Support Level, where a breakdown is expected to emerge, raising bearish pressures. It will provide the required volume to pressure the USD/ZAR below its intra-day low of 18.0100, the base of its previous sell-off, and clear the path into its support zone. Price action will challenge this zone between 17.1639 and 17.4404, as marked by the grey rectangle. Today’s US ADP data may deliver a short-term fundamental catalyst to initiate the next breakdown phase.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 18.4300

Take Profit @ 17.2300

Stop Loss @ 18.7200

Downside Potential: 12,000 pips

Upside Risk: 2,900 pips

Risk/Reward Ratio: 4.14

A breakout in the Force Index above its ascending support level could lead to a limited price spike in the USD/ZAR. South Africa is in a unique position to avoid mistakes made by developing countries, creating conditions for a sustained recovery. It will take longer, but the forced adjustments will ensure a healthy economy moving forward. In the absence of a fundamental change resulting in a material adjustment to the outlook, the upside potential remains confined to the narrowing zone between its 38.2 Fibonacci Retracement Fan Resistance Level and the bottom range of its resistance zone.

USD/ZAR Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 18.8200

Take Profit @ 19.0700

Stop Loss @ 18.7200

Upside Potential: 2,500 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 2.50