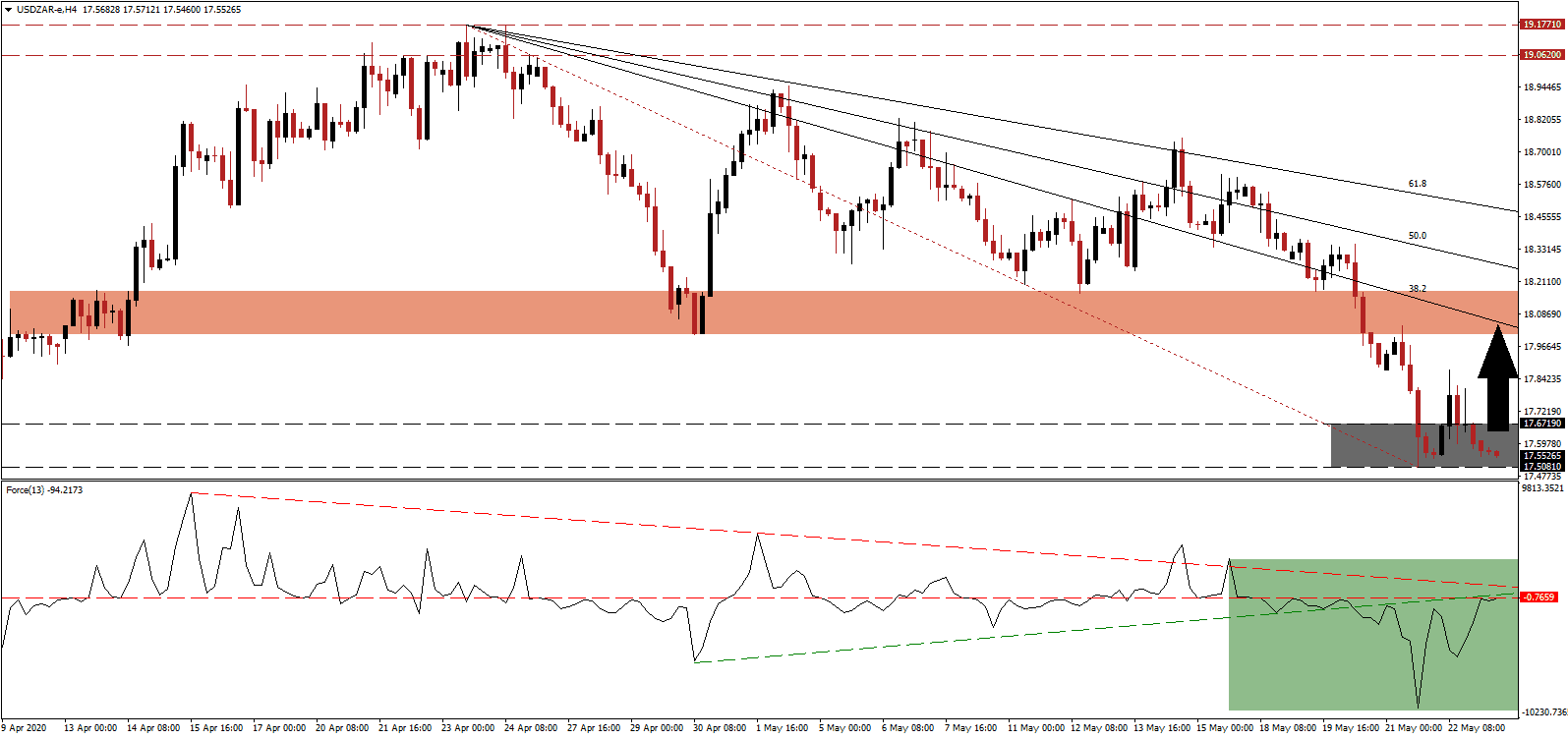

South Africa will lower its disease alert level to three on June 1st, allowing an expected eight million employees to return to work. It comes as new Covid-19 cases are on the rise, but President Ramaphosa stated in a televised speech yesterday that the economy cannot remain under lockdown indefinitely. An option to retain certain hotspots, which includes major industrialized areas, under more stringent measures remains in place. While the long-term outlook for the USD/ZAR maintains a distinct bearish bias, the present correction is vulnerable to a minor counter-trend advance sparked by its support zone. It will ensure the longevity of the established bearish chart pattern.

The Force Index, a next-generation technical indicator, recovered from a new 2020 low and is now challenging its horizontal resistance level. It does remain below its ascending support level, as marked by the green rectangle, and the descending resistance level is adding downside pressure. Bears remain in control of the USD/ZAR with this technical indicator in negative territory, but a short-term spike is favored to precede a resumption of the downtrend. You can learn more about the Force Index here.

An anticipated surge in Covid-19 cases, as testing and screening become more widespread, prompted the South African government to construct 27 field hospitals with 20,000 beds. President Ramaphosa warned his citizens that the threat of the virus will now increase, as restrictions are relaxed. The global pandemic has forced Africa’s most industrialized nation, and second-biggest economy measured by GDP, to address permanent changes to labor and tax laws, adding a long-term bullish catalyst to the USD/ZAR. A temporary short-covering rally is likely to emerge after a breakout above its short-term support zone located between 17.5081 and 17.6719, as marked by the grey rectangle before selling resumes.

Limiting the upside potential are bearish developments out of the US, ranging from weaker than expected economic data to monetary policy mistakes, and a worsening relationship with China. The descending 38.2 Fibonacci Retracement Fan Resistance Level is expected to end any counter-trend rally in this currency pair and enforce the dominant long-term bearish formation. It is on track to move below the short-term resistance zone located between 18.0100 and 18.1727, as identified by the red rectangle, further adding to bearish pressures in the USD/ZAR.

USD/ZAR Technical Trading Set-Up - Limited Short-Covering Scenario

Long Entry @ 17.5500

Take Profit @ 18.0000

Stop Loss @ 17.4000

Upside Potential: 4,500 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 3.00

Should the descending resistance level reject the Force Index and pressure it to the downside, the USD/ZAR is favored to resume its long-term corrective phase. A minor counter-trend advance is healthy for the downtrend, and failure to embark on one now will delay this essential development. The next support zone awaits price action between 17.1172 and 16.8949 from where more downside cannot be excluded, partially encouraged by weakness in the US Dollar.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 17.3500

Take Profit @ 16.9000

Stop Loss @ 17.5000

Downside Potential: 4,500 pips

Upside Risk: 1,500 pips

Risk/Reward Ratio: 3.00