Last week the US reported job losses related to the Covid-19 pandemic exceeded 30 million. With the death toll rising, several states started to allow partial activities to resume. Texas was one of the initial states, but new infections soared after it. At a time governors attempt to identify a sustainable path forward, US President Trump is threatening China with new tariffs, as he blames it for the global Covid-19 pandemic. The primary US response was roughly $3 trillion in stimulus and bailouts, adding to its unsustainable debt load. While the USD/ZAR recovered from its first breakdown, another wave of selling is likely to follow the fundamental deterioration of the long-term outlook for the US economy.

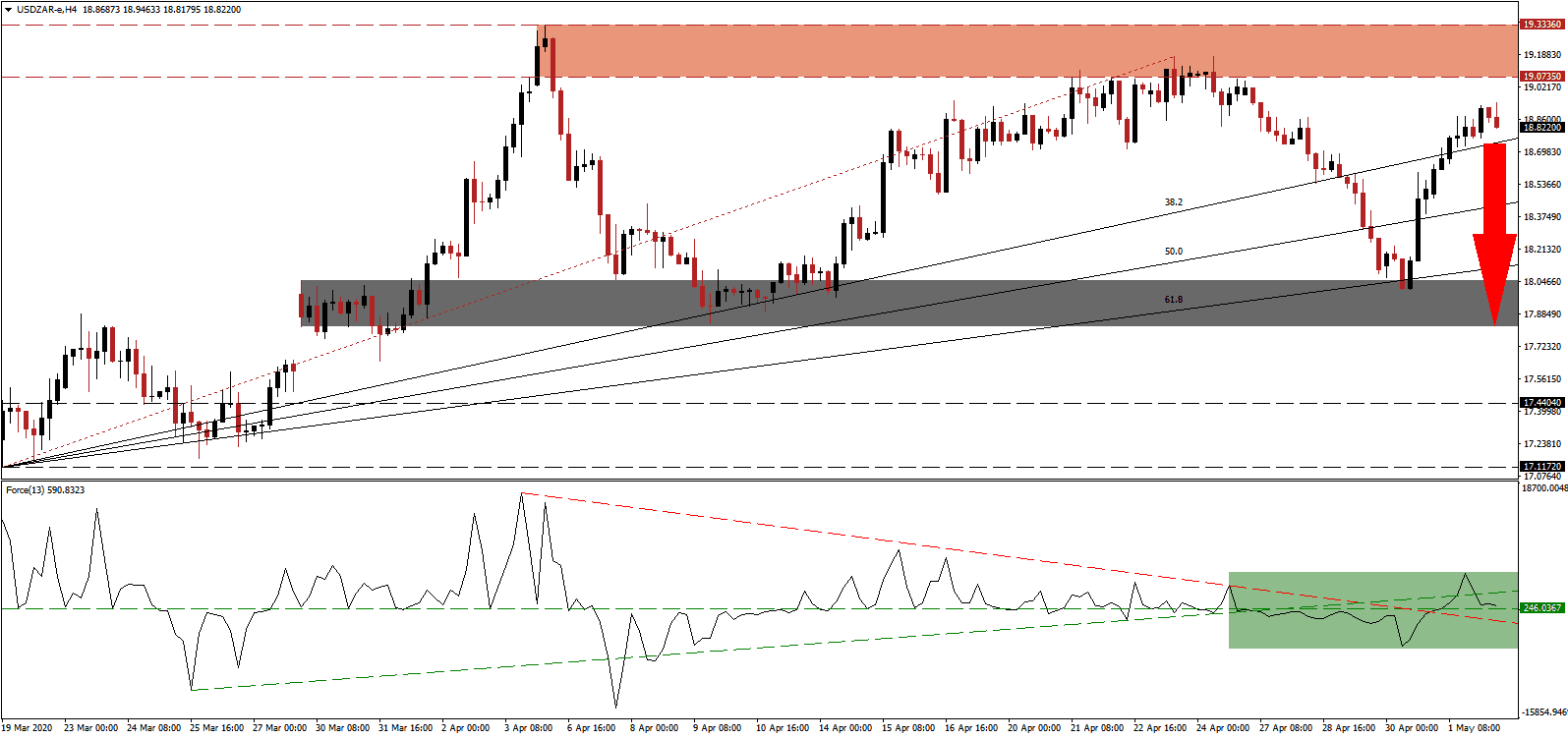

The Force Index, a next-generation technical indicator, temporarily spiked above its ascending support level, which serves as resistance, as the USD/ZAR entered a short-term counter-trend reversal. It quickly reversed direction and is now on the verge of converting its horizontal support level back into resistance, as marked by the green rectangle. This technical indicator is expected to collapse below its descending resistance level, acting as short-term support, and into negative territory, ceding control of this currency pair to bears.

South African’s are extremely concerned over the recovery potential of the economy. A recent survey revealed over 93% of respondents were worried over a total economic collapse as Africa’s second-largest economy is coping with the Covid-19 pandemic. More than 60% were depressed over their health as they adhere to strict lockdown measures, while 80% remain wary over the potential civil unrest as a result of the actions taken against the virus. Business and consumer concerns assisted the bounce in the USD/ZAR, which fell short of its resistance zone located between 19.0735 and 19.3336, as marked by the red rectangle.

After the recovery stalled, a lower high materialized, adding to long-term bearish developments in this currency pair. The USD/ZAR, on the back of a deepening fundamental breakdown in the US, is anticipated to enter a new breakdown sequence, taking it through its ascending Fibonacci Retracement Fan and back inside of its short-term support zone. This zone is located between 17.8202 and 18.0513, as identified by the grey rectangle. The bottom range of it marks the top of a previous price gap to the upside.

USD/ZAR Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 18.8250

Take Profit @ 17.8250

Stop Loss @ 19.0250

Downside Potential: 10,000 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 5.00

A breakout in the Force Index above its ascending support level could inspire the USD/ZAR to attempt more upside. While South Africa’s short-term economic outlook is challenging, the government started to announce long-term positive adjustments and a willingness to take the Covid-19 pandemic as an opportunity to position itself for a sustainable expansion. This mindset is absent in the US, adding a bearish fundamental catalyst to price action. The next resistance zone is located between 19.8564 and 20.0550, presenting Forex traders a second short-selling opportunity.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 19.5000

Take Profit @ 20.0000

Stop Loss @ 19.3000

Upside Potential: 5,000 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 2.50