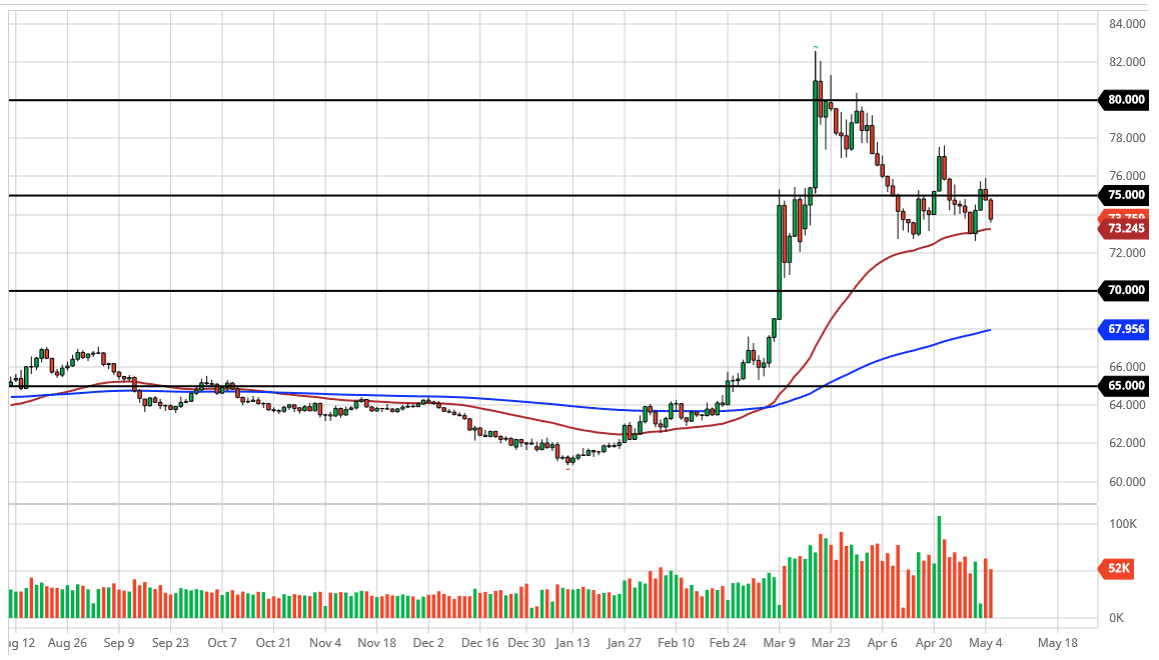

The US dollar has fallen again during the trading session on Tuesday against the Russian ruble, as we are breaking below the 74 level. That being said, the 50 day EMA is sitting just below and that could in fact bring in a bit of support. However, it should be noted that we have been seen a series a “lower highs”, which suggests that we have some work to do.

The 73 ruble level has offered significant support previously, and the 50 day EMA is just above there. For those of you who do not normally trade the Russian ruble, it is highly levered to the crude oil market. Because of this, it is not a huge surprise to see that it has done fairly well against the US dollar, as there has been such a massive surge higher in the crude oil market over the last couple of weeks. That being said, oil markets are getting a bit stretched to the upside at this point, so if that market starts to rollover it is highly likely that this pair will bounce again. In fact, unless there is some type of political headline, most of the time the Russian ruble trades based upon crude oil more than anything else.

This does not mean that I expect this market to turn around on a dime and simply go to the one, rather that I think we are starting to see a lot of an overreach in the crude oil market, so it does make sense that we get a little bit of a boost here. Furthermore, the Russian ruble is an emerging market currently, and at this point most traders are much more comfortable owning US dollars than they are EM currencies. This will be especially true if we get some type of negativity out there. However, if we were to break down below the 72 ruble level then it is obvious that we have much further to go, perhaps down to the 68 ruble level which is where the 200 day EMA is currently sitting. All things being equal though, I do think that we are going to see some support here of the next several sessions and therefore would not surprise me at all to see the 50 day EMA area hold relatively well in the face of what has been a continued grind to the downside recently.